Enhanced data analytics tools and strategies to drive consumer engagement will be critical.

Consumer goods industry outlook key takeaways

The pressure from investors and management to sustain margin expansion will force companies to reevaluate operational initiatives.

The focus on consumer membership programs will be even stronger going into 2023.

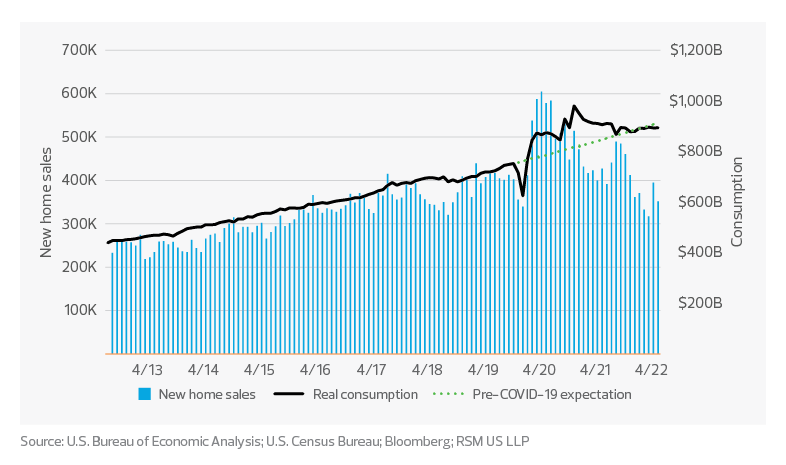

As the Federal Reserve attempts to tame inflationary pressures by increasing the federal funds rate (3.7% to 4.0% at the time of this writing), and mortgage rates hover above 7.0%, new home sales are experiencing a direct impact. Given the housing component of inflation is not anticipated to ease until sometime in late 2023, home products companies should be prepared for a sustained period of economic pressure.

Home sales impact on real home product consumption

Historically, consumption of home products correlates to new home sales, as many homebuyers refurnish or upgrade appliances within a year of a new home purchase. This correlation shifted during the COVID-19 pandemic as a result of the surge in mortgage refinancing and shifts in consumer spending toward goods and away from services. As shown in the accompanying chart, from April 2020 through May 2022 consumer spending on home products exceeded the pre-COVID trend line (assuming an average monthly growth rate equal to the eight-year pre-COVID period) as consumers upgraded their homes and repurposed spaces for at-home gyms, schools and offices.

Only since June 2022 has real consumption of home products fallen below pre-COVID expectations, as new home sales continue on the downward trajectory that began in summer 2022. Companies operating within this sector will need to evaluate their business to ensure they are prepared for a period of sustained downturn. Strategies to lower operational expenses and drive higher earnings will be critical for navigating what is expected to be lower sales in the immediate term.

This means targeting investments to drive consumer engagement and reduce operational waste. In many recent earnings calls and press releases, companies selling discretionary goods have emphasized the need to right-size head count and operational capabilities as the likelihood of recession reaches 65% over the next 12 months, based on RSM’s analysis. Middle market companies have an inherent advantage over some of their larger competitors because they are able to more nimbly integrate new strategies to drive future earnings expansion, which will be critical through 2023 and beyond.

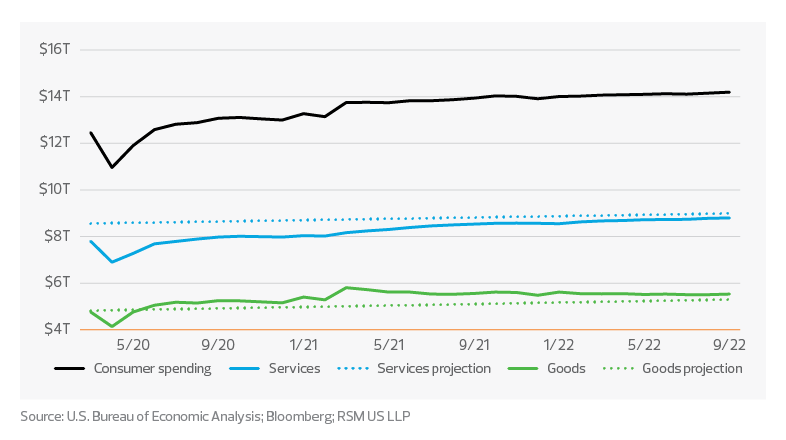

Renewed focus on goods vs. services spending as discretionary budgets shrink

Since the start of the pandemic, real (inflation-adjusted) spending on goods has overshot pre-COVID expectations based on the average monthly growth rate for the preceding eight-year period. This surge in goods-based spending was primarily driven by a shift in consumer purchasing habits as consumers pulled back on spending on services (e.g., travel, dining out and elective medical procedures).

