As inflation grows, health care providers will struggle to maintain margin.

Key takeaways

Reimbursement rates cannot keep up with increasing costs.

COVID-19 case volumes continue to drive expense for providers.

Inflation has been dominating headlines in both financial and mainstream news, and will continue to challenge hospital operators for the next several quarters, and likely beyond.

Historically, most health care organizations had little reason to worry about inflation given the economics of domestic health care delivery. However, as inflation grows at rates not seen in decades, service providers will struggle to maintain positive margin.

Battling inflation’s impact

Reimbursement simply cannot keep up with increasing costs, nor can patients bear much more of the direct financial responsibility for their care. This puts much of the inflation onus directly on providers.

This view was affirmed as several large health care providers released their third-quarter earnings. One community health system admitted that costs unrelated to salaries, wages and benefits are adversely affecting margins while others made clear they do not expect reimbursement increases to keep pace with inflation.

Some organizations also directly mentioned or implied that monetary policy may help offset wage inflation pressure. As our economics team at RSM has written previously, the Federal Reserve is increasing interest rates to promote price stability and temper inflation. This action will, by design, increase unemployment. Some think that if unemployment increases, wage pressures will lessen. While we may see a decline in the rate at which wages increase, however, we are unlikely to see nominal decreases in the actual dollar per hour employers pay for most job titles and roles.

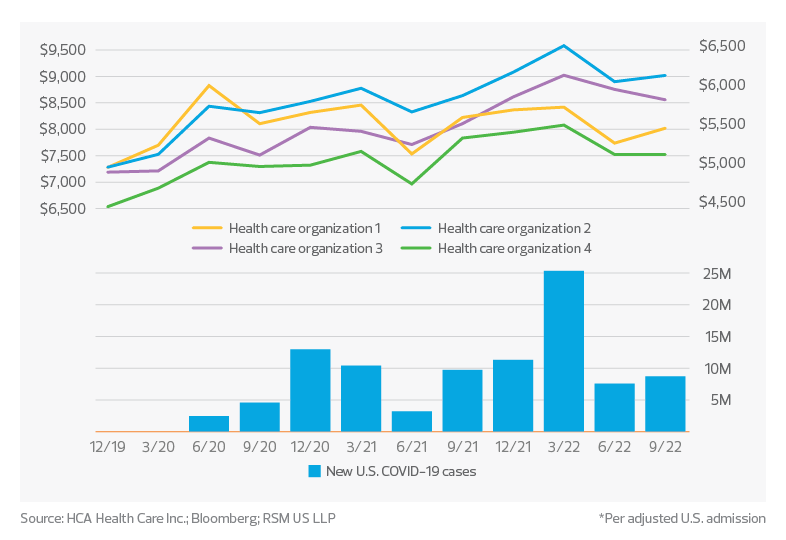

COVID-19 continues to drive expenses

Regardless of the monetary policy environment, COVID-19 cases continue to drive expense for providers. Three of the four largest public acute care operators managed to reduce their use of contract labor, which provided margin support. However, as COVID case volumes remain sticky, so do the related cost structures as measured by wage expense per adjusted admission, which incorporates both inpatient and outpatient volumes. This ratio remains high because of COVID. While acuity of care may account for some of the difference, the data suggests that even when COVID cases fall to zero, the wage costs per adjusted admission will not return to 2019 levels.

COVID-19 continues to drive wage expense*

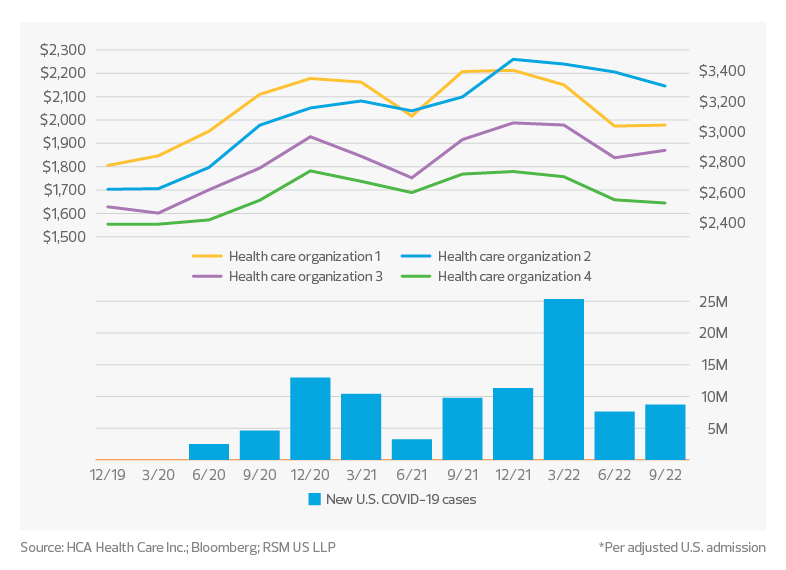

Supply expenses tell a similar story. As global supply chains improve, we are more likely to see a nominal decrease in the cost of supplies than in wages. However, we are also watching for signs of "nearshoring" or "friendshoring"—the practice of establishing supply chains in locations that are cost-competitive and offer stability. With this approach, medical supply prices still may not come down much, given that organizations prioritize stability of supply over price.

In the meantime, COVID case volumes continue to inform cost. However, if COVID cases fall to zero, we're unlikely to revert to a 2019 cost structure.

COVID-19 continues to drive supply costs*

Recently, two major health care systems were more optimistic about inflation, suggesting in their earnings calls they haven't seen significant impacts of inflation on margins yet. Time will tell, and we hope they're right. However, sentiment elsewhere in the ecosystem and the underlying data suggest we are in an era of even higher cost and there is likely no going back.