Understanding price elasticity will be key to protecting market share and margins during the impending economic slowdown.

Key takeaways

Businesses will continue to face margin pressure from rising costs.

Emerging innovations in production processes can help meet changing consumer preferences and increase efficiency.

In the coming months, food and beverage businesses will face headwinds from consumers uncertain about lingering inflation, geopolitical issues and a looming recession. These challenges are in stark contrast to the pantry-loading days of the pandemic and come only shortly after these businesses were finally able to pass surging costs for ingredients, logistics and labor to the end consumer

Real and nominal off-premises food and beverage consumption*

Food and beverage business executives’ understanding of price elasticity will be key to protecting market share and margins during the impending economic slowdown. Price hikes passed down to the consumer in 2022 have already influenced behavior, with U.S. households buying less food for at-home consumption than pre-COVID projections, despite spending more on food and beverage products than ever before.

As supply chains continue to improve there will be more products on grocery shelves and more competition for the consumer’s shrinking wallet. Middle market food and beverage companies should expect the added competition for shelf space to bring about higher slotting fees and more promotions aimed at protecting market share from national and private label brands and penetrating new households.

While a more promotional environment may be inevitable, understanding where consumers are willing to pay premiums will also be critical to maximizing value. Even as prices have risen, health, well-being and environmental responsibility still drive consumer purchases. Premium food and beverage brands continue to outperform conventional brands in growth despite the overall pullback in spending, indicating the stickiness of some pandemic behaviors has overcome the impact of inflation.

It is also important for food and beverage companies in the middle market not to hold back on innovation. When supply chains were tighter and commodity prices increased, many companies were unable to acquire certain raw ingredients or packaging. They worked to reformulate and repackage to meet consumer demand. Continuing to innovate is essential for staying ahead of the competition and capitalizing on evolving consumer preferences. Innovation can also provide tax savings via the research and development credit, as the law now requires companies to capitalize and amortize those expenditures instead of expensing them immediately.

TAX TREND: Food and beverage

Food and beverage companies investing in research and development projects, such as sustainable packaging, might be eligible for R&D tax credits. This consideration is especially timely because the tax treatment of R&D expenses became less favorable for taxpayers in 2022 due to a change in the law. The process involves identifying and quantifying R&D activities and costs, compiling proper documentation and support, and developing an overall methodology to quantify and support past, current and future credits.

Rising costs

Food and beverage businesses will continue to face margin pressure from rising costs. The softening of commodity price increases has yet to fully make its way through the supply chain, as the year-over-year increase in the producer price index (the measure of what producers are paying their suppliers) remains in the low double digits. Moreover, commodity prices with the greatest impact on the food and beverage industry are notoriously volatile and susceptible to everything from weather patterns to geopolitical events and policy decisions.

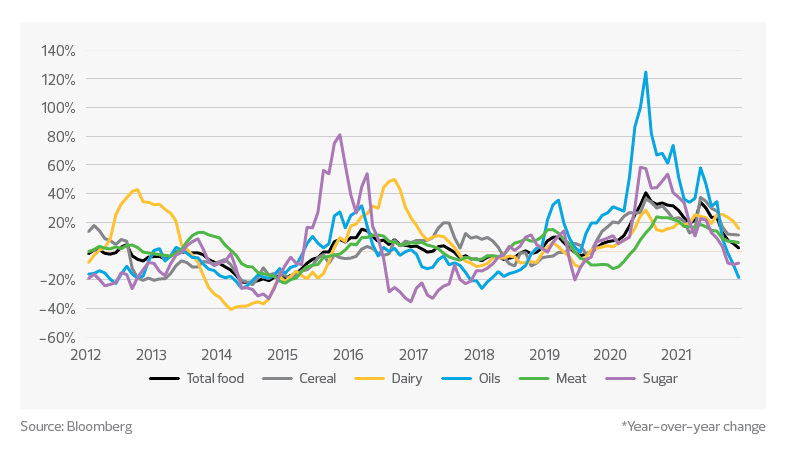

UN food and agriculture world commodity indexes*

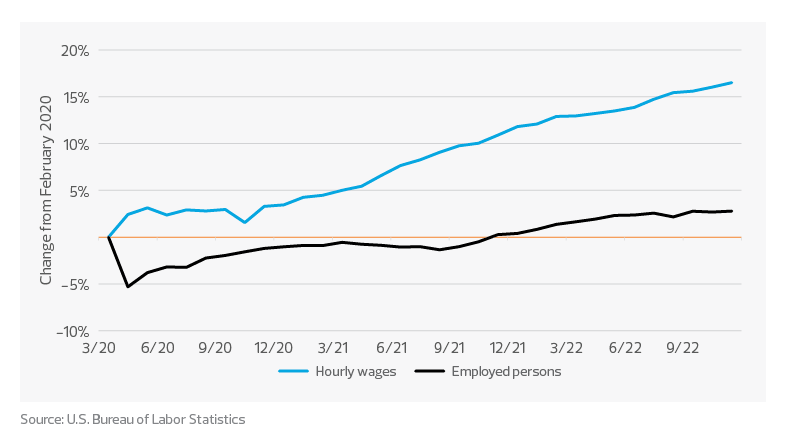

Labor is still an issue as well. For interest rates to decline, hiring must slow. However, technology is the only sector that seems to have more employees than necessary. Food and beverage manufacturers and distributors in the middle market are still struggling to hire and retain employees. These companies cannot afford to continue to increase wages and have found that higher wages alone do not improve retention. From the employees’ perspective, wage increases are not keeping up with inflation. To retain employees, middle market food and beverage companies need to consider providing flexible work arrangements, enhanced benefits and on-the-job training.

TAX TREND: Food and beverage

An attractive total rewards program can help an organization recruit and retain employees. By understanding the tax implications of compensation packages that feature more than just salary, an organization can make decisions that support its business objectives while avoiding surprise costs. Such packages can include educational assistance, remote work and much more.

Food manufacturing production and nonsupervisory workers

What lies ahead? Innovation can equal opportunity

Middle market food and beverage companies have proven their resilience time and time again. As challenges continue and competition increases, it is imperative for companies to invest in tools that help them understand their business and their customers.

Consumers are redefining value, not just in their response to pricing, but also by allowing personal beliefs to guide buying decisions. While companies may have adjusted to supply chain challenges by changing packaging or ingredients or passing along price increases, it will take a more refined approach to retain customers and grow revenue. For example, in response to consumers’ environmental concerns, middle market companies need to communicate mitigation efforts such as delivering products in environmentally friendly containers or using natural ingredients.

To meet consumer demands for cost-effective nutrition, companies must innovate to get the most out of their raw materials and bring efficiency to production processes. As demographics shift and younger consumers gain more purchasing power, developing a digital strategy to track and adapt to changing preferences will be as important as developing the product itself.

Innovations in production processes can help businesses respond to changing consumer preferences and increase efficiency. Advances in agricultural processes like regenerative vertical farming are bringing sustainable ingredients closer to end consumers. The Food and Drug Administration’s recent approval of lab-grown meat could signal a proliferation of new sustainable ingredients and the potential to revolutionize consumer diets.

Connecting to customers provides middle market food and beverage businesses an opportunity to build loyalty and market share. Maintaining a nimble environment can help them drive success through innovation and strategic initiatives.

TAX TREND: Food and beverage

Food manufacturers whose operations were affected in 2020 and 2021 by coronavirus mitigation measures may be eligible to claim employee retention tax credits for the covered periods, subject to eligibility requirements. Many companies did not have the resources to garner this credit, but there still is time to make sure your business is not leaving money on the table.