The middle market continues to support ESG policies.

- Strategic planning

- Motivating factors

- Popular policies

- The climate change conundrum

- Measuring progress

- Small versus large companies

- The generation gap

- Political controversy

- Moving forward

Key takeaways from our 2022 environmental, social and governance report

Companies are focusing on specific concepts rather than broad goals.

Large companies are investing in ESG more than small companies.

ESG policies are especially important to younger workers and customers.

The nature of American business is constantly changing, and ideas accelerate from unknown concepts to vital functions with breathtaking speed. This is the case with environmental, social and governance (ESG) policies, which were unfamiliar to many companies in past decades, but are now a key component of many organizations.

Support for ESG initiatives continues to be high among middle market companies. However, the nature of that support is evolving. Middle market companies are reprioritizing their ESG policies to reflect their industries and organizational goals better. Companies are focusing on what they can realistically accomplish and are striving for specific objectives rather than attempting to tackle a broad range of ESG concepts. In addition, bigger organizations are making larger investments and adopting more ESG initiatives than smaller ones. These insights come from the data provided by the third-quarter RSM US Middle Market Business Index survey. For the survey, 407 interviews were completed from July 5, 2022, to July 26, 2022, of middle market executive decision-makers working in a broad range of industries.

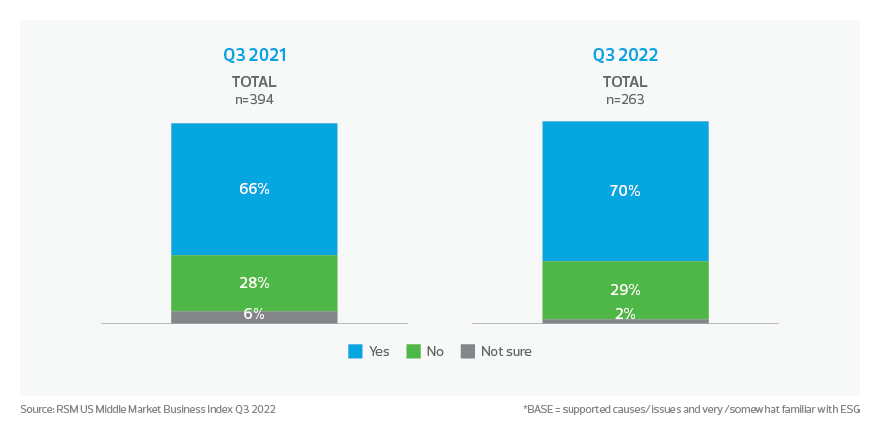

The survey reveals that 70% of middle market companies have formal plans or strategies regarding ESG initiatives, up from 66% for the comparable period a year ago.

Organization has formal plans/strategies regarding commitments to ESG initiatives*

Furthermore, 88% of the companies provide external reporting on their ESG performance, a statistically significant increase from 77% the previous year. And 69% of companies now have a dedicated senior executive whose primary responsibilities include establishing and achieving a vision for ESG. This is on par with 66% the previous year.

“A higher level of education about ESG has developed in the middle market over the past few years,” says Anthony DeCandido, a partner at RSM US LLP and leader of the firm’s ESG practice. “Under the ESG banner, there are components that allow professionals to go much deeper and make an impact. But what matters most to one industry will sometimes differ from another industry.”

Strategic planning

DeCandido says the middle market recognizes that the bar has been raised for ESG commitments and policies. Indeed, the specialization of ESG initiatives might be one reason why just 56% of companies with a formal ESG plan specify all of their commitments—such as environmental goals, gender and ethnicity programs, community involvement and so on—in their policies. This percentage is down from 72% a year ago, implying that organizations may be highlighting certain aspects of their ESG efforts.

“It’s almost impossible to improve everything and to track hundreds of different variables,” says Tu Nguyen, economist and ESG director at RSM Canada. "Companies don't have the money, time and resources to improve everything. So it’s much better to pick a few things that are key indicators that can really move the needle and make a difference in ESG performance.”

