Rising costs, labor constraints and supply chain disruption will persist due to inflation.

Key takeaways

Manufacturers will need to scale their data and related capabilities to tap opportunities.

Manufacturers spending on technologies to advance their digital maturity will have an edge.

The importance of innovation for the industrial sector amid inflation

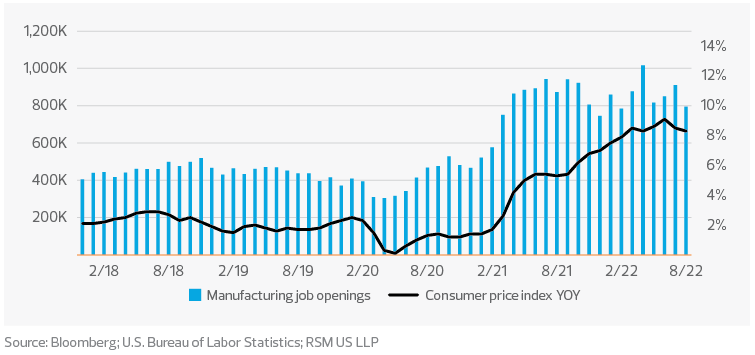

Just a year ago, rising inflation seemed to be a transient issue driven by the pandemic. However, the temporary inflation narrative has vanished. Regardless of the size of inflationary increases, which have spanned 7% to 9% throughout 2022, inflation will continue to take a toll on manufacturers through rising costs, labor constraints and supply chain disruption.

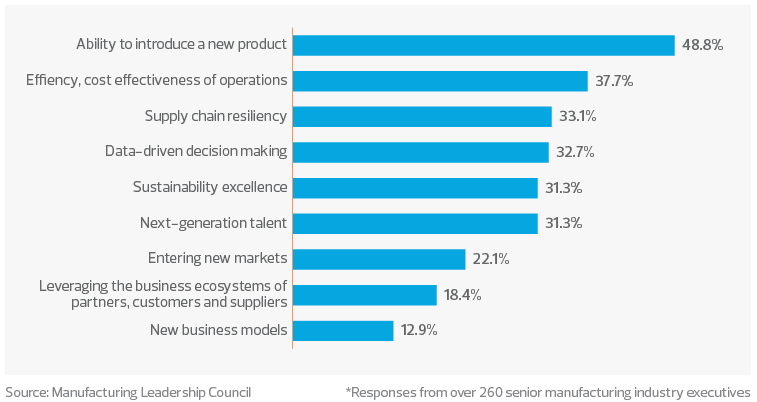

Despite these challenges, many manufacturers remain optimistic about the future. In a November 2022 survey conducted by the Manufacturing Leadership Council, executives expressed a positive outlook due to expectations that digital innovation and adoption will have a significant impact across functions and activities within their business.

Automation has been a key theme throughout the digital revolution. Many middle market manufacturers have accelerated their investment in automation throughout the pandemic to adapt to the dynamic and challenging environment. As inflation persists and expectations for a coming recession have further complicated budgeting and forecasting processes, midsize manufacturers will need to determine whether they should delay capital projects and purchases and how automation might be able to help augment such plans.

On one side, the rising cost of capital and labor and the shifting of supply and demand require companies to be cash-conscious and may support delaying investments until the storm has passed. But some organizations may be in a favorable cash position and looking to prioritize investments in productivity-enhancing solutions. Investing in innovative projects that contribute to the company’s bottom line and have a compelling potential return on investment may prove to be a smart move as the Federal Reserve continues with interest rate hikes in an effort to control inflation without triggering a recession. If that effort is not successful and the Fed overcorrects, triggering a downturn, businesses may regret their spend, wishing they had the liquidity to better weather the storm.

But investments in advanced technologies may be the very thing that will help them weather that storm. Capital spending, when appropriately executed, can be deflationary. Manufacturers that are spending on tools and technologies that will advance their organization’s digital maturity will have an edge. This innovative spending is expected to rise well into 2030 according to the MLC, and areas where this could have the greatest potential impact on operations include product design, research and development, production, supply chain, logistics, customer experience, and field service. Advanced technologies like Internet of Things devices, machine learning, artificial intelligence, 5G, digital twins, and augmented reality and virtual reality will have the most significant impact on those operational areas, according to the MLC survey.

Middle market insight

As inflation persists and expectations for a coming recession have further complicated budgeting and forecasting processes, midsize manufacturers will need to determine whether they should delay capital projects and purchases and how automation might be able to help augment such plans.

Digital adoption

Despite the wave of economic uncertainty, nearly 84% of manufacturers expect that the pace of digital adoption will accelerate throughout the decade, according to a recent survey by the MLC, A Lens on the Future. Over half of the respondents said digital adoption will be a game changer for the industry by 2030. Manufacturers are looking to unleash the power of digital to drive growth and boost their competitive advantage as we enter a post-pandemic era.

Manufacturers are adopting these digital solutions to improve business operations and competitive posture. Critical to that competitiveness is the smart use of data across the organization. According to the MLC, manufacturers expect their data volumes to balloon by 200% to 500% within just a few years. With this expected data tsunami, it will be critical for manufacturers to scale the data and related capabilities to increase opportunities. By making more decisions driven by data gathered from the factory floor, organizations can better address supply chain resiliency, evaluate energy consumption to improve sustainability, plan for preventive or predictive maintenance that can increase operational uptime, and optimize production while improving quality. Data has been, and will continue to be, the foundation of manufacturing digitization and innovation.

Middle market insight

Middle market manufacturers will need to continue to find ways to increase productivity with lower head counts. Implementing new technology as part of a broader Industry 4.0 strategy will be critical to combat these challenges in a high-inflation environment.

Manufacturing competitive posture factors

There were 806,000 open manufacturing jobs in the United States in September 2022, according to the Bureau of Labor Statistics—nearly twice the average of the two years preceding the pandemic. With hiring conditions remaining exceedingly tight, along with continued wage pressures, middle market manufacturers will need to continue to find ways to increase productivity with lower head counts. Implementing new technology as part of a broader Industry 4.0 strategy will be critical to combat these challenges in a high-inflation environment.

U.S. manufacturing job openings and inflation

Agility will be key

Stubborn inflation may counterintuitively spur innovation in the manufacturing sector for companies that make strategic technology investments. Advanced technologies like IoT, machine learning, artificial intelligence, 5G, digital twins, and augmented and virtual reality will be crucial to improve operations and competitiveness while guarding against rising costs, continued supply chain disruptions, and pervasive workforce shortages. Agility will be essential for middle market manufacturers to ride out inflation and a threatening recession.

TAX TREND: Manufacturing

Manufacturers investing in automation and new or improved manufacturing or production processes should consider research and development tax credits and incentives at the federal and state or provincial levels. The process involves identifying and quantifying R&D activities and costs, compiling proper documentation and support, and developing an overall methodology to quantify and support past, current and future credits.