Proactive tax planning can help businesses offset inflation costs.

Key takeaways

Credits, timing considerations and entity restructuring can unlock liquidity.

Embedding tax considerations into sourcing, workforce and tech decisions can build resilience.

When costs rise, businesses often turn to pricing adjustments and operational efficiencies to maintain and improve their profitability. While those responses are proven techniques to relieve margin pressure, tax planning can also play a meaningful role in managing expenses and protecting margins.

After all, inflation affects sourcing arrangements, workforce strategies and investment decisions—and there are tax implications to all of these.

When chief financial officers and tax leaders collaborate earlier in planning cycles and use tax modeling to inform decisions on sourcing, pricing, investments and working capital, that collaboration can protect margins. To be effective, though, tax leaders have to approach the discussion as a strategic necessity, instead of as a matter of compliance.

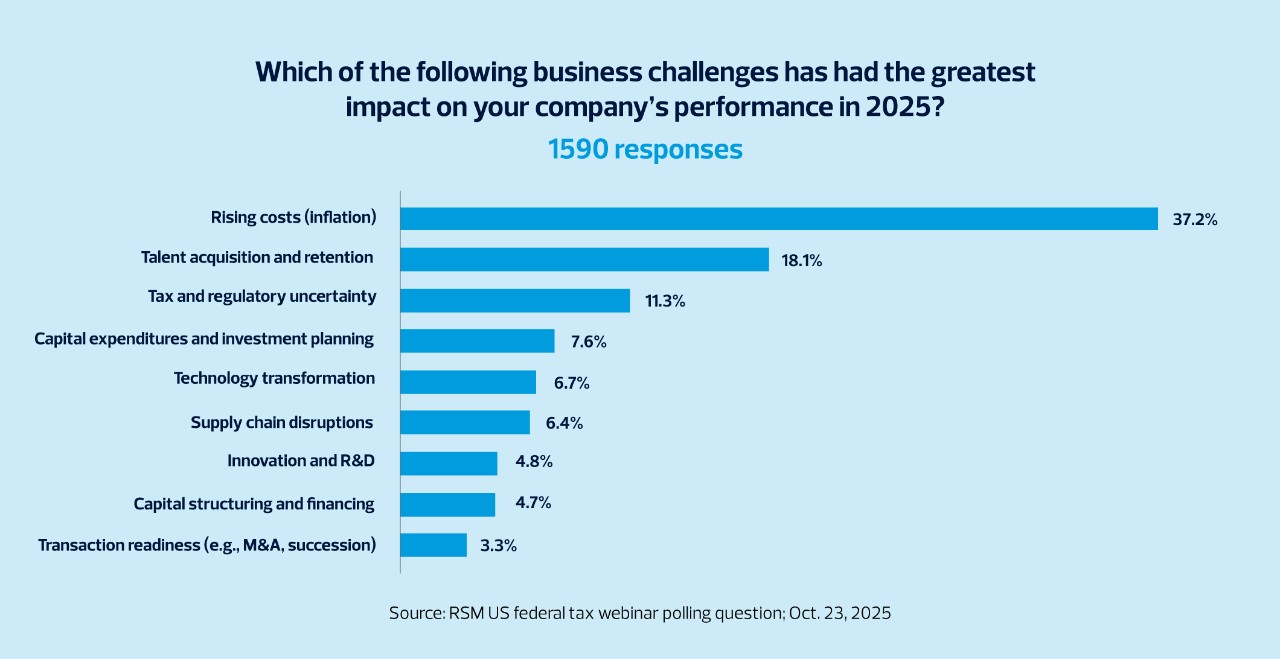

This is especially important, given how pervasive inflationary challenges have been. An informal survey by RSM of nearly 1,600 business leaders on Oct. 23, 2025, showed that rising costs was the most consequential business challenge of the year.

As CFOs and tax leaders devise how to curb the effects of inflation, here are seven tax strategies to consider:

1. Tax credits: Capture tax credits to reduce cash outflows

Federal and state tax credits can help offset the cost of capital projects, technology investments, innovation initiatives and workforce development. Energy-related incentives, research and development credits, and manufacturing incentives tied to domestic production are examples of programs that can deliver meaningful savings.

