Executive summary: Over half of IRS $80 billion additional spending allocated to enforcement.

The Internal Revenue Service issued an ambitious strategic operating plan for spending $80 billion in additional funding provided by the Inflation Reduction Act. The 150-page plan details five key objectives, 42 initiatives, 190 projects, and 200 milestones. The five objectives include:

- Improve customer service

- Quickly resolve taxpayer issues

- Expand enforcement on taxpayers with complex tax filings and high-dollar noncompliance

- Deliver cutting-edge technology, data and analytics for efficiency

- Increase IRS staff

IRS Commissioner Daniel Werfel plans to overhaul the IRS by upgrading technology and improving all interactions with IRS stakeholders. For accountability, the agency has identified projected milestones as indicators of success for each initiative. The report includes a high-level roadmap of the plan, which spans fiscal years (2023 – 2028). In addition to dramatically improving services to taxpayers, the IRS will close the tax gap through more efficient enforcement.

IRS releases spending plan for $80 billion IRA funds

The Inflation Reduction Act of 2022 granted the IRS $80 billion in funding to be used over the next 10 years. Treasury Secretary Janet Yellen requested the IRS develop an operational spending plan to specify how the agency will allocate the funds. On April 6, 2023, the IRS issued the Internal Revenue Service Inflation Reduction Act Strategic Operating Plan for the fiscal year 2023 – 2031. The IRS predicts the additional funding will allow it to increase federal revenue by more than $180 billion or more over the next ten years. The agency’s plan focuses on using technology and data analytics to improve the taxpayer experience and enforcement activities. Case planning and selection will be centralized and performed using data analytics to detect potential noncompliance.

The plan’s five objectives are supported by underlying initiatives and projects as well as milestones for measuring success. These objectives include:

- Dramatically improve services to help taxpayers meet their obligations and receive tax incentives for which they are eligible

- Quickly resolve taxpayer issues when they arise

- Focus expanded enforcement on taxpayers with complex tax filings and high-dollar noncompliance to address the tax gap

- Deliver cutting-edge technology, data and analytics to operate more effectively

- Attract, retain and empower a highly skilled, diverse workforce and develop a culture that is better equipped to deliver results for taxpayers

Objective one: Dramatically improve services to help taxpayers meet their obligations and receive eligible tax incentives

Objective 1 includes 12 initiatives designed to improve the availability and accessibility of customer service, expand digital services and digitalization, improve self-service options, provide earlier legal certainty and build status-tracking tools for taxpayers.

The IRS wants taxpayers to be able to securely file documents and exchange correspondence electronically. The plan includes projects that focus on digitalizing paper-submitted forms, returns, applications and other correspondence. Milestones for these digital projects are scheduled to be achieved as early as fiscal year 2023 with the enhanced scanning of key forms using a Digital Enablement Platform launched in 2022.

The agency plans to provide taxpayers with access to secure online accounts with robust account information and the ability to make changes and interact with the IRS by expanding self-service options. The IRS also plans to provide greater access to tax professionals authorized online to view clients’ balances, payments, notices and other correspondence. Improvements with initial business accounts are scheduled for as early as fiscal year 2023 but as late as 2026 for full enhancements to online accounts for individuals and businesses.

The IRS plans to provide greater clarity to tax law by publishing more legal guidance, publishing new forms and providing informal guidance to apprise taxpayers of tools to comply. Milestones for the special projects are scheduled to be issued in fiscal year 2024.

The IRS will provide taxpayers with new status-tracking tools to see real-time status updates, next steps and estimated time to process documents and resolve issues. The agency plans to provide detailed explanations on reasons for delays as early as fiscal year 2023 and plans to improve online accounts with status tools for the 2024 filing season.

