With proper planning, dramatically reduce or eliminate exposure to estate tax after a business sale.

Key takeaways

You can also fulfill your charitable giving goals and several effective options may be available.

You may be able to change your state of residence to reduce income tax, if appropriate.

Following the sale of a business, you should ensure that your estate plan is updated to conform with your new financial situation. This process will often require you and your advisors to figure out what steps will be appropriate to decrease your exposure to estate tax.

The following article briefly describes some of the common techniques to make gifts to family members or charity. These gifts may be made directly to these beneficiaries or through trusts. Each strategy may be an effective way to transfer your wealth to your beneficiaries while reducing estate tax. Consult with your RSM US LLP tax professional about which strategy may be best for your estate planning goals and current assets.

The sale of your business interest may dramatically change the nature of your wealth. In a brief period of time, your wealth may become more diversified and liquid, which will change how you manage your wealth going forward. Such a dramatic change in your financial situation may also require careful revisions to your estate plan. The increase in your wealth may leave you and your family with serious exposure to estate tax upon your death. Fortunately, for those who are willing to plan, this exposure can be greatly reduced or even eliminated. The following discusses some of the common strategies you should consider in revising your estate plan to be more in line with your new financial situation.

Strategies for reducing your tax burden after the sale of a business interest

Reviewing your current estate plan

A good place to start is to review your basic estate planning documents: your will and durable powers of attorney for health care and financial purposes. A revocable trust may be a necessary addition to your estate plan, depending on your state of residence.

If you have never created an estate plan, you should engage your RSM tax professional and an attorney who specializes in estate planning to create at least these basic estate planning documents as soon as possible. Doing so will help ensure that your wealth will pass to your beneficiaries in accordance with your wishes, rather than pursuant to state inheritance laws.

If you have created these basic estate planning documents, after a business sale, you need to review and update these documents to ensure these documents reflect your current financial situation and wishes for the transfer of your wealth.

Estate tax reduction strategies

Under current federal law, everyone has an exemption from estate and gift tax. If the value of assets transferred by gift or at death is below the exemption, no estate or gift tax will be due. If the value is above the exemption, the excess is subject to tax at a 40% rate. Thus, for those who have wealth above the exemption, the estate and gift tax can be quite substantial.

The exemption for 2022 is $12.06 million per individual (or $24.12 million for married couples). The exemption is adjusted for inflation each year. The estate and gift tax exemption will “sunset” on January 1, 2026, meaning that the exemption will be essentially cut in half from the 2025 exemption amount.

If you are over the exemption or will be over the exemption after the sunset, there are numerous planning opportunities available that will essentially move assets during your lifetime to those you want to inherit your wealth but without paying gift or estate tax. Some of the most common options for those who have just completed a sale of a business interest are briefly explained below. Contact your RSM tax professional for more details.

Annual exclusion gifts

When making gifts, typically you only need to dip into your exemption if the value of the assets transferred to an individual in a year exceeds the annual exclusion amount. For 2022, the annual exclusion amount is $16,000 per recipient. Married couples can “split” gifts made by either of them, in which case the annual exclusion amount for such gifts is $32,000. This amount is increased periodically due to inflation.

If you have significant liquidity from the sale of a business interest, annual exclusion gifts can be a relatively simple way to reduce your estate tax exposure while benefiting family members. Many people simply transfer available cash to children, grandchildren, or others, up to the annual exclusion amount each year. These gifts can add up over time. For example, a married couple making $32,000 annual exclusion gifts each year to 3 children and 7 grandchildren will remove $960,000 from their estates after three years, all without using any gift tax exemption.

Additional aspects of annual exclusion gifts are worth noting. Often, annual exclusion gifts can be made to irrevocable trusts if necessary to preserve and better manage the assets transferred. Annual exclusion gifts can not only be made with cash but with stock and most other liquid assets as well. If you have set up a 529 plan for a family member’s college fund, you can “frontload” annual exclusion gifts by transferring five times the annual exclusion amount in a single year, allowing those funds to grow tax-free over a longer period. Finally, payments made directly to a school to pay tuition or a medical institution to pay medical expenses for someone else are exempt and have no annual limit.

Spousal lifetime access trusts

Many high-net-worth families are interested in making substantial gifts before 2026 to use their exemptions before part of it is potentially lost due to the sunset. However, many struggle with making a substantial gift to a family member or an irrevocable trust because they will lose direct access to those assets if needed. One solution to this dilemma for married couples is a spousal lifetime access trust (SLAT), which allows you to make a substantial gift to an irrevocable trust, use exemption before the 2026 sunset, and give your spouse access the trust assets if necessary to meet other financial goals.

A SLAT is funded with assets of one spouse (the grantor spouse), using his or her exemption. Children or other individuals may be named as beneficiaries. In addition, the trustee may make distribution to the other spouse (the beneficiary spouse) for certain purposes. If the trust is drafted properly, the beneficiary spouse may even serve as trustee. Often a married couple will have two SLATs: each spouse will create a SLAT for the benefit of the other, using both spouse’s exemptions (these trusts must be sufficiently different from each other to avoid adverse estate tax consequences).

