The digital economy has redefined how goods and services are exchanged, pushing businesses to adapt to increasingly complex value-added tax (VAT) and goods and services tax (GST) regimes. Frequent regulatory updates and real-time reporting mandates only heighten the pressure.

Internal tax teams are navigating limited resources, shifting rules and increasing stakes. The risk of errors or noncompliance is significant, potentially leading to penalties or reputational damage.

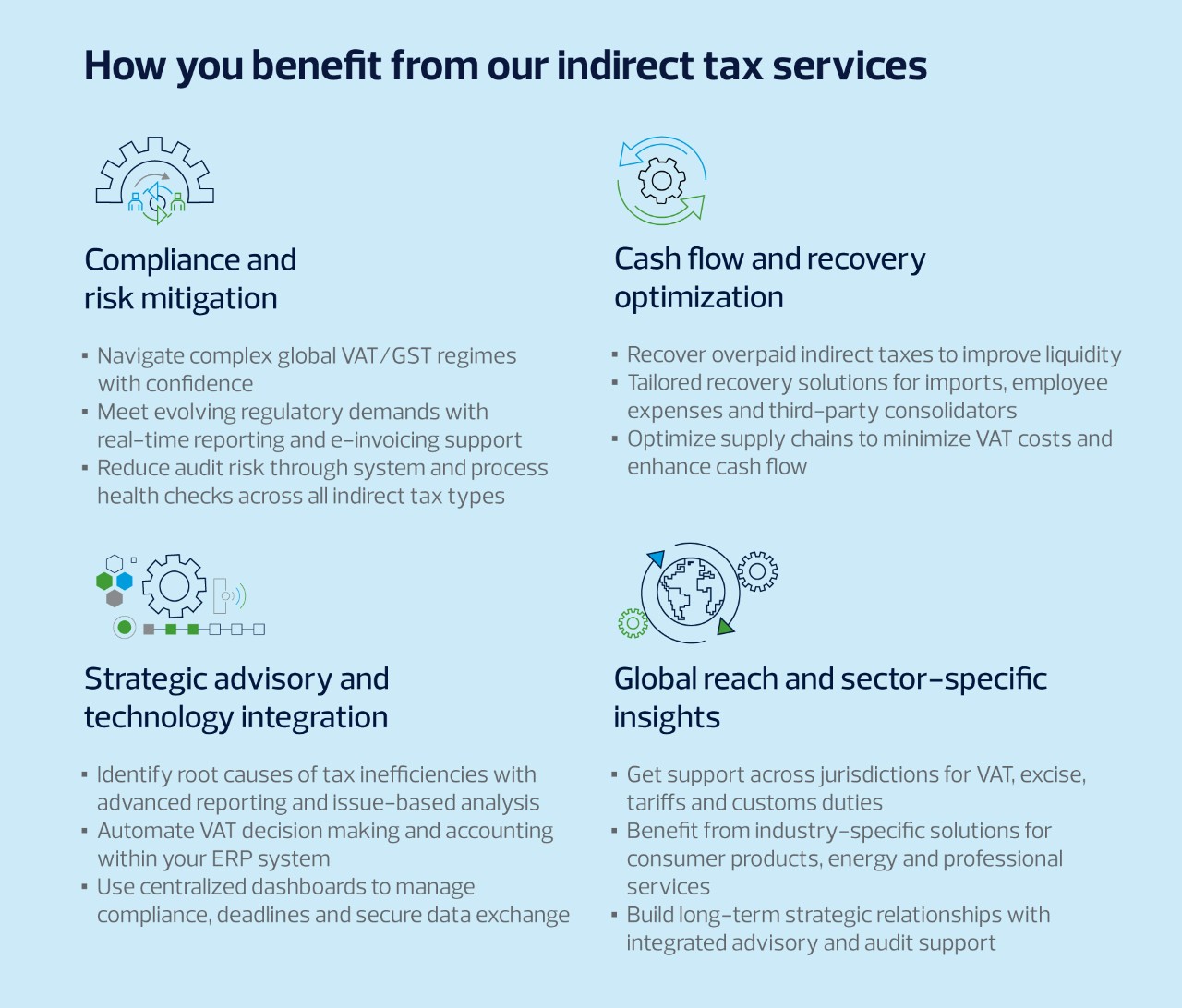

RSM helps organizations manage these challenges with practical experience, global reach and technology-enabled solutions tailored to their specific operations.