The growth of donor-advised funds is unlikely to slow down anytime soon.

Key takeaways

DAFs have become a popular way for individuals and families to take advantage of tax benefits.

Nonprofit fundraisers need to consider DAFs a pillar of their fundraising strategy.

The world of philanthropy has seen an explosion of donor-advised funds (DAFs) over the past decade. In 2021 (the most recent year for which full data is available), the four largest recipients of philanthropic contributions were DAFs, as were seven of the 10 largest. Such rapid growth and asset accumulation compels nonprofit fundraisers to develop DAF-specific fundraising strategies, and to give them at least the same weight as strategies for fundraising from private foundations.

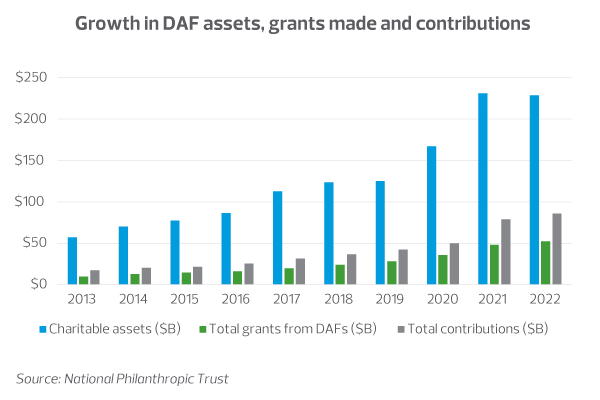

The cumulative assets in DAFs have grown an average of over 23% annually over the past five years. They continue to be attractive vehicles for individuals and families to take advantage of tax benefits and build nest eggs for future charitable deployments.

The future of DAFs

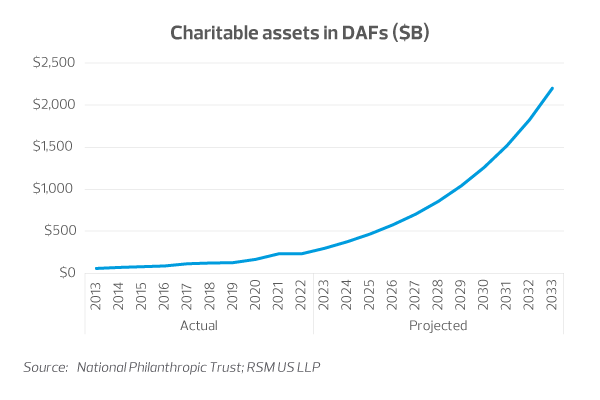

The growth of DAFs is unlikely to slow down anytime soon. Using some basic assumptions, we can project their long-term growth.

With projected assets of over $1 trillion by 2029, DAFs will increasingly be a critical vehicle for fundraising. Indeed, our projections show that DAFs will grant nearly $200 billion per year by 2029.

DAFs vs. private foundations

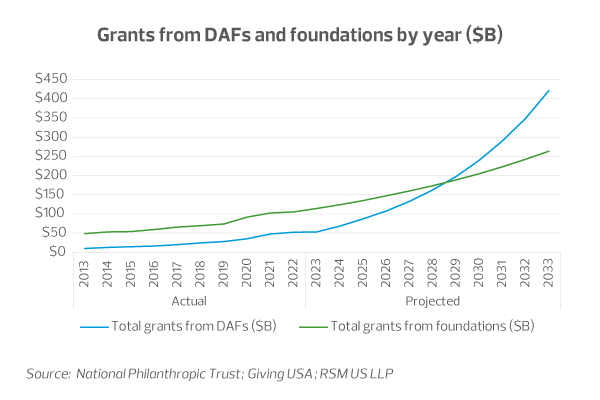

Since 2020, more individual giving has gone into DAFs than private foundations, a significant shift in the philanthropic landscape. Additionally, roughly 20% to 25% of DAF asset balances are distributed to nonprofits as grants yearly, compared to an average of 5% to 7% allocated from private foundations.

So, if more money is going into DAFs than foundations each year, but a higher percentage is being granted to foundations, how much future growth can DAFs expect? Based on current data, we estimate that DAF balances will continue growing at 18% to 22% per year for the next decade, even accounting for their grants made. We expect foundations to grow at their historical rate of 8% to 10%.

Since assets socked away for financial gains provide no direct benefit to the social sector, what trends can we expect in nonprofit grants? Here, we see DAFs catching up to private foundations in dollars granted, surpassing foundations by 2029.

Developing a DAF fundraising strategy

With overall giving trends declining, nonprofit fundraisers need to hone their strategies. One way is to focus more attention on affluent households and major gifts, which often come via a DAF or a private foundation. While historically, strategies of this sort would focus exclusively or primarily on raising from private foundations, that needs to change going forward.

Here are five strategies to consider for fundraising from DAFs:

- Make DAF giving easy. Inform your donors about the option of giving through DAFs by adding a DAF widget or button to your website, donation forms and email campaigns. You can also integrate DAF giving with peer-to-peer fundraising, events and campaigns.

- Know your donors. Identify and segment your donors who have DAFs or are likely to open one. Use data from your customer relationship management system, surveys or wealth screening tools—or from public sources—to discover your donors’ giving preferences, interests and motivations. Better yet, ask your donors if they have DAFs or are interested in learning more about them.

- Understand sponsoring organizations. Sponsoring organizations are the public charities that operate DAFs. These organizations have the legal authority to distribute grants from DAFs. Know which sponsoring organizations your donors use and how to communicate with them effectively. Research the practices and policies of different sponsoring organizations and tailor your outreach accordingly.

- Incorporate DAFs into your planned giving programs. DAFs can be a powerful tool for legacy giving. Donors can name your organization as a beneficiary of their DAF or set up recurring grants from their DAF. Encourage your donors to include DAFs in their estate planning and provide them with the necessary information and guidance. You can also steward your DAF legacy donors as part of your planned giving program.

- Take a different approach with DAF donors and sponsors. Donors who use DAFs may have different expectations and needs than other donors. Cultivate and engage them in a way that aligns with their philanthropic goals. Build relationships with the staff of the sponsoring organizations and keep them updated on your organization’s impact and needs.

The takeaway

Nonprofit fundraisers need to consider DAFs as a pillar of their fundraising strategy. The tremendous wealth that has accumulated within these funds—and continues to do so—is waiting to be put to charitable use. Engaging now with DAF donors and sponsors with the same level of effort put toward private foundations is a critical shift many nonprofits need to make.