Private equity deal activity is finally expected to return to its normal growth trend.

High Contrast

Key takeaways

High interest rates are a key driver of private equity strategy, with a focus on driving efficiency.

Corporate carve-outs present a particular opportunity as they are ripe for transformation.

Private equity deal updates

Look for growth trend to resume

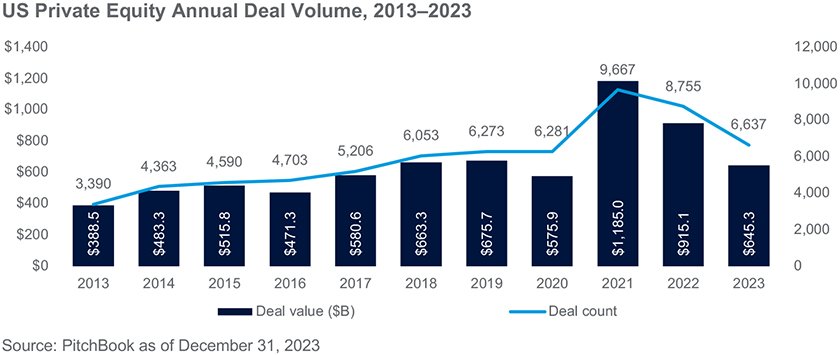

PE deal activity may be shaping up to finally return to its normal growth trend in 2024 following two consecutive down years. Deal volume fell by 24% in 2023 in what may be labeled a “pump the brakes” year due to rising interest rates and slowing overall growth. Bid-ask spreads were wide across the board as PE firms generally didn’t want to pay what sellers were seeking. However, deal activity climbed in the fourth quarter, finishing the year on a positive note.

The fact that PE deal volume has declined for two consecutive years must be viewed in context. In 2021, deal volume jumped by over 50%, spurred by low interest rates and liquidity from government stimulus spending. And although deal volume fell 9% in 2022, it was higher than in any of the preceding 10 years excluding 2021. PE deal activity remains very healthy when viewed over a longer-term horizon.

From a sector perspective, the worst-hit sectors in 2023 were tech, media and telecom (TMT); retail; and energy. We expect those sectors to rebound in 2024, as described in more detail below.

The long-term PE mergers and acquisitions (M&A) growth trend should resume in 2024 barring any major disruptions from geopolitical shocks and other macro factors. The PE market continues to show resilience amid the overall M&A landscape. While larger buyouts have lost some momentum, PE firms are opportunistically deploying capital across a range of verticals and transaction types. High interest rates are a key driver of PE strategy going forward, elevating the value of operating cash flows and incentivizing PE firms to continue their focus on making portfolio companies more efficient.

Carve-out transactions should remain strong

PE firms are expected to continue focusing on corporate carve-outs this year. With interest rates at high levels and economic growth likely to slow, we expect companies to maintain their focus on divesting underperforming assets. Carve-outs present a particular opportunity for PE firms because they are often neglected and undercapitalized corporate segments and therefore are ripe for transformation through careful revenue and margin growth.

Roll-up strategies will keep on rolling

Add-on transactions have risen every year for the past two decades. We expect this trend to continue in 2024 as PE firms seek to expand the profit margins and revenue footprints of their portfolio companies, especially those with proven business models that can quickly be implemented across new segments. In particular, we expect PE firms to continue their heightened focus on sectors and sub-industries with plentiful fragmented businesses—for example, veterinary and physician practices, CPA firms, and wealth management firms.

Tech and health care deal volume should rebound

The technology sector continues to diversify across software, hardware, cloud, AI, cybersecurity, e-commerce, gaming and more. Its innovative and disruptive character is attractive to PE firms looking to invest in companies with strong growth potential, competitive advantages, loyal customer bases and high margins. PE firms are well-positioned to help tech companies overcome the key challenges they face, such as scaling up, accessing capital, managing talent, enhancing governance and complying with regulations.

In health care, the COVID-19 pandemic accelerated the demand for innovation and transformation. New opportunities abound for PE firms to invest in companies that can provide solutions for unmet medical needs, improve patient outcomes, reduce costs and increase efficiency. PE firms can also leverage their operational expertise, networks and capital to help health care companies scale up, expand into new markets, acquire complementary assets and technologies, and navigate a complex regulatory and competitive environment.

Carve-outs

We expect PE firms to continue their focus on corporate carve-outs in 2024 as companies look to improve efficiency and shed underperforming segments. When considering carve-out activity, two themes stand out:

Rapid execution

PE firms are increasingly focused on getting carve-out deals done quickly. Moving with urgency during the deal evaluation stage can boost a PE firm’s chances of being viewed as a preferred buyer and improve the odds of success. In fact, some PE firms tactically use faster deal-making to differentiate themselves from strategic buyers. These firms come to the transaction with well-honed and carefully delineated processes and plans based on experience and industry knowledge. For example, they know how to quickly set up a tech stack or a payroll system. Historically, these processes could take a year or longer. Today, however, PE firms are standing them up in as few as six months.

To execute carve-outs quickly and precisely without taking excessive risk requires a specific mindset, skill set and team—including a thoughtful mix of internal and external staff. The ability to stand up a business in an accelerated timeframe can increase the chance of success when bidding for a carve-out. Limiting the ask for transition service agreements (TSAs) places less of a burden on the seller, which they may find attractive as they are trying to turn resources and management attention elsewhere.

PE buyers can bolster their execution capabilities through a range of creative approaches that help to limit the dependence on TSAs while also reducing redundant costs. They can also differentiate themselves by taking more of a long-term view of carve-out deals. Regularly engaging with Fortune 500 companies that are serial sellers can boost the credibility of a PE firm, making it more likely to be viewed as a friendly buyer in future transactions.