Because the trustee can make distributions to the beneficiary spouse, the married couple may access the trust assets if necessary. If the assets stay in the SLAT, the grantor spouse will remove such assets from his or her taxable estate for estate tax purposes.

Taxable income arising from the SLAT assets will be taxed to the married couple, not the SLAT. These tax payments further reduce the grantor spouse’s gross estate, while the SLAT assets grow income tax-free.

Irrevocable life insurance trusts

Many people use life insurance to provide the liquidity necessary to pay an estate tax bill, which is due only nine months after death. The life insurance itself, however, can cause a substantial increase in estate taxes due. When someone dies owning a life insurance policy in his or her own name, the tax laws treat the entire death proceeds as part of the decedent’s taxable estate.

Irrevocable life insurance trusts (ILIT) resolve this problem. An ILIT is another type of irrevocable trust drafted to hold life insurance policies. You pay any premiums on behalf of the trust, typically without any gift or income tax consequences. Upon your death, the life insurance proceeds will be paid to the trust. The proceeds will be distributed to your beneficiaries, usually in the same way as the rest of your assets. The difference is that those death proceeds will not be part of your taxable estate for estate tax purposes. If funds are still needed to pay estate tax, the trustee of the ILIT can make the death proceeds available to the executor of your estate for that purpose.

Charitable giving strategies

After the sale of a business interest, you should work with your RSM tax professional and other advisors to decide whether you can take advantage of any year-end planning to capture deductions that could help offset the tax consequences of the sale. This may also be a great opportunity to make significant charitable gifts in the year of the sale to carry out the charitable goals that you may not have had the liquidity to accomplish before the sale. The following briefly describes some of the common and effective strategies available.

Donating appreciated stock to charity

A relatively simple strategy is to make your annual charitable gifts with publicly traded stock held for more than one year rather than cash. This approach avoids taxable capital gains and generates an itemized deduction for the current market value of the stock on the date of the gift (generally subject to a limit of 30% or 20% of AGI).

Donor-advised funds

A donor-advised fund (DAF) is a separate account held by an existing public charity (called the sponsoring organization) that provides a donor with advisory privileges over the distribution or investments of assets within the account. For contributions made to a DAF, you receive an immediate charitable deduction equal to the current market value of the assets contributed and, if those assets have appreciated, you avoid any taxable capital gains. Furthermore, any contribution to a DAF reduces your taxable estate for estate tax purposes.

The downside is that any asset you contribute to a DAF is considered an irrevocable gift. This means that once you make a contribution, the DAF has legal control over it. However, you, or your successors, generally keep the ability to make investment or distribution recommendations. Often, a DAF can be set up as a dynasty charitable giving vehicle by appointing your heirs as successor advisors.

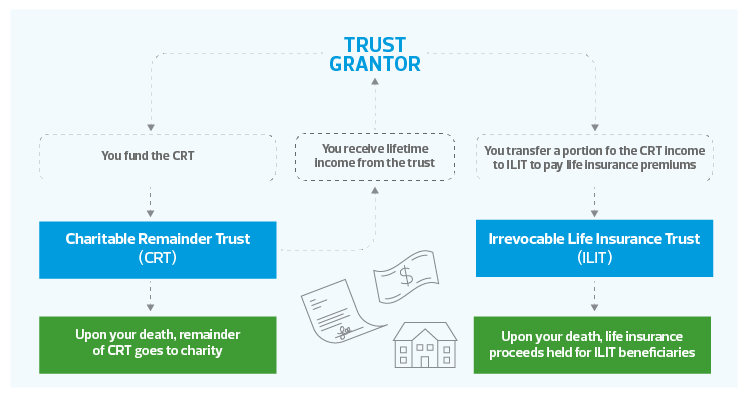

Charitable remainder trusts and wealth replacement trusts

A charitable remainder trust (CRT) is an irrevocable trust that provides an income stream to the trust grantor or other beneficiaries for life or for a term of years with the remainder going to a charitable beneficiary. In the year you fund the CRT, you will receive a partial charitable deduction based on your life expectancy and expected income stream and defer taxable capital gains (if you contribute appreciated property). This technique provides you with a supplemental income source and ultimately reduces the size of your taxable estate. Furthermore, you can set the level of income paid out of the trust (within reasonable IRS guidelines).

Two primary types of CRTs exist: the charitable remainder annuity trust (CRAT) and the charitable remainder unitrust (CRUT). The primary difference between these two types is how the annual payments from the trust to the beneficiaries are determined. The annuity paid under a CRAT is a fixed dollar amount, while the unitrust payment under a CRUT is a fixed percentage amount, revalued annually based on the balance of the trust.

A wealth replacement trust is the same as the irrevocable life insurance trust (ILIT), discussed above, but you contribute funds to the ILIT to make life insurance premium payments by using all or a portion of your income stream from the CRT. The payments from the CRT are then removed from your taxable estate, and the life insurance proceeds payable to your family replaces the wealth that was left to charity under the CRT.

