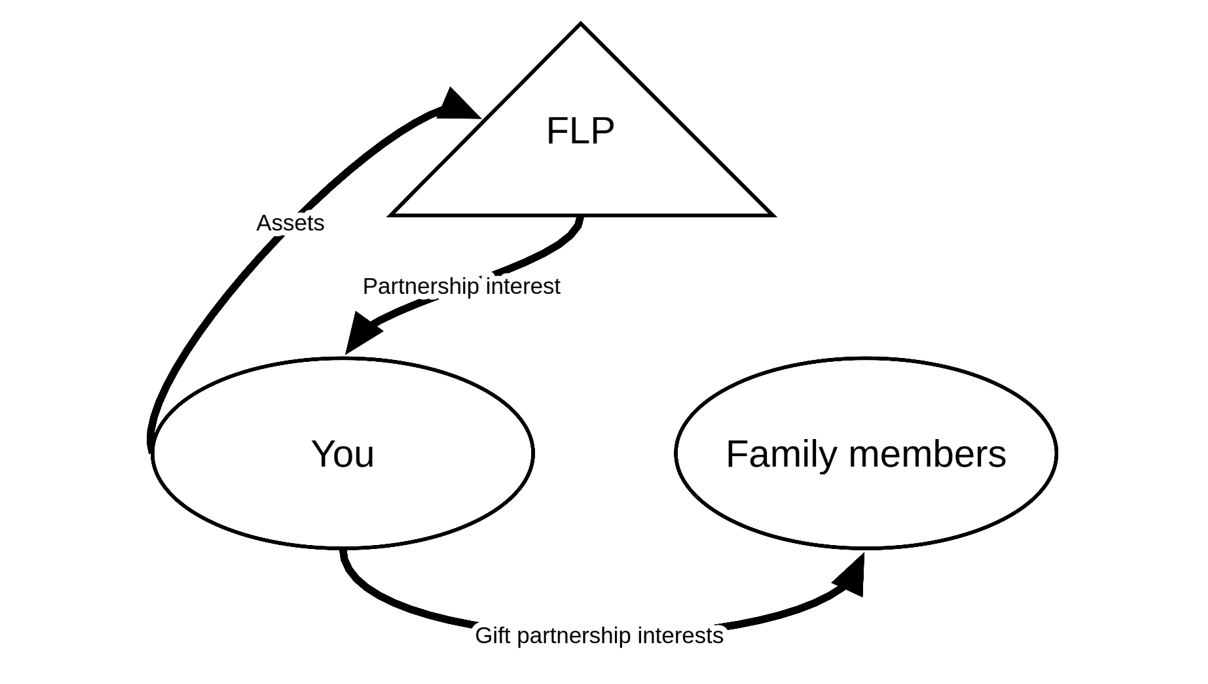

A Family Limited Partnership (“FLP”) is a valuable tool to transfer wealth out of your estate during life by transferring partnership interests to your family members.

What is a FLP?

A FLP is a partnership that creates a shared ownership structure for you and your family members. A FLP consists of a general partner, who runs the business and is liable for its debts, and limited partners, who are passive investors and are not liable for partnership debts. It is common for a FLP to pool resources of family members and operate as an investment entity or provide centralized management for multiple operating family businesses. After a FLP is funded, it can be used as an estate planning tool by gifting interests in the FLP to family members.