The lifetime exemption had been set to revert from $13.9 million to about $7 million on in 2026

Key takeaways

The OBBBA increased the lifetime exemption to $15 million starting in 2026, adjusted for inflation

Depending on your net worth and cash flow needs, you still may want to take action now

This article, originally published Sept. 19, 2024, has been updated multiple times, the latest to reflect that the One Big Beautiful Bill Act (OBBBA) was signed into law on July 4, 2025.

With the One Big Beautiful Bill Act (OBBBA) signed into law on July 4, 2025, the estate, gift, and generation-skipping transfer (GST) tax exemptions are permanently set at $15 million per individual (or $30 million for married couples) starting January 1, 2026, with inflation adjustments beginning in 2027. This legislation eliminates the previously scheduled reduction to pre-2018 levels and provides long-awaited certainty for long-term wealth transfer planning.

That may sound reassuring, but beware of the potential trap of so-called permanence. After all, you don’t need to look beyond the OBBBA to see how the tax policy pendulum can swing based on the latest election results.

Estate planning is inherently complex, and that’s especially true because estate, gift, and generation-skipping transfer (GST) tax exemptions are not static—no matter whether they’re enacted as permanent. They are subject to legislative changes that can significantly alter the landscape of wealth transfer planning.

This uncertainty makes it difficult for individuals to make fully informed decisions about their estate plans, as the rules governing these exemptions may change, affecting the tax liabilities associated with transferring wealth.

That’s why it’s essential to weigh the benefits of gifting now against the risks of waiting. Align your strategy with your long-term financial goals and legacy aspirations—and revisit it regularly.

What are the estate, gift and GST exemptions?

The lifetime exemption is the amount that individuals can transfer during their lifetime or at death to others without incurring a 40% tax.

For 2026, the lifetime exemption amount is $15 million per individual, or $30 million for a married couple. In addition to the estate and gift taxes, a separate generation-skipping transfer tax is levied upon amounts that skip a generation with similar exemption and phaseout timelines.

What key changes should I anticipate in upcoming tax reform?

The OBBBA permanently increases the unified estate and gift tax exemption amounts to an inflation-indexed $15 million for taxable years beginning after Dec. 31, 2025.

In addition to the increases, Senate members have discussed a potential repeal of the estate tax altogether. While the specifics of such a proposal and the likelihood of success remain uncertain, it is crucial to stay informed and prepared for any changes that may arise.

What can you do to prepare?

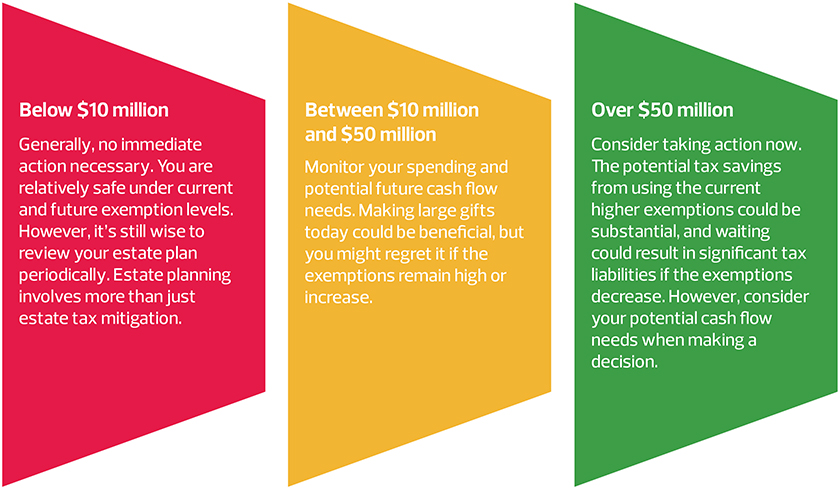

Given the ever-present long-term uncertainty surrounding the estate/gift and GST exemptions, it’s crucial to consider your options based on your current net worth and future financial plans. Here’s a general guide based on your net worth (per individual):

If you decide to take advantage of the current higher exemptions, it’s essential to act now.

Estate planning requires careful planning and timely execution. Depending on the circumstances, there may be multiple strategies to review with tax professionals, attorneys, and other advisors. An appraiser may need to value assets before the transfer. In addition, an attorney may need to draft several estate planning and transfer documents.

Consider taking the following actions:

- Review your estate planning documents to ensure they are in line with your goals.

- Gift in accordance with your annual exclusion and have your prior gifting reviewed to determine the available remaining exemptions.

- Review assets for growth and potential to transfer.

- Engage advisors to review your gift plans, provide recommendations and draft documentation.

- Monitor your gift plans and update accordingly for any changes in your wishes, tax law, assets and family members.

Establishing trusts, such as irrevocable grantor trusts, can be an effective strategy for transferring wealth. However, there has been recent legislation and proposals to limit or eliminate the benefits of certain types of trusts, such as grantor trusts, including grantor retained annuity trusts. While there have been discussions and proposals, the specific details and the likelihood of these changes are uncertain.

With the OBBBA now law, quelling fears of the previously scheduled sunset—at least in the short-term—we have a more stable foundation for planning.

However, permanence in tax law is often more political than practical. As the OBBBA itself demonstrates, what one Congress enacts, another can revise. That is why estate planning still demands proactive, flexible strategies.

Even with what appears to be short-term certainty, individuals should consider preparing now to act later. For example you might:

- Draft trust documents today and delay funding until your strategy is clearer.

- Execute a nominal gift to a trust now, preserving the ability to sell assets to it later.

- Revisit existing plans to ensure they align with the new exemption levels and your long-term goals.

By understanding your current financial situation and staying attuned to legislative developments, you can make well-informed decisions that protect your wealth and align with your long-term goals.

RSM contributors

Related insights

Tax resources

Timely updates and analysis of changing federal, state and international tax policy and regulation.

Subscribe now

Stay updated on tax planning and regulatory topics that affect you and your business.

Washington National Tax

Experienced tax professionals track regulations, policies and legislation to help translate changes.