A Spousal Lifetime Access Trust (SLAT) can be a valuable tool to transfer wealth to future generations while helping to ensure your spouse’s financial security.

What is a SLAT?

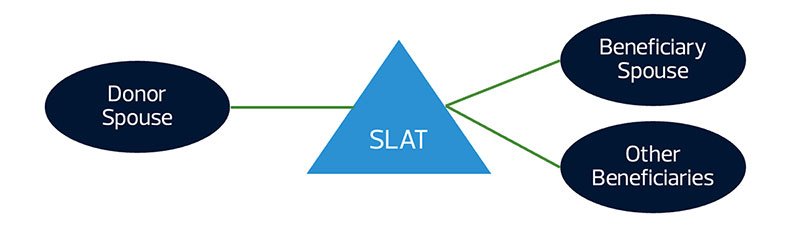

A SLAT is an irrevocable trust that can provide significant flexibility for married couples. One spouse creates and funds a trust primarily for the benefit of the other spouse. The spouse that is the beneficiary of the SLAT can receive distributions from the trust. Thus, if necessary, your spouse is able to use funds from the trust to maintain their standard of living even though the trust assets have been removed from your estate. SLATs most often terminate at the death of the beneficiary spouse, at which point the trust assets pass to the other SLAT beneficiaries (typically a younger generation), either outright or in trust.