Better connectivity will enable next-gen Industry 4.0 capabilities.

Key takeaways

5G connectivity may help manufacturers improve how they measure workforce efficiency.

Manufacturers failing to invest in 5G infrastructure will be at a disadvantage.

Manufacturers should invest in 5G infrastructure and planning

For the past two decades Wi-Fi has been the de facto standard for private wireless communications. While new generations have improved overall capacity, speed and latency, challenges persist around Wi-Fi as a shared medium and in the coverage capabilities of each access point. When devices roam from one access point to the next, drops and latency persists. This presents an issue for anything that requires a continuous connection or for devices sensitive to network latency.

Many companies are planning or eyeing the rollout of private 5G networks on their corporate campuses, and manufacturers are no exception: In an October 2022 survey conducted by the Manufacturing Leadership Council, 48% of respondents said they are considering or planning investment in 5G in the next 12 to 24 months.

Middle market insight

While today private 5G networks are not widely deployed in the middle market manufacturing space, we see this market growing as companies continue to integrate 5G use cases into their business and look toward digital innovation to maintain competitiveness in the market, offset staffing challenges and deal with increased labor costs.

The improved connectivity enabled by 5G networks is crucial for the industrial sector, especially as tools such as cloud-based data and Internet of Things devices play a bigger role throughout manufacturing operations. Better connectivity throughout operations will enable next-gen Industry 4.0 capabilities, including video analytics, augmented reality, industrial IoT devices, automated guided vehicles or even the ability to relocate traditionally fixed machines for customized or short life-cycle product runs.

The benefits of 5G cellular connectivity fall into four primary areas:

Performance

As your digital transformation progresses, one common driver for all improvements is the quantity of real-time data from all aspects of manufacturing. 5G networks have been engineered from the ground up to support speeds 10 to 20 times faster than previous networks. This means it’s easier for such networks to support everything from massive IoT deployments to mission-critical communications.

Security

Wi-Fi typically uses a known network name and password or certificate. 5G instead uses SIM cards programmed to connect to your network. Additional security protocols built into the platform create a more secure network over Wi-Fi overall.

Coverage and flexibility

A key benefit of cellular technology is the coverage capabilities. In a manufacturing landscape, one 5G radio can cover the same area as two dozen Wi-Fi access points, reducing the need to hand off between radios and resolving network congestion in highly dense areas. In mining, energy and shipping, all of which involve difficult-to-cover areas, the benefits are clear.

Service levels

A private network may provide several advantages over a public network from a major carrier. A key benefit of 5G is the ability to slice the network to guarantee network performance for certain workloads. For example, autonomous forklifts or robots require very low network latency to navigate the facility and communicate with other autonomous guided vehicles. A private network can guarantee bandwidth to these critical devices, just as a traditional wired network does.

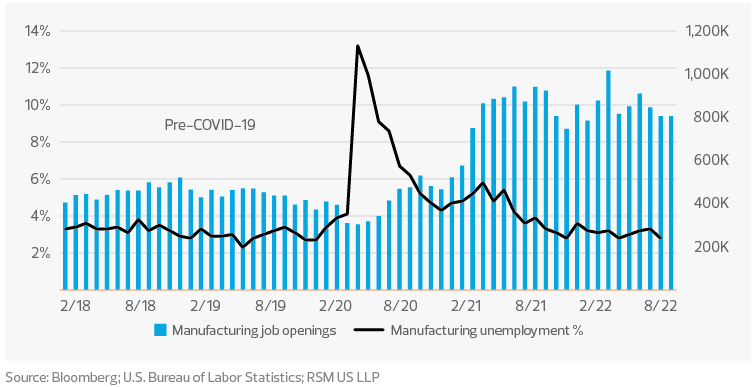

5G connectivity also has the potential to help industrial organizations improve the way they measure workforce efficiency—and that’s crucial at a time when manufacturers continue to struggle with hiring and high labor costs, and open jobs in the industry are nearly double their pre-pandemic levels.

TAX TREND: Manufacturing

As manufacturers sharpen their strategies for recruiting and retaining employees, considering the tax implications of cash and noncash compensation will help them avoid surprising tax obligations, which should make their strategies more sustainable. From education assistance programs to equity compensation to retirement plans, there are tax implications to the many ways in which employers compensate their workers.

Wearable devices can help teams get a clearer picture of how employees on the shop floor interact with each other and with machines. Augmented reality can reduce your repair and maintenance cycles, and IoT deployments can support advanced analytics and improve decision-making. All of this, though, depends on the strong and reliable network coverage that 5G can provide.

Manufacturing sector unemployment and open jobs

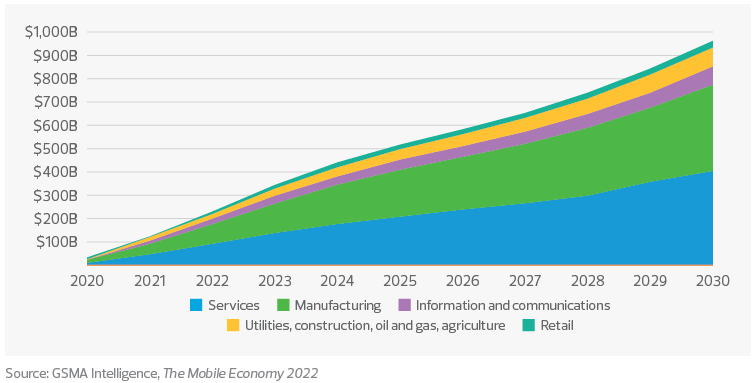

Manufacturers that aren’t making investments in 5G infrastructure and planning will be at a significant competitive disadvantage. Compared to five other sectors, manufacturing is expected to spend the second highest amount of money—behind retail—on such investments between 2020 and 2030, according to GSMA Intelligence.

While today private 5G networks are not widely deployed in the middle market manufacturing space, we see this market growing as companies continue to integrate 5G use cases into their business and look toward digital innovation to maintain competitiveness in the market, offset staffing challenges and deal with increased labor costs. Manufacturers looking to capture more data, provide real-time analytics or deploy more automation on the floor can use 5G connectivity to reach those goals.

Annual 5G investment by industry, 2020-2030

TAX TREND: Manufacturing

Manufacturers investing in automation and new or improved manufacturing or production processes should consider research and development tax credits and incentives at the federal and state or provincial levels. The process involves identifying and quantifying R&D activities and costs, compiling proper documentation and support, and developing an overall methodology to quantify and support past, current and future credits.

Also, the new advanced manufacturing investment tax credit and new federal grant products introduced by the CHIPS Act of 2022 create substantial benefits for manufacturers in the semiconductor sector, including middle market manufacturers of the tooling and equipment used in the semiconductor manufacturing process.