Businesses and individuals have reached a tax policy crossroads ahead of potentially sweeping tax law changes in 2025.

With a new president and Congress set to take office in January, conditions are ripe for legislative action that could remake the U.S. tax landscape. More than 30 provisions in the 2017 Tax Cuts and Jobs Act (TCJA) are scheduled to expire at the end of 2025, and a host of other tax provisions are potentially in play.

The nature and extent of any tax law changes will ultimately depend on the balance of power in Congress, where margins figure to remain slim, as well as on who wins the White House. The Sept. 10 presidential debate between Vice President Kamala Harris and former President Donald Trump underscored this crossroads while commencing the sprint to Election Day on Nov. 5.

Although the exchange between the candidates featured few tax policy details beyond those already known, the discussion reflects the early stages of a longer, and more protracted, tax policy marathon—with major tax changes potentially at the finish line sometime in 2025.

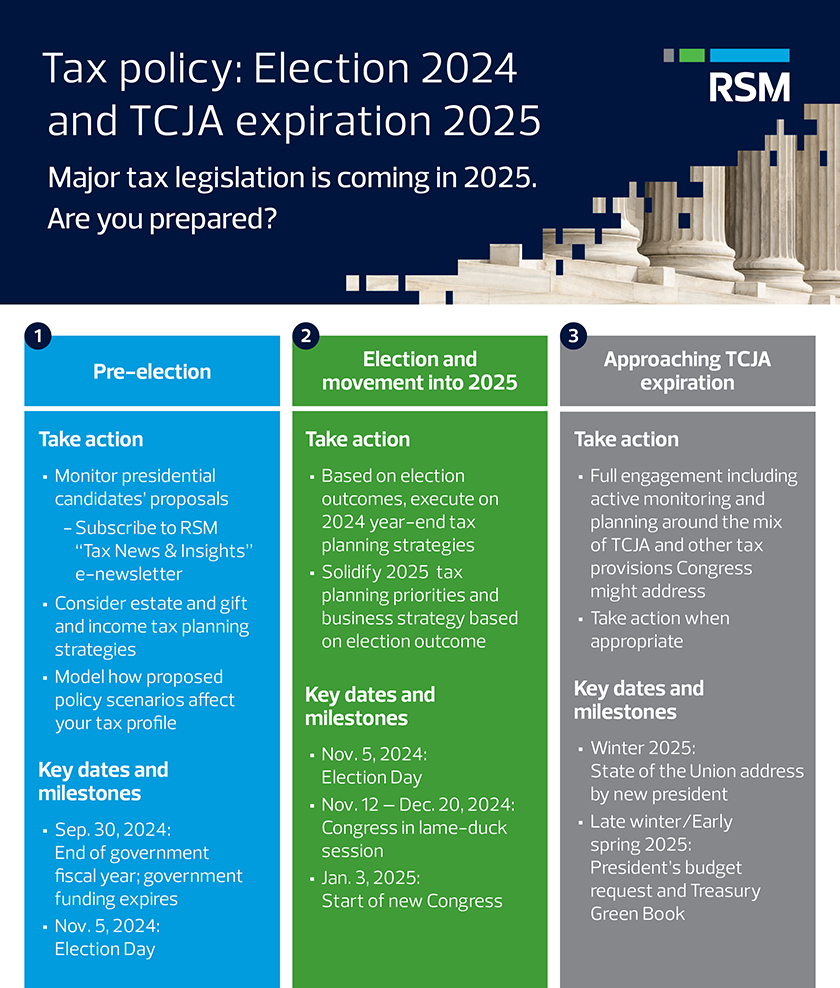

Before the general election, businesses and individuals can work with their tax advisor in the following ways to equip themselves to make smart, timely decisions once the tax policy outlook becomes clearer:

- Monitor candidates’ tax proposals

- Identify potential tax changes that could affect their business objectives, individual tax position and estate planning goals

- Begin to model potential cash flow and other impacts of significant proposals

- Create and execute a 2024 year-end tax planning strategy

- Below, we discuss each candidate’s notable tax proposals, explain the crucial power dynamics at stake in the election, and suggest actions that businesses and individuals should consider at various stages of the legislative cycle.