Your lease accounting challenges

Real estate leasing and accounting teams are changing the way they view leasing to address these challenges:

Real estate leasing and accounting teams are changing the way they view leasing to address these challenges:

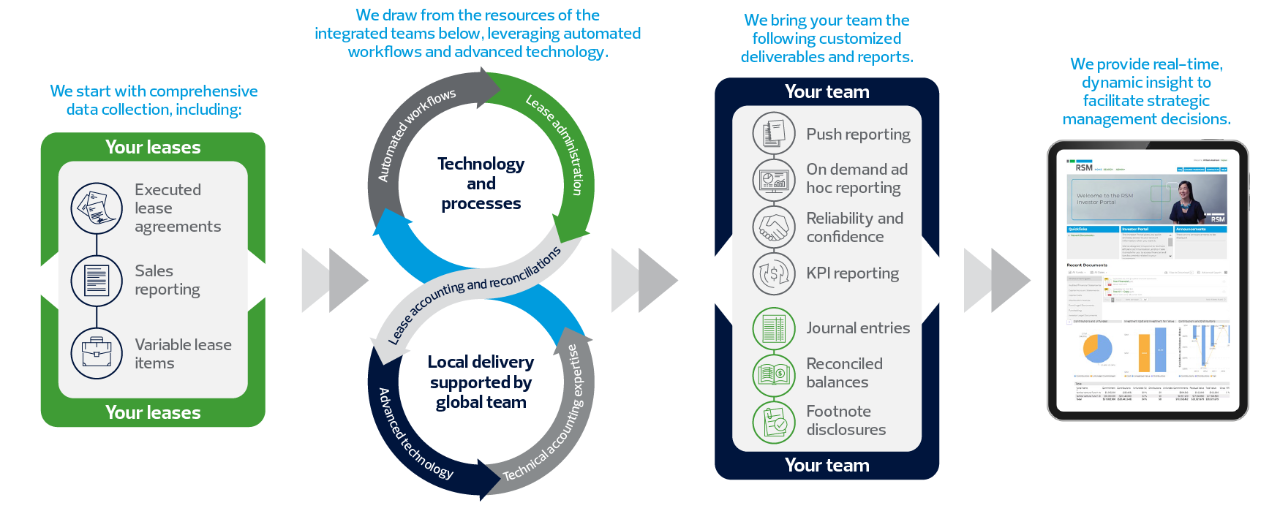

RSM’s lease accounting and lease administration team offers economies of scale and technology-enabled processes and workflows, as well as offshore, nearshore and local resources, to deliver with the end in mind. We provide public and private clients with the confidence that their financial statements are accurate, minimizing the potential for the discovery of errors during the audit process. We are uniquely qualified to serve your lease accounting and lease administration needs for real estate and equipment leases, delivering timely and accurate data through accounting and reporting under U.S. generally accepted accounting principles (GAAP), International Financial Reporting Standards (IFRS) and the Governmental Accounting Standards Board (GASB). With specialized focus on Accounting Standards Codification (ASC) 842, IFRS 16, GASB 87 and GASB 96.

We align people, process and technology in a comprehensive strategy, going beyond simply addressing your concerns and accurately reflecting your lease transactions to give you:

Delivering sustainable lease administration and lease accounting compliance by managing the volume, details and complexities of your company’s leases through best-in-class, technology-enabled workflows.

Trust RSM to effectively maintain your various lease portfolios and generate customized insights for each lease population. Through our holistic approach, you will be able to make key decisions based on accurate, current and meaningfully presented data.

We handle key business functions, including:

Whether public or private, your company needs confidence that your financial statements are accurate now, minimizing the potential for the discovery of errors during the audit process. If not properly updated and accounted for, lease populations become a significant financial reporting risk. Maintaining a portfolio under multiple standards or even one accounting standard—such as U.S. or local GAAP, IFRS or GASB—presents additional financial reporting risks for your team. Avoid risk and remove distractions by bringing in our team to singularly focus on your lease accounting. We elevate your team by managing:

Our center of excellence team will assist with more complex technical accounting issues, including:

The effort and technical experience required to accurately abstract your lease data and establish accurate lease accounting schedules can be underestimated, only to be revealed during the audit process. Our lease abstractors are not focused solely on abstraction for lease administrative purposes—they are also experienced lease accountants.

Our team consistently delivers key benefits, including:

If you are not yet using lease administration and lease accounting technology, or aren’t satisfied with your current system, we can help. Our experienced advisors can manage the selection and implementation of leading lease administration and lease accounting applications, provide training on their use and have assisted hundreds of clients in finding the right solution to fit their needs.

Already on a system? We can optimize your existing lease administration and accounting technology.

Don’t want to invest? We can set you up on our solution.

We have relationships with several leading technology providers, including: