RSM US LLP sponsors the Original Equipment Suppliers Association’s Automotive Supplier Barometer, a quarterly survey of the top executives of OESA’s regular member companies. The survey provides insight into the commercial issues and business environment the industry faces. Each quarter’s survey focuses on a different topic, from planning to production. The following article offers Q3 2022 insights on the changing interest environment and auto supplier investments.

For much of 2021, historically low interest rates provided rare opportunities for auto suppliers—and companies across the economy—to make strategic investments. Now, as interest rates rise and capital becomes more expensive, auto suppliers may need to reprioritize and accelerate their investments in the electric vehicle future.

While this is far from the first time the industry has navigated rising interest rates, the current environment raises the stakes on companies’ decisions about where to place their bets for the future and underscores the importance of strategic planning to drive innovation. The fact that full adoption of electric propulsion by auto suppliers is no longer a potential route but a necessary one makes planning even more crucial.

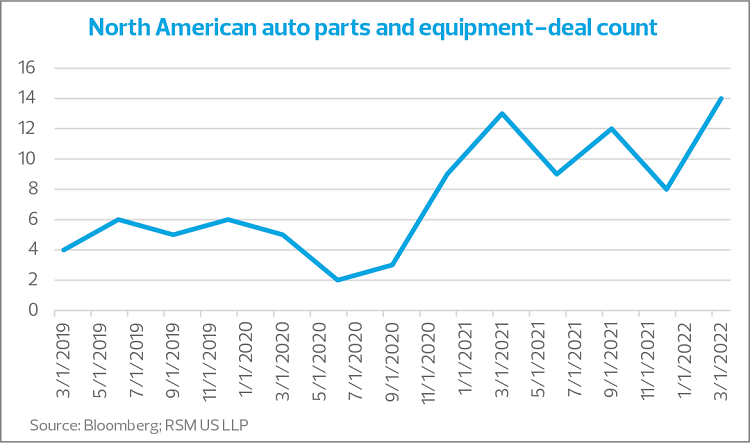

At the same time, companies will need to continue balancing the growing focus on EVs with ongoing manufacturing of internal combustion engine vehicles. Organizations may need to make strategic capital investment trade-offs, change their approach to the mergers and acquisitions landscape, and ensure they have the right leadership teams in place if they want to stay nimble and be able to adapt in this environment.

Areas of investment

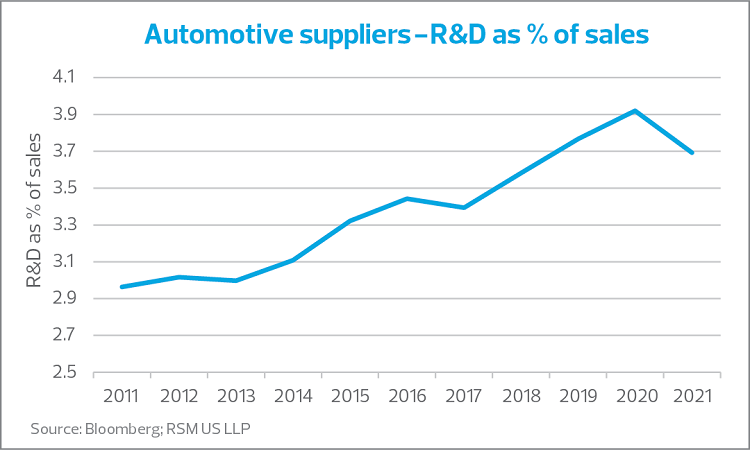

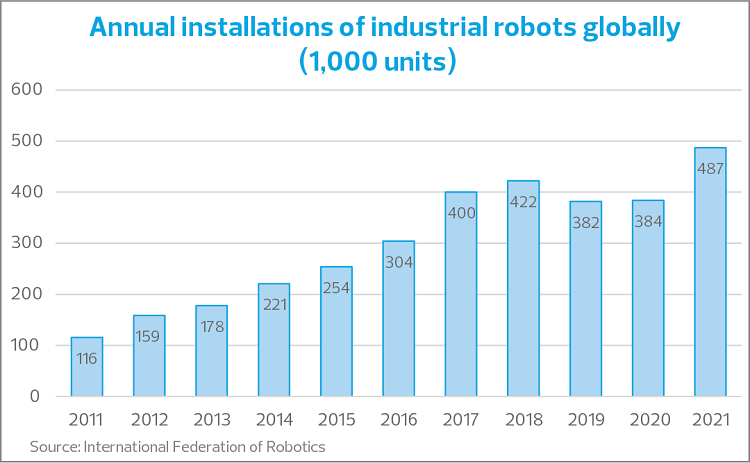

It’s not just electric vehicles that are necessitating innovative capital investments; autonomous vehicles, increasingly connected cars enabled by 5G capabilities, advanced vehicle safety systems, and companies’ push toward using lighter materials for vehicles to drive energy efficiency are all factors that auto suppliers need to bake into their planning for the future. Enabling progress in these areas will largely come down to investment decisions related to research and development.