Objective two: Quickly resolve taxpayer issues when they arise

Objective two includes seven initiatives that provide plans to identify issues during filing, expand engagement with non-filers, and improve data and analytics to tailor timely collection contacts. Internally, the IRS plans to enhance the systemic checks for return completeness and consistency and will quickly notify the taxpayer of each issue identified. The IRS plans to build enhanced internal analytics to detect more non-filers sooner and to address common issues that cause taxpayers not to file. To help taxpayers avoid additional penalties and interest, the IRS will provide tailored contacts to taxpayers with past-due balances and only escalate enforcement when appropriate. Milestones are projected to be reached as early as fiscal year 2023 and as late as fiscal year 2026.

Objective three: Focus expanded enforcement on taxpayers with complex tax filings and high-dollar noncompliance

Objective three has seven initiatives that include plans to employ data analytics to aid in case selection and enforcement treatments and ambitious plans to expand enforcement for high-income and high-wealth individuals, complex partnerships and large corporations. To implement this objective, the agency plans to hire and train staff in specialty areas to understand complex business structures and high net-worth individuals. The IRS recommitted to following Treasury’s directive to not increase audits with small businesses and individuals earning $400,000 or less.

The IRS will rely on enhanced data analytics to assist in case selection and focus on enforcement treatments to improve taxpayer compliance. The IRS plans to execute key projects that will incorporate all existing models and analytical tools for detecting noncompliance into one centralized platform. The agency also plans to continually update analytic models as the IRS receives more data and learns more about noncompliance and the efficacy of compliance treatments. Milestones for these special projects are projected to be reached mainly in fiscal year 2024.

For the expansion of enforcement to high-income and high-wealth individuals, large partnerships and large corporations the IRS will increase enforcement activities by hiring and training staff and refine approaches with data and analytics to explore new treatments. It will take some time to hire and develop staff to implement appropriate compliance treatments. The IRS projects to reach some hiring goals as early as fiscal year 2023 but may take 10 years to fully staff and train specialist and experienced hires.

Objective four: Deliver cutting-edge technology, data and analytics to operate more effectively

Objective four includes eight initiatives focused on modernizing and streamlining the agency’s technology infrastructure, as it currently utilizes 600 loosely integrated applications, which are many decades old. The IRS plans to retire these legacy databases, such as Individual Master File (IMF) and Business Master File (BMF) and replace them with more closely integrated applications. The agency announced plans to transition its core applications to secure, commercial, cloud-based platforms by fiscal year 2028.

In addition to migrating to more modern platforms, the IRS wants to consolidate taxpayer data within its new systems. The agency seeks to consolidate taxpayer data in a manner that allows employees to update accounts and resolve enforcement actions without navigating several applications, which currently operate independently. The consolidation of taxpayer data is also intended to help taxpayers update their accounts, send payments and resolve enforcement actions using online self-service options. This 360-view of a taxpayer’s data is intended to improve how IRS employees’ and taxpayers’ access account data to efficiently meet tax obligations and obtain timely account updates.

A clear part of this objective is the agency’s plan to ensure data privacy protection and data security enforcement as the IRS systems evolve under this strategic plan. The plan states that any new technologies implemented will include the authentication, authorization, accountability and encryption enforcement necessary to continue to safeguard taxpayer data across its systems. “As we become a digital-first agency, we will ensure strong cybersecurity protections of the technology ecosystem and guard against threats to taxpayer data,” the report states.

These technological advancements also provide the necessary foundation for the agency’s plans to utilize data and analytics to drive its operations and decision-making processes. When millions of taxpayers call the IRS with the same question, the IRS plan is to be able to identify the systemic issue based on the taxpayers’ inquiries and address the root cause of the issue to provide remedy in a timely fashion. Data analytics will also be leveraged to support compliance and enforcement by better identifying high-priority noncompliance, while also minimizing audits of compliant taxpayers. Finally, the agency seeks to use data analytics for strategic workforce planning, providing timely insight regarding workforce performance, work surges and hiring demands.

Objective five: Attract, retain and employ a highly skilled, diverse workforce and develop a culture that is better equipped to deliver results for taxpayers.

The strategic plan also provides for investment in the agency’s employees. Objective five focuses on hiring practices, training, employee advancement, organizational structures and culture. For example, the agency seeks to redesign its hiring and onboarding processes, including the use of data from digital skill assessment tools to identify which candidates may qualify to apply for a wider number of available roles than they initially sought.

The IRS also plans to enhance its onboarding and skill-enhancement training to support its evolving strategic operating plan, with a focus on developing a data-savvy workforce. The report references employee development, technical training, and customer service assessments as mechanisms to help dive a “a data-driven, collaborative and problem-solving customer service mindset across the workforce.”

Proposed allocation of funds

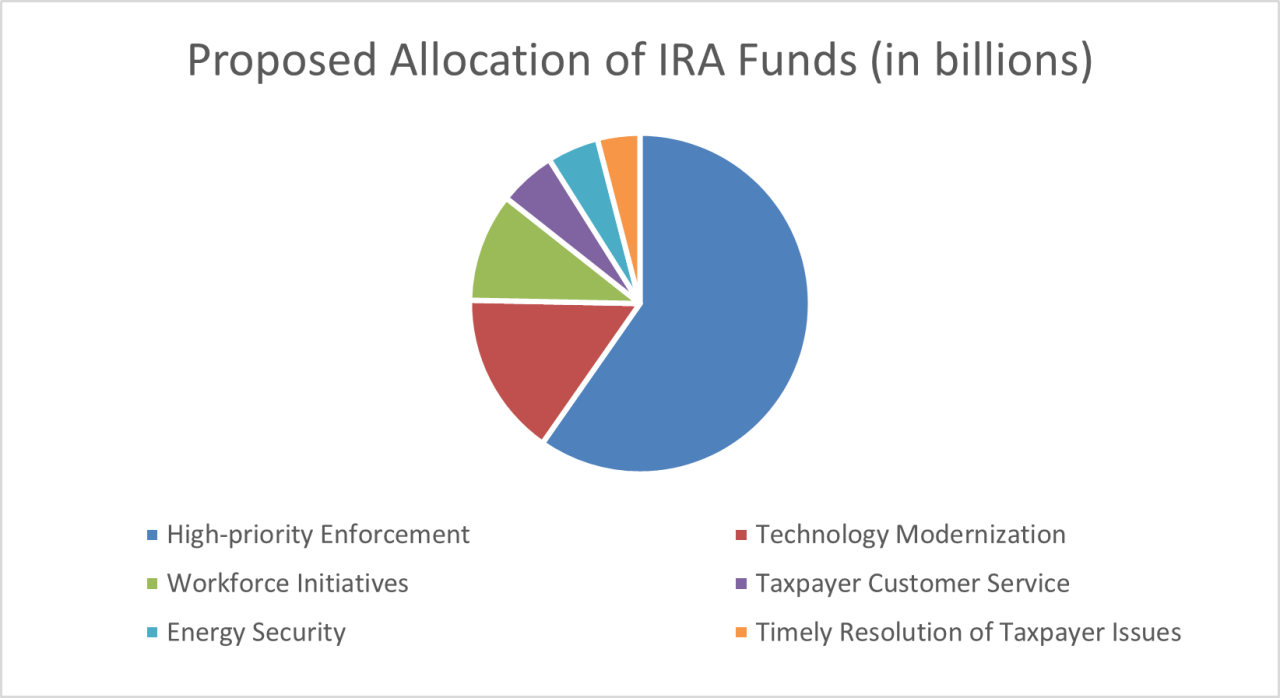

Of the approximate $80 billion granted to the IRS, Congress allocated most of the funds ($47.4 billion) to enforcement. The IRS will use those funds to increase examinations on high income taxpayers and those with complex filings (Objective three). Improvements to technology and data analytics (Objective four) were earmarked for $12.4 billion and IRS workforce initiatives (Objective five) were allocated approximately $8.2 billion. The agency estimates it will spend approximately $4.3 billion in general taxpayer services (Objective one) and $3.2 billion in advancing more timely resolution of taxpayer issues (Objective two). The agency also set aside $3.9 billion for energy security and clean energy investment incentives. Across all plan objectives, the IRS also provided a breakdown of the funds allocated to each objective across five categories: taxpayer services, enforcement, operations, technology and clean energy.