Tax-exempt health care organizations must take care to maintain their status.

Tax-exempt status in health care key takeaways

One of the most important measures is filling out IRS Form 990, Schedule H, as accurately as possible.

Organizations can also highlight their work within their communities to help validate their standing.

Hospitals and health care organizations granted tax-exempt status have the benefit of not paying corporate taxes on the income they produce from related business activities. Additionally, many of these organizations receive exemptions from other taxes (e.g., sales and real estate). Achieving and maintaining tax-exempt status requires reporting on a variety of activities, including community benefits and charity care. Accurately calculating these efforts is critical; failure to record compliance in real time might cause scrutiny later. However, performing accurate reporting can be a complex undertaking for many organizations.

Distinguishing tax-exempt status

Tax-exempt health care organizations, as described in Internal Revenue Code section 501(c)(3), are required to file Form 990, Return of Organization Exempt From Income Tax, to provide a view of their activities. Some of the most publicized data from Form 990 includes an organization’s executive compensation and, on Schedule H, a hospital’s reporting of compliance with section 501(r).

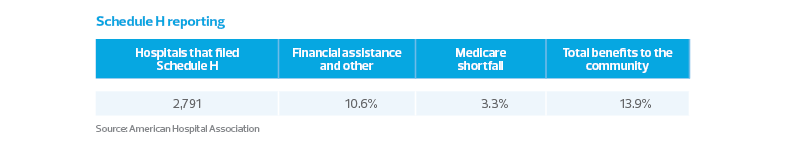

Schedule H requires data on a hospital’s financial assistance and community benefit programs, including charity care provided and Medicaid shortfall (i.e., the amount of uncompensated costs from treating Medicaid patients). This information is one of the factors that may distinguish tax-exempt hospitals from for-profit hospitals that offer the same medical services. The Court of Appeals for the 10th Circuit, invoking revenue ruling 98-15, held that “not every activity that promotes health supports tax exemption under section 501(c)(3).” The court added that “engaging in an activity that promotes health, standing alone, offers an insufficient indicium of an organization's exempt purpose. Numerous for-profit enterprises offer products or services that promote health.”

Various stakeholders, including Congress, view this reporting responsibility as a burden that tax-exempt health care providers must bear to justify their status. Comparisons of the public records of for-profit hospitals and tax-exempt hospitals contribute to a perception that tax-exempt hospitals need to do more to justify their tax-exempt status. Although no bright line indicates the minimum community benefit a tax-exempt hospital must provide to maintain its section 501(c)(3) status, organizations continue to emphasize the accurate reporting of these amounts, in part to provide interested parties a true depiction of the benefits they provide to the communities they serve.

What should providers do?

For health care providers, it is important to accurately capture and measure the organization’s community benefit and take credit for all its charitable efforts. Tax-exempt hospitals and health care systems should ensure that their reporting on Schedule H and to media outlets is complete and accurate, with every community benefit expense accounted for properly.

Hospitals and health care providers may report on their Schedule H, and in other documents for the public and stakeholders, the impact of meeting the health-need deficits identified through their community health needs assessment. They may also report on their environmental, social and governance efforts. Many constituents are interested in an organization’s formalized policies and programs related to service dedication, environmental protections, social justice efforts and more. An ESG strategy fortifies an organization’s reputation in the community and promotes goodwill. It’s another way to communicate an organization’s core passions, as well as the benefits and support it provides in the community.

While many health care providers can take substantial credit for changing the health care outcomes of their communities, the key to maintaining tax-exempt status lies in telling the story. In addition to providing data points, providers can focus on their impact in the community and other validating factors. The story of community benefits and other charitable efforts should be rigorously and accurately reported.