Companies don't have the money, time and resources to improve everything. So it’s much better to pick a few things that are key indicators that can really move the needle and make a difference in ESG performance.

She says the middle market is honing its approach to ESG, and the result is an increased maturity when it comes to establishing policies. She adds that companies are gathering data and identifying initiatives to meet their goals to back up the claims in their ESG reports. In this way, ESG stops being a buzzword and comes closer to becoming an integral part of an organization’s DNA.

Of course, there is another reason why some companies may be working on fewer ESG initiatives. The recent economic headwinds may have influenced some organizations to pull back on certain ESG efforts to focus on core capabilities. Evolving economic conditions could reinvigorate companies’ approaches to ESG. In addition, the Inflation Reduction Act—which passed on Aug. 16 after the survey was conducted—contains embedded climate spending initiatives that will allocate billions of dollars toward fostering renewable energy growth. These initiatives could mean more opportunities for businesses to enhance their environmental policies. In any case, over the long term, economic fluctuations are unlikely to derail ESG’s momentum.

"ESG is a marathon, not a sprint,” says Alex Kotsopoulos, partner at RSM Canada and a leader of the firm’s ESG practice. “Companies are putting money behind it. They're really taking ESG and corporate sustainability seriously. And we're seeing just how far the middle market has come in embracing ESG and really integrating it into their strategy, operations and business models.”

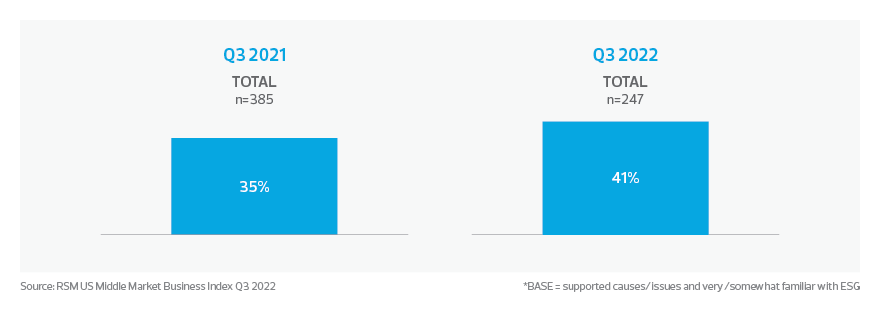

In fact, while business concerns will always be a prime motivator for any company to take action, ESG appears to have a strong intrinsic value, as 41% of respondents say they have embraced these initiatives because it is the right thing to do as an organization. Furthermore, this percentage is up from 35% the previous year.

Support of ESG initiatives is the right thing to do as an organization*

Motivating factors

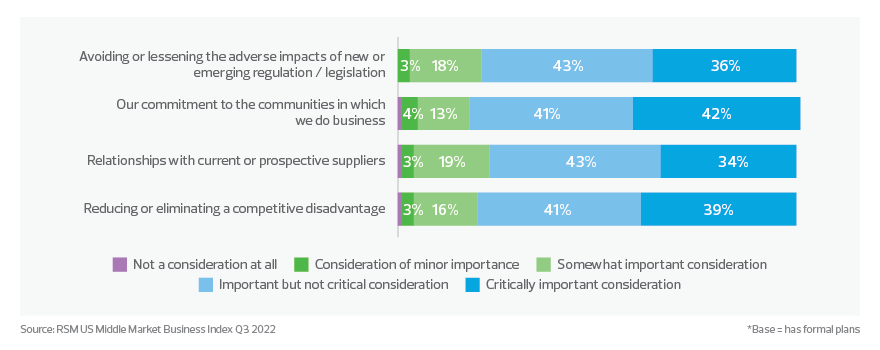

The decision to implement a formal ESG plan may come from a single spark or have multiple catalysts. Among companies that have instituted formal ESG plans, the desire to mitigate the impact of emerging regulations or new laws is a top factor, according to 97% of survey respondents. Other primary reasons for companies to take this step include reducing or eliminating a competitive disadvantage, improving relationships with current or potential suppliers, and enhancing a commitment to the communities in which the organization does business. All of those reasons were named by 96% of companies that had implemented formal ESG plans.

