Many people want their loved ones to inherit their home after they are gone. However, leaving the value of your home in your estate can contribute to a high estate tax bill. Qualified Personal Residence Trusts (QPRT) can be a valuable tool to make a lifetime transfer of your home to your family, still enjoy the home during your life, and potentially reduce your estate taxes.

What is a QPRT?

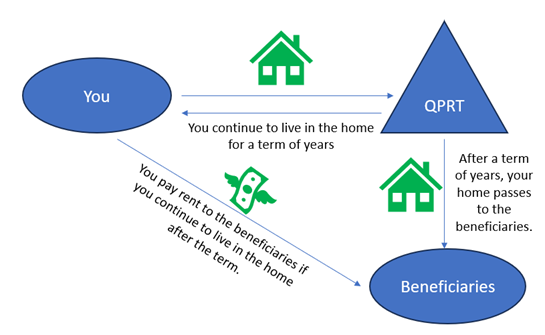

A QPRT is an irrevocable trust designed to reduce the amount of gift and estate taxes typically incurred when transferring a personal residence to beneficiaries. By transferring your home into a QPRT, you can continue living in it for a specified term while passing it on to your heirs at a reduced transfer tax cost. The essence of a QPRT lies in its ability to freeze (for estate tax purposes) the value of your home at the time of the trust's creation, potentially shielding any future appreciation from estate taxes.

What are the requirements for establishing a QPRT?

- Generally, the personal residence must be the sole asset of the trust.

- You decide on a fixed term (e.g., 5, 10, 20 years) during which you retain the right to live in the home. After this term, the residence passes to the beneficiaries designated in the trust. You may live in the home after the term, but you must pay rent to retain the estate tax advantages.

- Once established, the terms of the QPRT cannot be altered, and residence cannot be taken back