Credits reduce tax liability and free up cash, which can be beneficial when liquidity is tight. Notably, credits often require detailed documentation and compliance with eligibility rules, so careful planning is essential.

2. Accounting methods and timing: Accelerate deductions and optimize timing

Timing strategies don’t change the total tax bill, but taking deductions sooner can often improve near-term cash flow. Businesses may use cost segregation studies to claim depreciation sooner on buildings and improvements, adjust accounting methods for inventory and revenue recognition, and apply bonus depreciation—a provision that allows businesses to deduct an asset’s cost up-front.

These tactics can provide liquidity during periods of high borrowing costs or constrained capital. Some accounting method changes require IRS approval, so identify which changes apply and allow time for approval before implementation.

3. Supply chain: Reevaluate supply chains through a tax lens

Adjusting supply chains can trigger tax consequences, whether a business is shifting suppliers or moving production facilities.

For example, the timing for reclaiming value-added taxes (VATs) and goods and services taxes can affect working capital. Additionally, customs duties influence sourcing decisions, transfer pricing arrangements may require recalibration as costs change and indirect taxes can vary widely by jurisdiction.

Incorporating tax analysis into supply-chain planning helps avoid unexpected costs and identify opportunities for savings. For example, new suppliers or shipping routes may trigger additional filing obligations or indirect tax exposure. Involve tax teams as early as possible to manage compliance obligations and minimize risks.

4. Business structure: Restructure legal entities to reduce tax friction

Complex entity structures multiply compliance obligations—such as separate filings, transfer pricing documentation and governance requirements—which become more costly as labor and advisory fees rise during inflationary periods.

Businesses can reduce complexity by consolidating entities to simplify operations, relocating holding companies or distribution hubs, and streamlining intercompany financing arrangements. These steps can improve efficiency and lower effective tax rates.

However, they may also trigger taxable events, such as gain recognition on asset transfers or state tax exposure when relocating entities. Model the tax ramifications and allow time for approvals to prevent surprise liabilities and support smooth implementation.

5. Indirect taxes: Reduce margin leakage through indirect tax optimization

Indirect taxes—such as sales and use tax, VAT and other transaction-based taxes—often rise automatically as prices increase, adding cost pressure that businesses may underestimate. These taxes can erode margins if not actively managed.

Businesses may reduce their exposure to these increased costs by strengthening compliance processes for sales and use tax, ensuring accurate product classifications, and maintaining timely remittance and reporting. This could include exploring automation for key tasks, such as recording and remittance of sales and use taxes, tax rate updates, and indirect tax return preparation.

6. Workforce: Manage workforce costs with tax-smart strategies

Inflation typically includes labor costs, and wage pressures can strain budgets quickly. While businesses can’t always control market pay rates, workforce planning that incorporates tax strategies can help preserve cash flow without sacrificing talent or compliance.

Opportunities include reviewing payroll tax obligations for remote employees, which can vary by state and create unexpected exposure. Hiring and training credits can offset the cost of onboarding and upskilling talent. Location-based planning helps optimize payroll and income tax obligations for distributed teams.

Also, consider how compensation and benefits programs intersect with tax planning. Tax-efficient structuring of incentive plans, retirement contributions and fringe benefits can reduce overall labor costs while supporting employee recruitment, retention and morale.

7. Tax technology: Deploy tax technology to contain compliance costs

Rising costs often increase the expense of tax compliance and reporting. Manual processes for data collection, classification and filing can become more costly as labor rates climb. Investing in technology can help businesses manage these demands without adding headcount.

Technology that centralizes tax data, automates calculations and streamlines reporting can reduce administrative burden, lower compliance risk and free up resources for higher-value activities.

While technology can deliver significant efficiency gains, successful implementation depends on accurate data and thoughtful planning. To achieve the intended benefits of new systems, assess current processes and data quality before deployment.

The bottom line: Curbing effects of inflation using tax strategies

Cost pressures will ebb and flow, but the need for strategic tax planning is constant. Businesses that embed tax considerations into financial and operational decisions are better equipped to manage uncertainty, protect margins and position themselves for growth.

Tax planning is vital to building financial flexibility and resilience while maintaining or improving margins and profitability. Companies that make tax part of their decision-making framework can navigate volatility and seize opportunities with confidence.