Real consumer spending points to a pullback in volumes for apparel and home furnishings

Goods vs. services consumption

However, as economies have reopened over the last year, and the narrative around COVID has shifted toward living with the virus, service spending has also increased. Prior to the pandemic, monthly spending on services averaged approximately 65% of total consumer spend; this declined to about 61% throughout much of the pandemic. However, in 2022, available data shows service spending is rebounding and has averaged 61.7% of total spending, versus 60.8% in 2021. This points to a crack in the narrative that inflationary pressures are primarily to blame for a decline in spending. Rather, after an extended period of pent-up services demand, consumers are now overlooking price pressures and COVID-related concerns to enjoy services that had been put on hold over the last two years.

This furthers our belief that with fewer discretionary dollars available for consumers to spend on goods, and a potential recession in 2023, middle market companies will need to further tailor marketing and advertising approaches to maximize earnings potential. Enhanced data analytics tools and strategies to drive consumer engagement will be critical for directing discretionary dollars toward specific products. A key component of service spending is the experience it provides; therefore, consumer goods companies must ensure a quality shopping experience for the consumer. Measures to drive customer engagement include investing in mobile and online shopping applications and increasing focus on sustainable packaging and product presentation, as well as on ease of returns.

TAX TREND: Consumer goods

Companies investing in research and development projects, such as mobile applications or sustainable packaging, might be eligible for R&D tax credits. This consideration is especially timely because the tax treatment of R&D expenses became less favorable for taxpayers in 2022 due to a change in the law. The process involves identifying and quantifying R&D activities and costs, compiling proper documentation and support, and developing an overall methodology to quantify and support past, current and future credits.

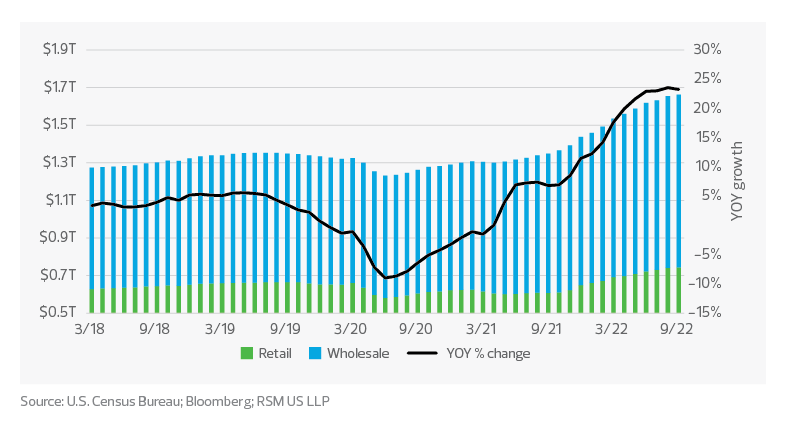

Inventory levels soar

After inventory levels soared leading into the holiday season (retail and wholesale inventory levels reached $1.7 billion as of October 2022, a 22% increase from the same period one year ago) and consumer demand shifted away from products and toward experiences, consumer goods companies were forced to discount product in an effort to right-size balance sheets leading into 2023.

Inventory

Companies that continue to sit on excess stock risk extended operational and financial pressures into the new year. The longer inventory remains on companies’ balance sheets at higher value (due to higher input costs), the greater the pressure to find ways to offset those costs. Holding inventory for extended periods risks further margin erosion due to storage facility costs, contracts with third-party logistics providers and elevated input costs from shipments during periods of higher inflationary pressures. These pressures will be magnified into 2023 as consumers likely pull back further on goods consumption after a strong holiday season—a prediction supported by many public comments from consumer products executives on recent earnings calls.

These challenges are the latest in the constant battle consumer products executives have waged to manage consumer demand and inventory levels over the last three years. On a bright note, some inventory pressures appear to be easing, led by lowering of oceanic freight rates on products from Asia that reached all-time highs in the summer of 2021.

TAX TREND: Consumer goods

Elevated inventory levels and high inflation make this an opportune time for consumer goods companies to review their inventory accounting methods—which affect net earnings and the associated tax obligations. Companies should confirm their methods align with how their inventory is purchased, inventory costs and how quickly it is turning over.

