Companies importing ingredients for development, testing, product evaluation or quality control may import them duty-free.

Key takeaways

Companies should analyze their imported materials to determine any tariff savings.

Importers must declare use to U.S. Customs and Border Protection when filing their customs entries and maintain detailed records.

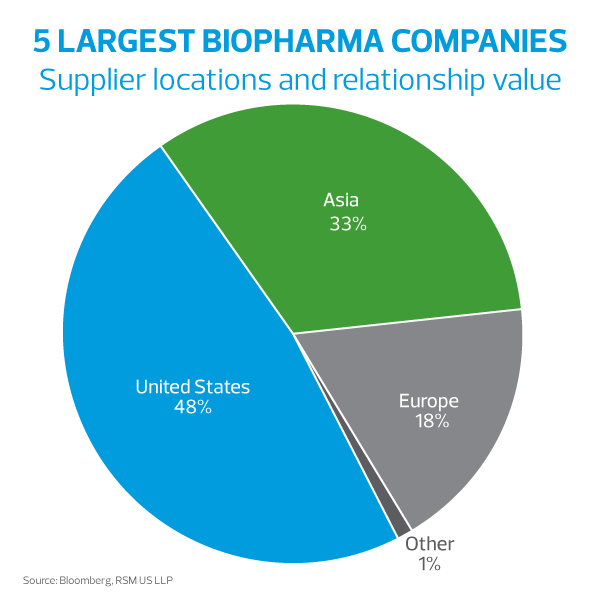

In an age of continuous globalization, biopharmaceutical companies frequently turn to suppliers outside their home country for various supplies such as active pharmaceutical ingredients (APIs), specialty chemicals and lab supplies. For example, for the top five largest biopharma companies, over 50% of their supplier spend comes from companies domiciled outside of the United States. A large portion of these expenditures comes from materials required for research and development (R&D).

This global supply chain has driven cost efficiencies through economies of scale and allowed many companies to access supplies that may not be able to be produced within their own country’s borders. When using these supplies within the United States for R&D purposes, there may be opportunities for cost savings, particularly in the way of tariff reductions.

Tariff savings opportunities

Tariff rates of many biopharma and pharmaceutical chemical compounds are assessed at a rate of 6.5% ad valorem. Since the cost of these products is quite high, tariffs can be substantial. However, companies importing ingredients engaging in the development, testing, product evaluation or quality control of materials may be able to import them duty-free, resulting in reduced R&D costs. The U.S. tariff contains a special tariff provision for “prototypes,” which can be applied to items such as pharmaceutical chemical compounds or active pharmaceutical ingredients. In addition to development, testing, evaluation and quality control analysis, articles must meet the following criteria to take advantage of this provision:

- Must be in the preproduction, production or postproduction stage

- Must be imported in limited noncommercial quantities that follow industry practice

- May not be sold after importation into the United States

- May not be incorporated into products sold in the United States.

- May not be subject to quantitative restrictions such as quotas, antidumping orders or countervailing duty orders

Importers may further develop articles imported under this provision from their original or model state. U.S. Customs and Border Protection (CBP) has consistently ruled that many compounds fall within the preproduction stage of pharmaceuticals, including those that fall under Investigational New Drug (IND) protocols to be tested and evaluated. Therefore, they satisfy the requirements of testing, product evaluation or quality control purposes defined in the tariff.

If utilizing this provision, importers must provide a declaration of use to CBP when filing their customs entries and maintain detailed records, including supporting documents, reports and records, to provide to CBP upon request. The importers must maintain the records for five years from the entry date.

This tariff provision demonstrates that pharmaceutical companies can find creative ways to reduce their R&D costs by taking advantage of tariff reduction opportunities. They can also use this exercise to explore other avenues of savings, such as importing from countries with which the U.S. has free trade agreements or performing development and testing activities in free trade zones.

Recommended next steps

Biopharma and pharmaceutical companies should analyze their imported materials to determine tariff savings opportunities. This endeavor needs to include, at a minimum, the following:

- Engage a cross-functional team that includes participation from clinical development and supply chain associates to explore cost reduction opportunities.

- Map the supply chain of all imported pharmaceutical chemical compounds and active pharmaceutical ingredients used in the R&D process.

- Review tariff classifications of all imported R&D materials.

- Assess the processes performed in the U.S. after importation to determine if any special tariff or trade programs may be applicable.