Life sciences companies must proactively plan for tariffs, pricing and corporate tax strategies.

Key takeaways

Tariffs can increase drug costs, disrupt supply chains, and affect profit margins and market dynamics.

Effective tax planning is crucial to offset new tariff costs and adapt to supply chain changes.

The life sciences industry has become increasingly global over the past few decades, with contract research organizations (CROs) helping conduct studies across the world, medtech companies outsourcing manufacturing to other countries to improve margins, and biopharma companies working with international contract development and manufacturing organizations (CDMOs) to ensure consistent and reliable products.

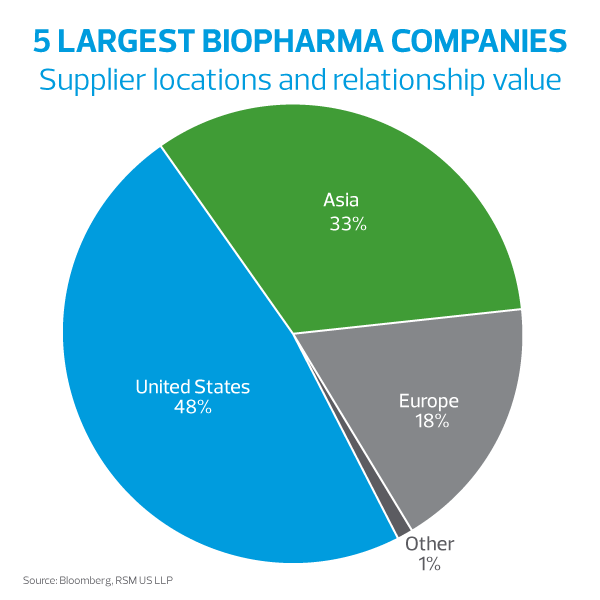

With all this global complexity, there are numerous implications related to the U.S. administration’s approach to trade and tariff policy. For the five largest biopharma companies, over one-third of their supply spend comes from Asia, according to Bloomberg, with 32% of active pharmaceutical ingredients (APIs) being produced in China, according to data from the U.S. Food and Drug Administration.

Tariff reduction strategies

While companies in the life sciences industry have always had opportunities to minimize tariff exposure, the additional 20% tariff on Chinese goods, and newly announced tariffs on most goods ranging from 10% to 50% depending on country of origin, highlight the urgency of trade and tariff strategy, especially in the age of drug pricing limitations. As of now, with the exception of Chinese origin products, pharmaceuticals are exempt from these new tariffs.

Companies can analyze various well-proven tariff reduction strategies and determine the best fit for their operations. The simplest options relate to tariff classification and customs valuation and are largely available to companies engaged in precommercial activities, including those organizations conducting clinical trials. For example, the U.S. tariff offers special provisions that may eliminate not only the regular tariff rate but also the punitive tariff on Chinese-origin goods if used for research and development purposes. Additionally, companies may review the imported value to identify potential reductions in the price declared to customs.

Companies with commercial products may want to explore using foreign trade zones to manufacture finished biopharma or medtech products. However, the current China executive order restricts their use. They can also partner with suppliers in countries not subject to tariffs or with lower tariffs. It is important to review all such options to determine eligibility.

Pricing considerations

Tariffs on pharmaceutical drugs can significantly affect drug pricing and availability. Here are some key considerations:

- Increased costs: Tariffs can raise the cost of imported drugs and APIs. This increase is particularly concerning for generic drugs, which often rely on imported APIs. If the cost of inputs rises, there is a likelihood of increased prices for consumers. We anticipate this might impair licensing agreements and transition services arrangements for mergers and acquisitions deals.

- Supply chain disruptions: Tariffs can disrupt the supply chain, leading to shortages. Disruption is especially problematic for generic drugs, which already face supply chain vulnerabilities. As there are currently drugs that are already facing scarcity challenges, the potential supply chain implications may significantly affect the availability of drugs. There is a chance that companies will look to “onshore” drug development and manufacturing to minimize supply chain disruptions.

- Profit margins: Manufacturers of generic drugs typically operate with thin profit margins. Tariffs can squeeze these margins further, potentially reducing production and availability. Overall, the tariffs are seen as operating costs but have a downstream impact on the gross-to-net pricing of products.

- Market dynamics: Tariffs can alter the competitive landscape. Domestic manufacturers might benefit from reduced competition, but overall market prices could rise. Ongoing changes in trade policies can create uncertainty, making it difficult for pharmaceutical companies to plan long-term strategies.

These factors highlight the complex interplay between tariffs and drug pricing, emphasizing the need to consider carefully trade policy decisions.

Corporate tax considerations

Finally, corporate income tax planning must evolve as the tariff landscape changes. Companies should incorporate tax planning strategies, including state and local and international tax considerations, when performing cost/benefit analysis for new manufacturing capacity. With changing immigration policies, companies will need to balance onshoring strategies against labor market changes in the U.S. Puerto Rico, which, as a U.S. territory, is currently exempt from U.S. tariffs, may become an increasingly desirable jurisdiction for various manufacturing functions.

Companies will need to carefully consider adjustments concerning intellectual property planning, global value-added tax, and transfer pricing planning. Maximizing indirect tax recovery and corporate tax incentives will be a critical component in offsetting new tariff costs. As the supply chain adapts to changing tariffs and increased uncertainty, robust international tax planning will be critical.

The takeaway

With many potential impacts of tariffs for life sciences companies working in an increasingly international industry, life sciences companies should ensure that they are proactive in overcoming challenges as they relate to tariff planning, pricing considerations and corporate tax strategy. In a highly regulated, technical and specialized industry such as life sciences, moving manufacturing capacity to another country is not as easy as a “lift and shift,” and companies should understand the financial, regulatory and strategic implications of making changes to their supply chains.