Deal activity will remain strong, although it is unlikely to return to the fervor of late 2021 and early 2022.

M&A health care trends: Key takeaways

The challenging health care operating environment will continue to drive consolidation and expose investment opportunities.

Many providers will focus on investing in existing operations and supporting organic and de novo growth.

Over the past year, the Federal Reserve has increased the upper limit of the federal funds rate to 5.0% from 0.25% to combat inflation. Higher interest rates translate to increased costs of capital, lower valuations for businesses, tighter lending standards and lower deal volume. The rate environment has put a pause on many deals as investors reassess macro and industry trends and focus on improving existing company operations.

Despite this environment, health care mergers and acquisitions are expected to remain strong through 2023. While the interest rate environment has certainly cooled activity from the frantic pace of 2021 and early 2022, the challenging operating environment will continue to drive consolidation and expose investment opportunities as multiples stabilize.

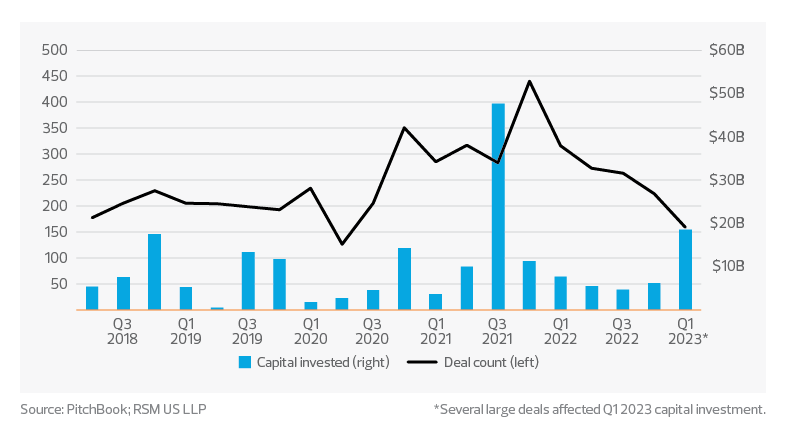

Health care services buyout activity has cooled to more normal levels

According to PitchBook, in the fourth quarter of 2022, deals in health care services fell to their lowest level since the nadir of the pandemic; then, first-quarter 2023 activity fell even lower to an estimated 159 deals, the second-lowest level in the observed period. However, capital invested increased to an estimated $19 billion due to several megadeals.

TAX TREND: Reporting for tax-exempt organizations

Tax-exempt organizations engaged in M&A activity with for-profit organizations must be cognizant of generating unrelated business taxable income that could be considered outside of their charitable mission and affect their tax-exempt status. Tax-exempt organizations must accurately capture and measure their activities that further their exempt purpose, including how they address social determinants of health and related ESG efforts.

A fragmented environment

We expect deal activity to remain strong, although it is unlikely to return to the fervor of late 2021 and early 2022. The challenging operating and rate environment will force some operators to sell. These and other buying opportunities will continue for financial and strategic acquirers with access to capital and strong industry convictions. Ultimately, health care remains highly fragmented, with opportunities to build economies of scale and scope in many areas.

However, we also expect that many operators will focus more on investing in existing operations and supporting organic and de novo growth, rather than inorganic growth by acquisition, which has become much more expensive and difficult to execute. More health care providers, including those backed by private equity, will deploy advanced customer relationship management, enterprise resource planning, and artificial intelligence solutions to deliver growth and improve outcomes.

TAX TREND: Tax ownership

State law often limits ownership of professional practices, such as medicine, to a licensed practicing professional. A transaction with private equity may require a master service agreement that governs a number of supporting agreements and, in turn, may result in questions of ownership for tax purposes.

The fervent deal-making of the zero-interest rate era may be over, but both strategic and financial buyers are eager to invest. As the uncertainty over future interest rates and operating environments abates, we will see an increase in deal flow. This may represent an opportunity for organizations that are able to put money to work acquiring new operations and entering new markets. We will, at the very least, see increased investment in existing operations.