Executive summary

New Dutch ATAD2 decree provides beneficial guidance in specific cost-plus situations

The Dutch State Secretary of Finance published a new decree on the interpretation of the Dutch anti-hybrid rules, known as the Anti-Tax Avoidance Directive II (ATAD2) rules, on Nov. 3, 2022. The decree addresses specific adverse situations resulting from the Dutch implementation of ATAD2, which impacts specific U.S. multinational enterprise (MNE) groups with cost-plus structures including companies in the Netherlands. The decree has a retroactive effect back to 2020.

ATAD2 overview

As of Jan. 1, 2020, anti-hybrid mismatch rules, known as ATAD2, have entered into force throughout all Member States of the European Union (EU). These rules generally apply to deductible payments between related parties that are not included in the tax base of the recipient or are also deductible elsewhere and where the mismatch (except in a double deduction (DD) scenario) originates from a different tax treatment of an entity or an instrument under the laws of two or more jurisdictions. The measures aim to neutralize the effects of such (hybrid) payments by either:

- denying the deduction of the payment in the EU payor jurisdiction or

- by including the payment in the taxable income of the EU recipient.

ATAD2 is particularly prevalent in U.S. MNE structures with EU entities due to the U.S. check-the-box provisions.

In principle, ATAD2 only applies to hybrid mismatch arrangements between related parties. A related party can include individuals and/or entities. Parties will generally be considered related if there is some element of control involving at least 25% voting rights, profit entitlement or capital ownership or in specific cases where they are part of a ‘collaborating group.’ ATAD2 also applies in specific ‘structured arrangement’ cases.

ATAD2 measures do not apply to certain categories of payments resulting in a deduction no inclusion (D/NI) or DD outcome to the extent that the payment can be set off against dual inclusion income, also known as the dual inclusion income escape. The dual inclusion income escape is available for:

- Payments by a hybrid entity (i.e., an entity that one jurisdiction considers non-transparent, whereas another jurisdiction considers as transparent) resulting in a D/NI

- Deemed payments between head office and permanent establishment (PE) or between two or more PEs resulting in a D/NI

- Remunerations, payments, expenses or losses that result in a DD outcome

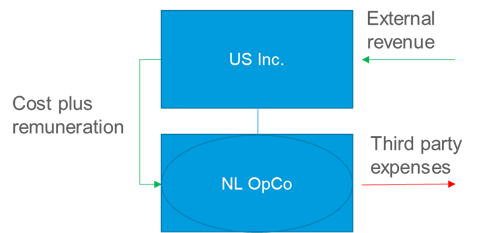

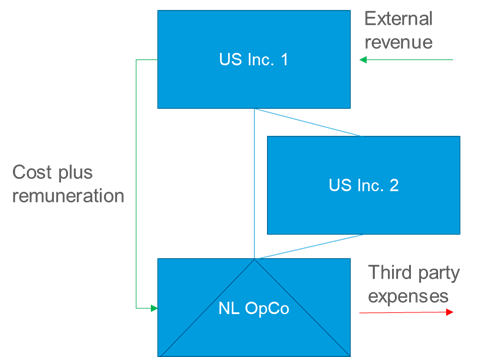

Dual inclusion income must be income taxed in the same two jurisdictions between which the mismatch has arisen (i.e., profit tax or a foreign personal income tax on business profits). The interpretation of what qualifies as dual inclusion income does however vary across the Member States of the EU. This contribution illustrates, by way of two simplified examples, the application of the Dutch dual inclusion income escape in relation to structures with U.S. shareholders that are holding an interest in a related Dutch group entity.