Strategic fit

When pursuing carve-outs, strategic fit shouldn’t be overlooked. PE bidders can gain an advantage by pursuing carved-out businesses that will fit well into their portfolio companies. When the acquired assets fit in neatly, the PE investor can mimic the privileges of being a strategic buyer without losing any control or compromising on deal vision. The traditional cost benefits of integrating businesses can be realized, along with potential revenue synergies.

The most innovative approach to carve-outs may be to partner with a strategic buyer. This approach recognizes that strategic acquirers have natural advantages in carve-out deals. Typically, in this type of deal structure, the strategic buyer would tuck the jointly acquired asset into their existing business and leverage their infrastructure to disentangle the carved-out business from its former owner. In addition to deal optimization efforts, partnerships like these can also create value through operational and top-line synergies.

Working capital optimization

High interest rates and slower growth should lead PE firms to sharpen their focus on working capital optimization in 2024 to sustain and improve financial models. Two areas of focus for PE firms are accounts receivable (AR) and accounts payable (AP) automation and improved inventory management.

AR/AP automation

Middle market businesses have not traditionally paid close attention to optimizing AR and AP. Under PE ownership, there is increasing use of tech and automation tools to do this strategically. Areas of focus include speeding up the financial close process with technology like Blackline, integrating purchasing and AP with procure-to-pay-systems, streamlining the order-to-cash process, and upgrading financial planning and analysis systems. These changes can produce fast working capital payoffs. Low-code automation—using visual interfaces and pre-built components to rapidly create and deploy applications and workflows with minimal coding—is a notable growing trend in PE.

Improved inventory management

PE firms are seeking better inventory management through a variety of processes and procedures, including using technology to control inventory strategically and consolidating warehouses.

Cost optimization

Cost optimization is expected to be a major theme in 2024 as PE firms continue their drive to make portfolio companies more efficient and protect working capital in a high interest rate environment. Cost-optimization strategies that PE firms are likely to focus on include:

License and vendor rationalization

We expect to see continued efforts to reduce overlap and redundancy in technology licenses and vendors, as well as to achieve volume discounts within and across platforms.

Outsourcing

Onshore and offshore outsourcing, including in areas like managed IT, should continue to grow. PE firms will need to manage the risk of having multiple incumbents assigned to given tasks and offset such risks with the potential efficiencies achieved.

Automation

Automation can encompass both labor rationalization and cost takeout. Importantly, automation should be done within the context of a growth strategy—i.e., how to continue growing without over-hiring and ensure the optimal mix of resources to support that growth.

Artificial intelligence

PE firms are expected to increasingly embrace artificial intelligence (AI) at all phases of deal-making from due diligence and transaction analysis to implementation of platform efficiencies.

Most PE firms are still in the analysis and education phase of AI adoption, seeking to understand its potential applications for their business. They are assessing various generative AI software implementation options and trying to determine the return on investment (ROI) of these tools. A key focus is on the various activities around change management and process optimization so AI can eventually be used on a greater scale.

Examples of AI adoption in the PE industry include:

- Validating financial projections: PE firms are using AI-assisted discovery along with massive, curated data sets to validate financial projections of targets and portfolio companies.

- Lead scoring: Firms are developing a lead-scoring approach to identify potential targets based on a combination of organization-specific and behavioral characteristics to indicate the odds of success based on past performance.

- Industry-specific use cases: Firms are applying AI to industry-specific use cases for portfolio companies, potentially leveraging a data consortium approach across multiple organizations.

Other potential focus areas in 2024

ESG

U.S.-based PE firms are considering how to best implement environmental, social and governance (ESG) strategies and how to quantify the ROI of those strategies. For PE firms with limited partnerships based in Europe, ESG is often a requirement for doing business. Elsewhere, it could be considered an optional extra. ESG strategies and policies are currently undergoing scrutiny globally, and we expect that PE firms will participate in this worldwide reevaluation of ESG strategy and messaging.

Cybersecurity

Cybersecurity is one of the most critical growth areas in technology. PE firms will continue to weigh cybersecurity options against ROI in terms of whether to do their own threat intelligence and cybersecurity monitoring to try to protect against attacks or, alternatively, seek out the best-possible cyber insurance coverage.

Executive talent

If the PE industry has a secret sauce, it may be locating and aligning with top-performing industry executives. PE firms find it a constant challenge to get enough qualified chief financial officers, chief information officers and other senior executives to lead portfolio companies. This should continue to be a top focus area.

Global expansion

Many PE firms are expanding office footprints beyond the traditional single office location. They are also expanding globally as PE deal-making becomes increasingly cross-border in nature

Finance and accounting

Portfolio company finance and accounting (F&A) operations should remain a key focus for PE firms as these are critical for managing cash flow, reporting performance and supporting decision making. Steps to improvement include assessing current conditions, identifying gaps and risks, developing a transformation road map, implementing best practices and systems, upgrading F&A staff skills, and monitoring performance using key performance indicators, benchmarks and other feedback mechanisms.

Back-office technology

PE firms will continue to look for ways to make back-office tech more efficient. This is the backbone that supports the core business activities of portfolio companies, like accounting, human resources, IT, compliance and risk management. We expect to see growing adoption of cloud-based platforms since these reduce the need for on-site tech, enhance scalability, improve security and compliance, increase efficiency, and reduce cost and complexity. We also expect to see more outsourcing of some or all functions, especially to third-party providers that specialize in servicing PE clients.