“In this world, nothing is certain except death and taxes,” U.S. statesman Benjamin Franklin once wrote.

Despite the unpleasantness of the topic, nonprofits need to consider their donors’ mortality. Demographic and economic trends are set to culminate in a possible windfall for nonprofits in the near future.

You can’t take it with you

Nonprofits have developed several phrases to refer to postmortem contributions: planned giving, legacy gifts, and bequests. Fundraising professionals simultaneously acknowledge the importance of such contributions and the awkwardness of having conversations with donors.

Nevertheless, the death of donors is unavoidable. The American population is aging, with the percentage of those aged 65 and older expanding nearly every year in recent history. The U.S. Census Bureau projects an increase in annual deaths in the U.S. from 2.9 million in 2023 to 3.7 million in 2040—a number surpassing even the COVID-19-driven record of 3.5 million in 2021.

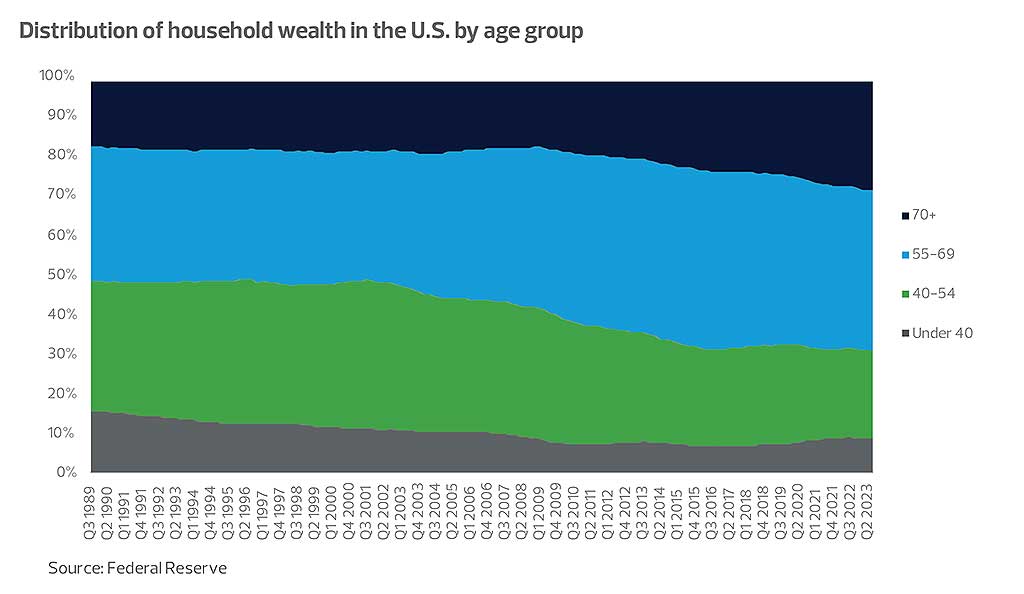

The baby boomer generation is not only shifting the median age of the U.S. older but also increasing that generation’s wealth. According to the Federal Reserve, individuals aged 55 or older hold two-thirds of the country’s household assets, and those 70 or older hold 28%. This amounts to $110 trillion and $45 trillion, respectively. So what is to become of this wealth at the passing of its holders?