To be sure, companies that have not instituted a formal ESG plan have their own incentives for doing so. The top reason companies cited for opting not to create an ESG plan was because other organizational goals took priority, with 26% of such companies naming this as a factor. This is not unexpected, given the conflicting priorities of companies regarding inflation, supply chain issues, labor shortages and other economic concerns.

In addition, a small but significant percentage of companies that do not have plans seem to be in no hurry to join the ESG movement. Fifteen percent of such organizations said they don’t believe an ESG plan is relevant to their industry, and 13% are still assessing the need to create one.

However, many companies that have not yet implemented ESG into their organization may soon join those companies that already have. Of those organizations without an ESG plan, 15% say that they are currently developing a formal strategy, and 8% are making do with an informal ESG plan, suggesting that many companies will eventually develop a more organized approach.

“A lot of it is behind the scenes,” Kotsopoulos says. “Companies are thinking about sustainability. They're thinking about resource efficiency. They're trying to do right by stakeholders. Maybe they haven’t necessarily formalized a plan around it, but they know how important it is.”

Importance of considerations on organization’s decision to have a formal ESG plan

Popular policies

If organizations are indeed fine-tuning their ESG efforts, what are some of the initiatives they prioritize?

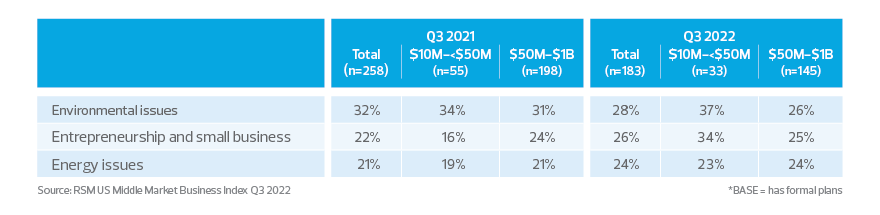

Again, it is important to note that ESG covers a broad range of topics. But when it comes to specific causes, 28% of organizations with a formal ESG plan included environmental issues in their strategy, making the environment the most popular concept.

Other top issues include entrepreneurship and small business, which 26% of companies have put into their plans, and energy issues, which 24% of companies have addressed. Both of these concepts saw a small but noticeable increase in support over the previous year.

However, some ESG initiatives saw declines. While 14% of companies list gender equality in their ESG plans, this is down from 22% the previous year. And 10% specify support for the LGBTQ community in their plans, down from 21% the previous year.

Still, Nguyen says not to jump to conclusions about apparent declines in certain areas.

“ESG is something that is still in flux, and it's evolving very quickly,” she says. “Organizations may get excited about the opportunities, then get overwhelmed at all the options. They might have realized, ‘Yes, we care about this, but we’re not sure how to approach it.’ It’s a process.”

Another way to analyze which ESG concepts resonate the most is to gauge their overall support in the middle market. Among all respondents—both those with a formal ESG plan and those without one—50% expressed support for community organizations, which was a significant increase over the 36% who said the same the previous year. Also increasing in popularity was educational support, which rose to 43% this year from 37% last year. And 36% of all respondents expressed support for community health and wellness, up slightly from 35% the previous year.

Environmental issues gained the support of 32% of all respondents, reflecting the importance of climate change as a business, political and cultural issue.

Causes or issues included in ESG plan*

The climate change conundrum

A significant majority of companies acknowledge that climate change threatens their businesses. About two-thirds of executives polled in the MMBI survey say that—to at least some extent—climate change will lead to higher operating costs, an increase in the price of raw materials or commodities, and a decrease in the reliability of their supply chains. And these percentages have remained fairly consistent year over year.

