The sports media rights landscape is shifting, led by the Big Ten’s recent media contract worth over $7 billion.

Key takeaways

Customers are rapidly cutting the cord from traditional cable packages, but many active sports viewers still have cable.

Large tech companies such as Amazon and Apple are boosting spending in the sports industry to increase content diversity.

With USC and UCLA joining the Big Ten Conference, the athletic conference renewed its media contract with a blockbuster deal worth over $7 billion over seven years in media rights fees. While Fox owns the majority of the Big Ten media rights, including prime-time games, CBS and NBC are also involved in the deal. In this case, nontraditional media such as Apple and Amazon bid large amounts for the Big Ten streaming rights, but came up short. This example is one of many demonstrating the wide variety of media consumers now can use to find content. The number of options, whether through traditional cable or nontraditional streaming channels, has never been higher, especially in the sports industry.

Traditional media

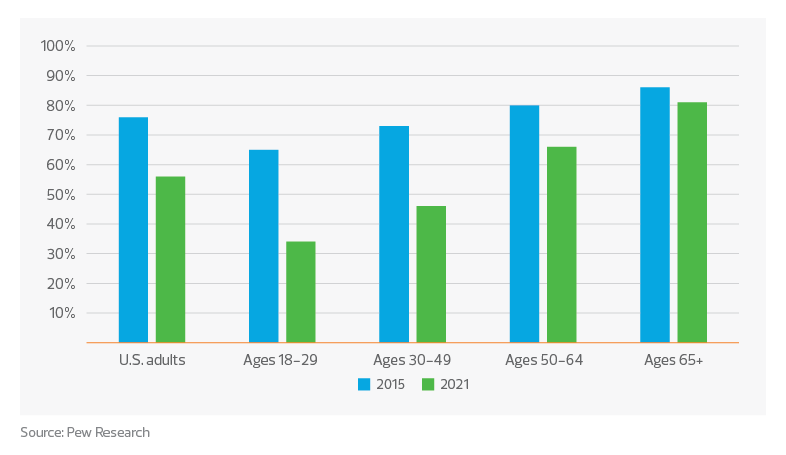

The decline of traditional cable is linear, with customers rapidly cutting the cord from their traditional cable packages and moving to more customizable, nontraditional media to access content. But because traditional cable providers are locked into long media rights contracts, sports content is an extremely resilient cable product with a very strong customer base. Watching live sports is a key reason why consumers have retained traditional cable packages. That said, as media rights contracts change hands to nontraditional media, we will likely continue to see a rapid increase in cord cutting across every demographic.

Nontraditional media

Percentage of U.S. adults who receive cable/satellite TV*

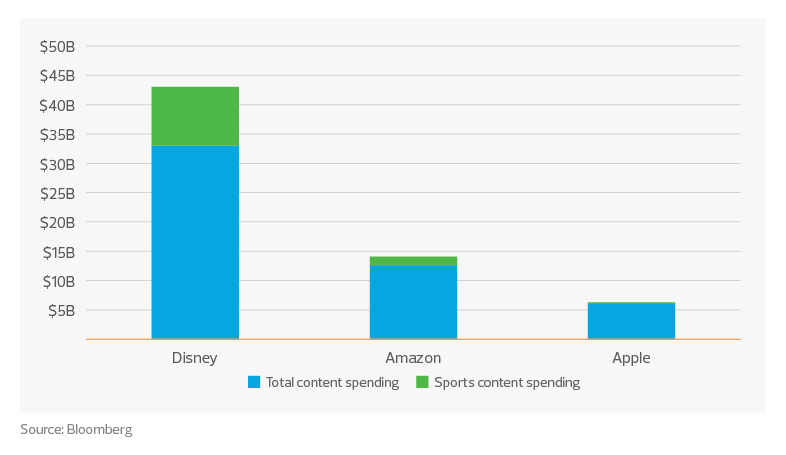

It is no secret that large tech companies have major media aspirations and are entering the industry as solid competitors against traditional media. The 2010s represented a massive shift in the way we consume media, as the cable TV model was disrupted by subscription video on demand, or SVOD. Platforms like Disney+, DAZN, Amazon Prime and Apple TV, for example, are now extremely commonplace, with over 80% of households having at least one SVOD service. To maintain their relevance to consumers, these companies are spending endlessly to increase content diversity, especially in the sports industry. In their 2021 annual reports, Disney detailed spending $33 billion, and Amazon and Apple $12.5 billion and $6 billion, respectively, with some of that attributed to sports.

Estimated 2022 content spending*

Amazon announced it will spend around $1 billion per year for the exclusive rights to the NFL’s Thursday Night Football package, adding that to its Prime streaming service after sharing it with traditional TV providers in prior years. On top of that, Apple announced it will carry Major League Soccer after entering an agreement that sources say is pegged at $2.5 billion over 10 years—for consumers to watch, they must subscribe to Apple TV+. Next, eyes will turn to the NBA, as its media contract is up after the 2024−25 season. Large tech companies appear willing to pay a pretty penny to bring new customers to, and keep existing customers on, their platforms, subsidized by the ability to provide targeted ads for their core software and hardware businesses.

Customer experience is another important factor in the ascent of nontraditional media. According to Integral Ad Science, consumers get a better experience on streaming platforms over traditional media when watching sports specifically. As ad tech advances, it will continue to improve the experience of consumers and provide great opportunities for nontraditional providers to generate revenue to spend on large media contracts.

Consumers are moving to cut the cord from traditional providers at a rapid pace. At the same time, technology companies are increasing their presence in the sports industry by purchasing media rights to boost content and drive customers. The future of sports broadcasting is shifting quickly, and as media contracts come up for renewal, bids are certain to come from providers outside of traditional media.