Companies across the entire industrial space should assess what low-interest rates mean for potential strategic investments.

Opportunities for industrial companies

Like most economic sectors, manufacturing experienced a crash last year around the onset of the pandemic in the United States. Since then, though, U.S. manufacturing activity has rebounded and remains relatively strong. Industrial companies should take advantage of this environment, in conjunction with low-interest rates, to make investments that will help their business longer term.

Investments in advanced Industry 4.0 technologies—and updating IT architecture to fully enable those technologies—can help drive productivity and efficiency and should be top-of-mind priorities for any industrial businesses looking to tap into this rare opportunity.

Companies in the manufacturing sector, energy companies in the power and renewables sectors, and others across the entire industrial space should assess what low-interest rates mean for potential strategic moves in the following areas:

Capital and strategic investment

- Facilities: For years, manufacturers have been making the shift from traditional factories to the vision of the “factory of the future,” in which shop floor automation, warehousing technologies, alternative materials, additive manufacturing, and energy-efficient processes can enhance productivity. This allows businesses to adapt more swiftly to market changes, manage workforce availability and efficiently resolve any production issues that arise. Middle market manufacturers have lagged their larger counterparts in this area and should seize on this moment to assess what facility investments may help enable these more automated factory operations.

- New markets: Industrial companies have had a front seat to major supply chain disruptions in recent years from the pandemic and also the United States’ years-long tariff battle with China. Businesses looking to diversify into new markets—whether that might involve reshoring or shifting away from China—should evaluate what options low-interest rates might afford them when it comes to geographic changes to their operations. Companies can also explore investments in digital go-to-market and e-commerce capabilities to accelerate revenue growth.

- Worker training: Technology will continue to become more essential to manufacturing operations, and as a result, many companies will need to rethink their worker training and workforce development strategies. This could be a good time to evaluate potential investments in upskilling employees and/or invest in solutions that capture the domain expertise of a retiring workforce.

Technology investment

- Data and connectivity: The current environment might afford midsize industrial companies a unique opportunity to catch up to larger companies in terms of making focused investments in technology infrastructure that enable advanced technologies including data analytics, cybersecurity, the industrial Internet of Things, and advanced robotics, to name a few. This is a holistic shift that has been underway in manufacturing for years, and those who embrace it will have a competitive edge. Investing in these smart technologies can help to drive efficiency and productivity, reduce risk, and provide opportunities for growth through new products or services.

- Green technologies: Market demands around environmental, social, and governance issues (ESG) and sustainability more broadly are of growing importance in the industrial space. Businesses should evaluate what technologies would make sense to invest in right now from the perspective of lowering carbon emissions and becoming more energy efficient.

Refinancing

- Companies across the economy are determining whether to take advantage of refinancing opportunities now while interest rates are low. Manufacturing businesses are no different; companies should refinance their existing debt and look at ways to strengthen their balance sheets as they prepare for the eventual post-pandemic environment.

Why invest now?

In recent years, middle market firms have lagged their larger industry counterparts in capital outlays, a trend that has been documented in the RSM US Middle Market Business Index. In an encouraging sign, the December 2020 MMBI survey showed that more than half of respondents (52%) said they expect to boost investment in productivity-enhancing capital expenditures such as software, equipment, and intellectual property over the next six months.

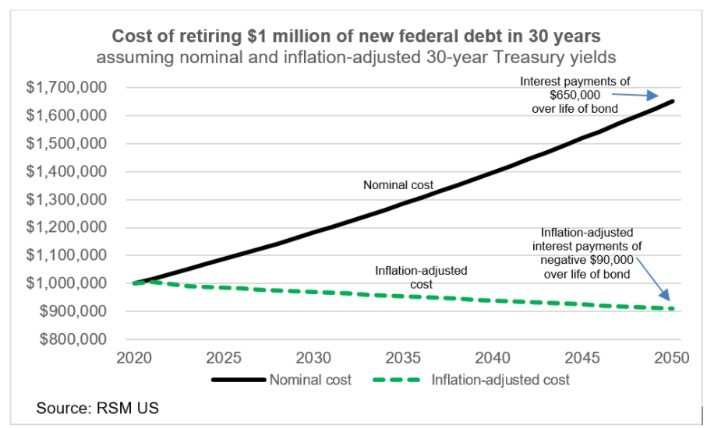

“Due to the unique confluence of events that is upon us,” writes Brusuelas, “firms will actually make money by borrowing, because we are operating at near-zero nominal interest rates that become negative when adjusted for inflation.”

Contact RSM Partner and Industrials Senior Analyst Jason Alexander, RSM Director and Industrials Senior Analyst Anne Slattery, or RSM Senior Manager and Industrials Senior Analyst Shruti Gupta for more information.