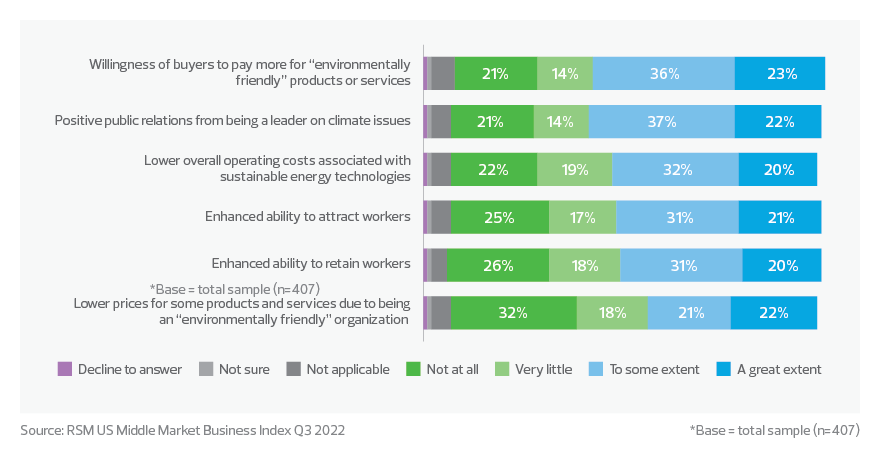

However, many companies see opportunities in the climate crisis. Over half (52%) of executives surveyed said that, at least to some extent, they might eventually lower their overall operating costs because of sustainable energy technologies. And an even higher percentage (58%) think they could garner positive public relations by becoming a leader on climate issues.

Extent climate change presents opportunities to organization, either now or in the future*

“Climate change is one of those issues that is pervasive across all industries,” says DeCandido. “And in certain industries, things like energy management, carbon emissions and waste were some of the leading ESG topics of the year.”

The importance of climate change policy is reflected in the fact that of those companies that have a formal ESG plan, 86% issue a sustainability report. However, many of these organizations have scaled back their environmental ambitions.

Less than half (44%) of such companies pinpoint reducing waste as a goal of their environmental plan, compared to 55% who listed this objective the previous year. Also, 57% of these companies indicate that better energy management is a goal, down from 66% a year ago.

In addition, the degree to which organizations are making investments to reduce their carbon footprint has decreased, dropping to 61% from 68% the previous year. Furthermore, just 11% of respondents say they have achieved net zero carbon emissions, which is down from 25% for the comparable time period.

Measuring progress

Nguyen believes that companies have not given up on adopting meaningful climate change policies. She says that organizations are likely more careful about stating their goals and are striving to collect evidence that verifies their efforts.

Companies may also worry about being accused of greenwashing. This term refers to the practice of an organization marketing itself as environmentally friendly when its products are not. Many consumers consider such practices deceptive, and a number of brands have come under fire for allegedly making false or misleading claims about their commitment to the environment.

“Some companies might pull back on their ESG disclosures because they’re worried about greenwashing accusations,” Nguyen says. “So they might be waiting until they have sufficient data to prove that they’re taking the steps that they claim they are.”

Because no company wants to alienate its customers, many organizations could be carefully treading when it comes to eco-conscious endeavors. This mindset likely extends to other aspects of ESG.

Of those companies that support causes and are very/somewhat aware of ESG, 17% do not report externally on their initiatives, a number that was a mere 2% the previous year. With regard to specific initiatives, 44% of such companies report externally on their diversity and inclusion policies, down from 78% the year before. Thirty-eight percent of such companies report externally on their efforts to combat the ethnicity pay gap, down from 59% the year before.