These trusts provide more control and flexibility than DAFs or outright charitable gifts. However, while there are technically no minimums, trusts are generally utilized for larger donation amounts because of the increased set-up cost and ongoing administrative costs associated with operating trusts.

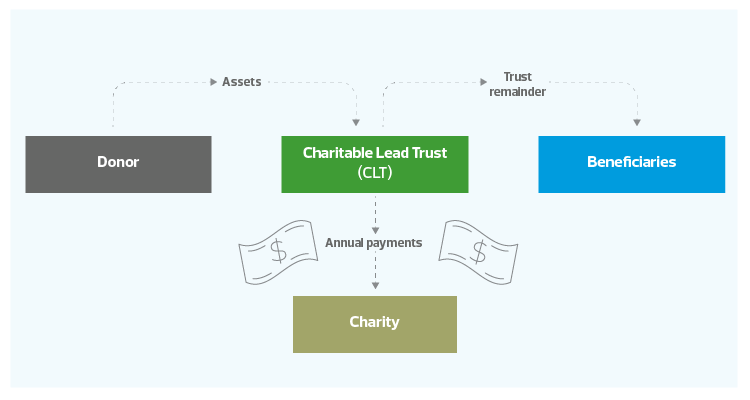

Charitable lead trusts

A charitable lead trust (CLT) is often described as the opposite of a CRT. This strategy gives the trust’s annual income to charity. After this income is paid to a charity for a term of years, the remainder goes to your beneficiaries. The charitable deduction is equal to the present value of the estimated income stream to charity. Like CRTs, you can establish either a charitable lead annuity trust (CLAT) or a charitable lead unitrust (CLUT), and the fundamental difference between the two is the calculation of the annual income payments.

Private foundations

Private foundations are tax-exempt entities that are eligible to receive deductible charitable contributions. They further charitable purposes by either carrying out their own charitable activities (e.g., operating a museum) or making grants to other organizations (usually public charities). The donor can exercise significant control over the private foundation, both with respect to long-term strategy and day-to-day operations. Thus, you can establish a private foundation to focus on your own charitable goals. In addition, you can use the private foundation to establish a philanthropic legacy by including other family members, such as your children, in an active role in the private foundation.

Private foundations, however, are not for everyone because they come with their own set of administrative obligations. With the ability to exercise more control over the private foundation’s activities comes the requirement to commit more time than that associated with administering a DAF or charitable trust. In addition, numerous tax laws regulate the operations and behaviors of private foundations, including: (1) a 1.39% excise tax on investment income; (2) prohibitions on transactions between the foundation and certain related persons (i.e., disqualified persons); (3) requirements to distribute annually at least five percent of the foundation’s assets; (4) limitations on investments in operating businesses; (5) restrictions on risky (i.e., jeopardizing) investments and (5) rules regarding how the foundation expends its funds and documents its grantmaking activities. Also, the amount deductible from a donation to a private foundation will be subject to greater AGI limitations than a donation to a public charity (i.e., typically 20 or 30 percent of AGI rather than 30 or 50/60 percent of AGI). Finally, the private foundation has an annual filing requirement with the IRS, which requires significant detail regarding its activities.

Before establishing a private foundation, we recommend evaluating your philanthropic objectives against the benefits and burdens of each of the charitable planning vehicles to determine which one or more offers the best solutions for your personal goals and level of involvement.

Residency tax planning

You may wish to reconsider your state of residence to reduce your overall tax burden. Many people who have completed a business sale have the resources and flexibility to move their residence to a state that imposes substantially less or no state income tax.

Currently, there are eight states that do not impose a state income tax: Florida, Washington, Texas, Nevada, Alaska, South Dakota, Tennessee, and Wyoming. Tax rates in other states vary and may be significantly less than the applicable tax rate in your home state. Unfortunately, changing your primary residence for income tax purposes requires a lot more than changing your address on your tax return. There can be several requirements to both (1) relinquish residency in your current state and (2) establish residency in a new state. Depending on the nature of your assets, it may not be possible to avoid state income tax in your home state (for example, if you still hold an interest in a passthrough business in your home state). In addition, you likely must spend at least half of each year in the new state. The tax authorities in states that have a high-income tax are particularly aware of residents trying to establish residency for tax purposes in a state with no income tax but spending most of their time in the high-income tax state. Further, there may be other taxes imposed by the new state that must be considered (e.g., state estate tax, inheritance tax, sales tax, property tax, etc.). Talk to your RSM tax professional about what may be required for your situation.

Of course, a decision to change your residence requires consideration of much more than taxes. Many conclude that the tax savings do not justify the changes to their lifestyle and family and social connections. Others can make the move while keeping a vacation home in their former home state.

Don’t let an inadequate estate plan ruin your financial legacy

Although most people don’t enjoy thinking about estate planning, it is a critical part of securing the financial future of your family. If you have attained substantial wealth through the sale of your business, an unorganized estate plan, and a massive estate tax bill will greatly diminish this financial success. RSM has estate planning specialists with extensive experience in complex estate planning matters for high-net-worth families. Reach out to your RSM tax professional to begin this important planning process.