Address the key trends of workforce challenges, patient volumes and investment performance.

Key takeaways

Continue investing in and using technology to bridge operational gaps.

Analyze people, process and technology to maximize margin.

Identify challenges and resulting opportunities to close gaps and boost efficiency within the supply chain.

Health care providers across the country have been challenged with rising costs for medical supplies, drugs and labor while also facing poor performance in the financial markets. Collectively, these trends decimated operating margins for 2022, arguably the worst financial year on record for hospitals. As the pandemic's toll continues into 2023, hospital leadership is being forced to identify innovative ways to continue to provide high-quality health care services to the communities their facilities serve. In 2023, some key financial trends hospitals are experiencing include the following.

High workforce cost

The high cost of labor remains top of mind for providers, given that labor is the most significant operating expense for many hospitals. During 2022, many higher-cost traveling nurses returned to permanent jobs as contracts came to an end. Many hospitals subsequently spent less on travelers as a percentage of total labor expense. However, the cost of labor in health care continues to rise and has been on an upward trajectory since pre-pandemic days. According to a recent report from Kaufman Hall, total labor expense for providers of all bed sizes is still significantly higher through February 2023 as compared to 2020 and in some cases by as much as 24% higher. This is directly contributing to negative operating margins.

Strategic workforce reductions

Attracting and retaining talent is still a priority for providers, but many are making strategic workforce reductions. Becker’s Hospital Review reported that “health care, which includes hospitals and health care products manufacturers, overall has announced a total of 16,482 job cuts this year. That is an 85% increase from the 8,928 cuts announced during the first two months of 2022.” We believe this trend will continue as providers streamline operations to focus on core services by removing layers of leadership and consolidating operational structures.

High workforce demand

Despite a modest unemployment rate increase to 1.4% in February 2023 from 1.2% in December 2022, according to the U.S. Bureau of Labor Statistics, as well as strategic workforce reductions, demand for clinical hospital labor continues to remain high and surpassed pre-pandemic levels late in 2022. There is no evidence to suggest that this upward trajectory will reverse anytime soon, and it may indicate that more nurses and other employees who left health care soon will be returning.

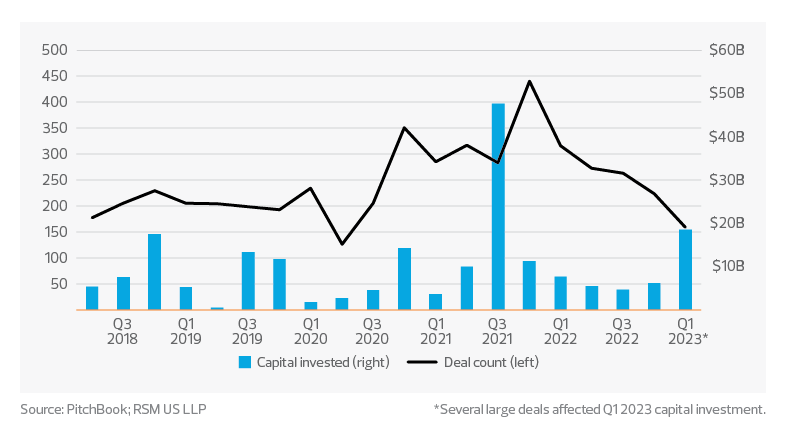

Health care services buyout activity has cooled to more normal levels

In a report released in February this year, the Health Financial Management Association found that the industry can expect to continue to see health care staffing shortages across every category of worker. During the pandemic, nearly 20% of health care workers quit their jobs; up to 47% plan to leave by the end of 2025. Two out of five nurses and nearly one-third of physicians are reporting physical, mental and emotional exhaustion due to the stress of their jobs, an indicator that burnout is taking a toll on the industry.

Higher patient volumes

We’re seeing patient volumes increase in health care systems, but this increase is not keeping pace with the rise in expenses due to inflationary pressures.

Poor investment performance

Last year saw poor performance in the financial markets. The S&P 500 dropped more than 18%, according to Slickcharts. Poor market performance significantly reduced available liquidity and operating margins for health systems across the country.

Solutions to consider

To continue to provide high-quality care to the communities they serve, providers should consider taking steps to manage operating margin and other challenges facing the industry.

Creation of a sustainable workforce

Demand for health care service providers will continue. Organizations should identify creative opportunities to attract and retain talent such as investing in nursing programs offered at colleges and universities to provide the resources needed to expand enrollment.

Continued technology investment will be critical to bridge the gap between the need for health care services and the available labor resources to provide them. In addition, providers must train and educate their constituents in the use of this technology for it to be effective in achieving established goals.

TAX TREND: Workforce

Health care organizations may strengthen their recruitment and retainment efforts by centering compensation and benefit offerings around total rewards packages instead of just cash salary. Retirement programs, equity compensation, education opportunities or assistance, health savings accounts and subsidized transportation benefits are just a few of many common offerings with tax implications.

Margin improvement initiatives

“Margin improvement,” says Tina Hodges, health care revenue integrity leader at RSM US LLP, “may encompass a variety of pillars to reduce cost and improve net revenue, including revenue cycle, managed care strategy, clinical operations, pharmacy strategy and supply chain.” She adds that the successful integration throughout the pillars, which is imperative for margin improvement, relies on the following:

- A collaborative team of operational and technical subject matter experts with a robust knowledge of current regulatory demands

- A vision for identifying technical opportunities for optimization and automation, as well as analytics to drive data-guided decisions and create transparency in performance

- Support of financial integrity with accurate documentation and severity capture to report the true acuity of a patient and capture appropriate reimbursement

According to Hodges, providers must take the time to analyze the people, process and technology associated with all the pillars to maximize margin.

TAX TREND: Cost Management

Tax departments in middle market organizations are commonly strained by a variety of challenges, including difficulty finding qualified professionals and new compliance requirements resulting from frequent regulatory changes. A company that outsources or co-sources its tax function can augment the strengths of its in-house resources with manpower and secure technology without having to add full-time employee.

Supply chain management

Organizations should identify opportunities to close gaps and boost efficiency within their supply chain. Consider engaging a professional to conduct a comprehensive rapid assessment in order to gain an independent perspective. Reviewing every facet of the supply chain and aggregating the information into one holistic view is important. Once you have gained this high-level, comprehensive perspective, implement the changes necessary to reduce costs and fortify supply chain resilience using solutions and frameworks that precisely fit your needs.

TAX TREND: Supply chain

As supply chains evolve, the transfer pricing implications can be outsized, leading to tax planning opportunities and risk management needs. More immediately, the increasing permanence of supply chain disruptions may necessitate organizations to update their transfer pricing more frequently than in previous business cycles. A company that understands the transfer pricing life cycle can tackle its numerous complexities—including data management, analyses, documentation and implementation—to ensure compliance and tax efficiency.