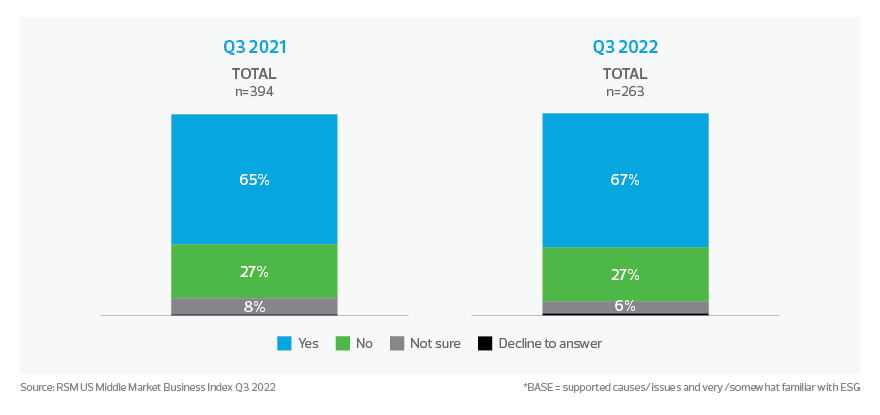

However, the hesitancy to report outcomes has not stopped companies from attempting to measure their progress. Of those that support causes and are very/somewhat aware of ESG, 67% have tried to gauge their policies’ broader societal impact—up from 65%.

According to a recent PitchBook survey, many companies have difficulty measuring certain ESG outcomes, and data-related challenges remain an obstacle to achieving some organizational goals. Part of the problem is that there is no obvious set of uniform standards that guides the middle market. Companies often need help assessing their options and prioritizing their ESG efforts.

Organization attempting/has attempted to gauge broader potential impact of achieving ESG goals on environment or society*

Small versus large companies

Perhaps the greatest indicator of a company’s ESG investment is its size, evident in the performance gap between large (annual revenue of $50 million to $1 billion) and small firms (annual revenue of $10 million to $50 million). Bigger organizations had higher levels of investment and more ESG activities than smaller ones. On one level, this is not surprising, as bigger companies tend to have more resources that they can devote to ESG initiatives. But Nguyen says there is more to this performance gap.

“Larger companies tended to do better during the pandemic and to deal better with supply chain issues and inflation,” Nguyen says. “So they are well positioned to focus on ESG initiatives, compared to smaller companies that might just be trying to stay in business.”

In addition, larger companies are more likely than smaller ones to go public. The broader public scrutiny that comes amid preparation for an initial public offering has led many organizations to proactively establish strong ESG policies before they are subject to regulations and investor inquiries.

For these reasons, smaller companies were significantly less likely than their larger peers to have initiatives that addressed topics such as the gender pay gap, an issue for which 45% of bigger companies have a policy versus 32% of smaller companies. Also of note is that the percentage of large companies that use ESG measurements to evaluate their own performance was unchanged at 91%. But the percentage of small companies that employ this standard plummeted to 47% from 70% a year ago.

Smaller organizations may still be evaluating their ESG options after the surge in social consciousness and political debates of the past few years. However, smaller companies may not have the luxury of time with regard to integrating ESG into their organizations. This is because larger businesses will influence smaller companies—either directly or indirectly—to adopt ESG policies. For example, a large firm that creates environmentally friendly products would need its suppliers to adopt certain ESG policies to maintain its standards. In such circumstances, smaller companies will have to follow the lead of larger companies when it comes to ESG.

The generation gap

According to a recent Harris poll[1], older Americans are more likely to say companies that take a stand on social issues risk their reputations. But the same poll found that younger Americans believe CEOs who speak out on social issues are more likely to help their companies than hurt them.

Numerous studies have shown that younger people pay attention to ESG efforts and often evaluate companies’ policies when considering where to work. This is a vital concern in a labor market that is expected to be tight for the foreseeable future.

"One of the most substantial proliferators of ESG is the younger generation,” Kotsopoulos says. “Companies need to view ESG in the context of their employee attraction and retention strategy. And if they don't, they’re going to be hard-pressed to find the people they need to grow their businesses and companies.”

One of the most substantial proliferators of ESG is the younger generation. Companies need to view ESG in the context of their employee attraction and retention strategy.

Kotsopoulos adds that in addition to attracting younger workers, companies will lose younger customers or clients if their ESG policies are not robust. This could be bad news for the 23% of companies that say they are not familiar with the notion of using ESG to evaluate the performance of organizations.

“Many younger people fundamentally make buying decisions based on companies' ESG or sustainability performance,” Kotsopoulos says. “In many cases, they are willing to pay more for products and services that achieve a certain sustainability performance.”