As we move into 2023, companies must continue to develop strategies to improve consumer demand in both the short and long term. Driving consumer engagement through targeted discounts, consumer loyalty programs, regionalized marketing strategies and even product rationalization will drive future profitability. Today’s uncertain economic conditions, including high interest rates and inventory forecasting challenges, will test executives as 2023 forecasts continue to evolve.

Investment in sophisticated sales forecasting tools will be critical to drive profitability, especially in a recessionary environment. Brands will need to look for opportunities to interact directly with customers to create and convey compelling stories and identify and target buying preferences.

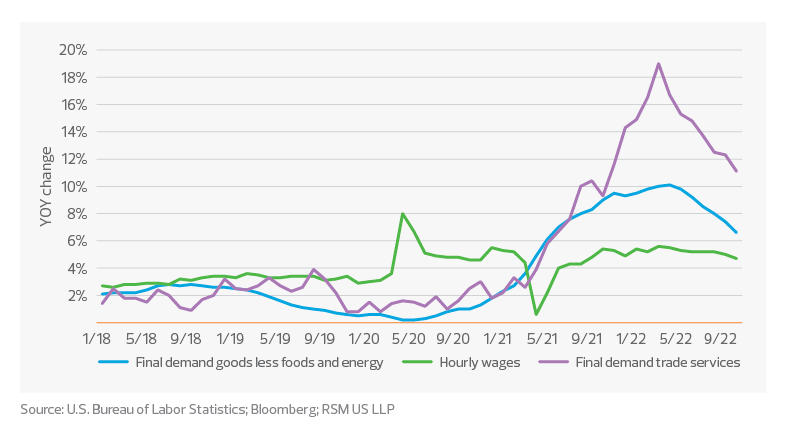

Focus on profitability has companies looking at costs

Inflation has been at the forefront of the economic discussion and corporate strategy since early 2021. With businesses’ ability to pass along elevated costs under pressure due to shifting consumer demands and an expanding gap in spending power by income level, companies are being forced to find operational cost savings to support margin growth. As shown in the accompanying chart, year-over-year growth of final demand trade services (also known as corporate margins) has begun contracting from the high of 19.0% in March 2022. The latest information as of October 2022 provided by the Bureau of Labor Statistics shows a year-over-year increase in corporate margins of 11.1%; while this is still well above pre-pandemic levels, September represented the seventh consecutive monthly decline.

Margin compression

Even with cost pressures from two of the most significant inputs, materials and wages, declining in recent periods, companies have struggled to maintain the strong margins experienced over the last two years.

The pressure from investors and management to sustain margin expansion will force companies to continue to reevaluate operational initiatives, including investments in labor-enhancing technology, elimination of wasteful overhead, divestiture of underperforming product lines or brands, and investment in enhanced data analytics tools. Unfortunately for many companies, the days of operating by intuition are largely over, and businesses, especially those in the middle market, will need to lean into technological investments to promote efficient and strategically targeted operations that will spur future growth.

Leverage loyalty programs to build meaningful consumer databases

Consumer goods companies looking to drive consumer engagement may find a solution in consumer loyalty programs. These programs, when utilized correctly, provide companies with valuable consumer data to help them create more effective sales strategies for a targeted consumer base rather than relying on a one-size-fits-all sales strategy.

However, loyalty programs must be viewed as a partnership between the company and the consumer, with each party willing to enter the arrangement because of the perceived value they receive. Perhaps the most famous loyalty program, Amazon Prime (which boasts more than 200 million members), charges a fixed annual fee to consumers, who receive a vast array of benefits across Amazon’s suite of services. Walmart has introduced Walmart+, its own paid membership program. Throughout the holiday season Walmart+ customers received additional benefits, including early shopping options, as part of their membership.

While middle market companies do not possess the suite of products and services offered by companies the size of Amazon and Walmart, consumer loyalty programs can still provide similar benefits.

The focus on consumer membership programs will be even stronger going into 2023 as companies look to maximize revenue opportunities by catering to their most loyal customers and using data to optimize operations. The number of companies mentioning “loyalty programs” on public earnings calls increased from an average of 36 per quarter in 2021 to 45 in 2022, based on data compiled by Bloomberg. However, this does not tell the full story as many companies refer to loyalty programs using a specific program name for the individual company that is not captured on public earnings calls. This likely means the discussion and attention around loyalty programs is actually even higher.

Moving into 2023, the use of loyalty or membership programs will be a key strategy for companies as we continue the transition to a datacentric business environment. In periods of uncertainty, as we expect in 2023, the effective use of real-time data to manage the business will differentiate companies looking to thrive versus simply survive.