Accounting for tax implications of your workforce strategy will help you sustain your approach.

Key takeaways

Unexpected tax obligations are more likely for employers that don’t understand how laws apply.

As workers declare their preferences, a mutually beneficial recruit-and-retain strategy can form.

Labor market pressures continue to compel businesses to strategize about the compensation and benefits used to attract and retain employees. From remote work arrangements and incentive compensation to education assistance to parking spaces for electric vehicles, the range of items in any total rewards package can seem limited only by the imagination.

Most compensation methods and benefits, whether traditional or relatively new to the equation, affect an employer’s or employee’s tax obligations in some way. Taking those implications into account helps businesses establish a sustainable approach to their workforce objectives. They’re also key to remaining competitive, especially since 83% of middle market executives anticipate some degree of challenges in staffing open positions in their organization through the first three quarters of 2023, according to the Q4 2022 RSM US Middle Market Business Index survey.

“Tax needs to be at the table in conversations about overall compensation philosophy—not necessarily as the decision-maker, but because businesses should weigh it as a factor in the cost of whatever they’re doing,” said Anne Bushman, a partner in RSM’s Washington National Tax group and leader of the firm’s compensation and benefits practice.

Take remote work, for example; 33% of middle market companies reported having employees working remotely due to the pandemic who were not doing so before the pandemic (a slight dip from 36% a year ago). Of that segment, 54% consider making remote work a full-time permanent option for some employees.

There’s a litany of tax considerations for those companies structuring remote work arrangements, including state and local income tax withholding requirements and compliance ramifications of the so-called tax home of remote and hybrid employees. The potential for unexpected tax obligations is higher for employers that don’t understand how laws apply, not to mention the costs of compliance in an increasing number of jurisdictions.

“You’ve got to do your homework and understand what your requirements are so you can make informed business decisions,” said Peter Berard, RSM senior director and leader of the firm’s employment tax practice.

If an employee is getting value from the flexibility of a remote work arrangement, maybe the employer can dial down a salary level or a benefit from somewhere else—because it’s all a balancing act.

Rather than tax driving those decisions, though, Berard and Bushman suggest a comprehensive compensation philosophy should shape workforce strategy.

Bushman encourages businesses to ask themselves what value they are providing employees. And as workers continue to make their preferences known—including flexibility in where and when they work and offerings that make them feel valued—a strategy to serve both parties can come into focus.

“If an employee is getting value from the flexibility of a remote work arrangement, maybe the employer can dial down a salary level or a benefit from somewhere else—because it’s all a balancing act,” she said.

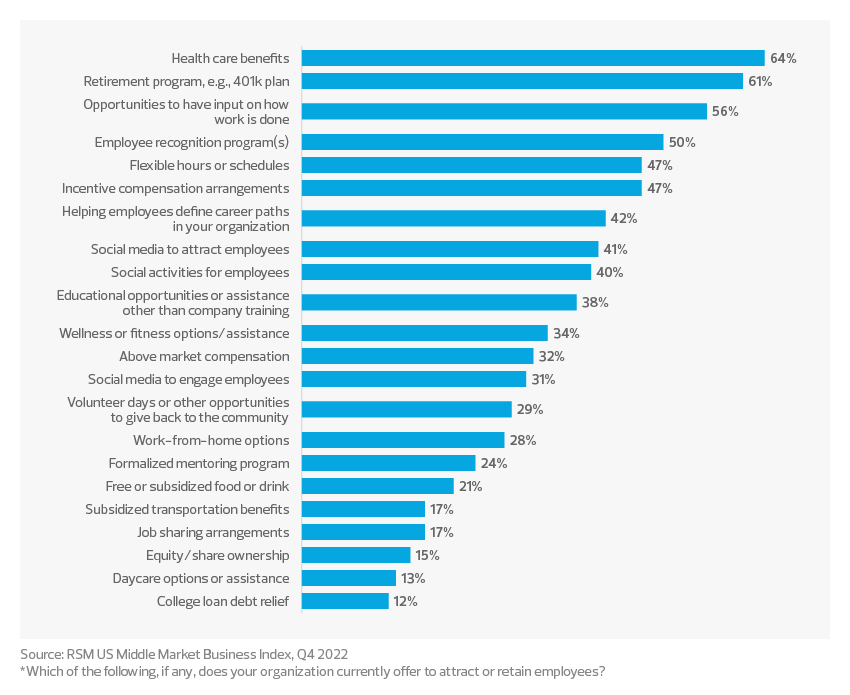

The compensation methods and benefits on the scale vary too. Retirement programs (61%), incentive compensation arrangements (47%), education opportunities or assistance (38%), subsidized transportation benefits (17%) and equity/share ownership (15%) are among more than 20 compensation methods and benefits that middle market executives said their companies are offering to attract and retain employees, according to the MMBI survey.

That list evolves along with the labor market and other economic conditions, which is why companies benefit from regularly revisiting their compensation philosophy.

“We’re in another shift right now where we’ve been in an inflationary period and we’re talking about a recession,” Bushman said. “How might that change your plan? Do you have to dial back the cash compensation because you simply cannot afford it? You can get ahead of that when you know it’s coming.”

RSM contributors

On-demand webcast

3 signs it's time to optimize your HR function

RSM's HR advisors share tips for effectively defining what HR transformation means for your unique business as well as critical questions to ask before getting started:

- Approach transformation as a process, not a one-time event.

- Use technology to reduce time-consuming administrative tasks.

- Free up HR professionals for work that directly supports business objectives.