Political controversy

It is well known that ESG policies have created a political backlash. Many conservative leaders have dismissed ESG endeavors or expressed hostility toward companies that adopt such policies.

Negative reactions to ESG may be due to a lack of understanding of what such policies entail. Or the controversy may result from the nation’s continuing struggle with political polarization.

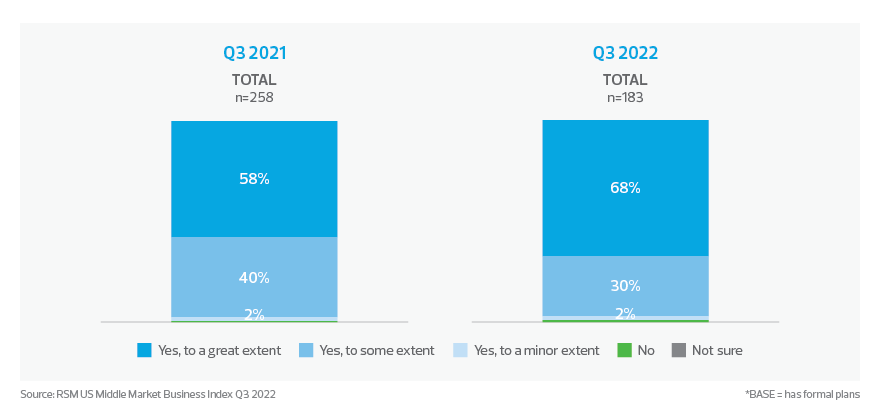

In any case, the political debate seems to have had a limited effect on the middle market. Of those companies that have implemented formal ESG plans, over two-thirds (68%) say they are committed—to a great extent—to a corporate structure and reporting system that incorporates social responsibility or environmental initiatives. This percentage is a substantial increase over the 58% that agreed with this statement the previous year.

“ESG is becoming institutionalized in a very significant way,” Kotsopoulos says. “Companies have embraced ESG, and the ideas that are proliferating through the middle market in substantial and measurable ways are actually remarkable. The train has definitely left the station.”

Kotsopoulos gives the example of financial institutions that offer sustainability-linked loans that tie an interest rate or other loan terms to a borrower’s performance on various ESG metrics. Elsewhere, some companies have tied employee bonuses to meeting ESG objectives. And many organizations are betting that investments in green-energy technologies will lead to accelerated growth.

It appears unlikely, therefore, that political pressure will end the middle market’s drive to implement ESG policies. The potential effect on the bottom line is too great for organizations to ignore ESG.

Extent organization is committed to corporate structure and reporting that incorporates social responsibility and/or environmental initiatives*

Moving forward

The term “ESG” did not exist until 2005, when a United Nations special report coined the term. In the ensuing years, however, the concept has grown steadily in importance. ESG is now solidified into the foundations of the middle market.

There is every indication that ESG will continue to be a crucial component of an organization’s viability. Companies may be adopting a more sophisticated approach to ESG that emphasizes specific areas of improvement.

“In the past, it might have been easy for organizations to make grand claims about ESG without the data and actions to back them up,” says Nguyen. “Now companies realize they have to walk the walk. They are being held to higher standards by ESG agencies, government regulations, investors and consumers. So we can expect improvements in ESG reporting and compliance from businesses. This could mean that companies’ ESG strategies of the future will be of a higher quality.”

Regardless of what ESG looks like in the coming years, middle market companies must embrace the reality that clear, effective policies and initiatives are not optional—they are necessary for success.

[1] Milken Institute-Harris Poll Listening Project 2021, a global survey conducted from July 30 to September 9, 2021, among nearly 17,000 people across 27 countries.

More special reports based on our proprietary MMBI research

Q2 2024 Middle Market Business Index (MMBI)

Sentiment improves as firms look to invest

Key findings:

- The MMBI rose to 132.0 in the second quarter from 130.7 in the prior period.

- Forty percent of senior executives indicated that the economy had improved.

- A majority of executives intend to boost capital expenditures over the next six months.