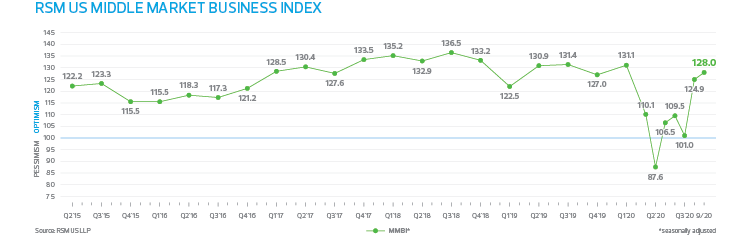

The modest improvement in economic activity following the gradual reopening of the economy this spring bolstered middle market business sentiment in September. The RSM US Middle Market Business Index improved to 128.0 in the month from 124.9 in August.

Middle market businesses appear to be expressing a palpable sense of relief as demand has returned and supply chain disruptions associated with the coronavirus pandemic have eased. Similar to sentiment data in August, the September top line reading should be interpreted as more of a forward-looking statement of optimism across the industries surveyed rather than a snapshot of the challenging current business conditions. Approximately 20% of the $20 trillion dollar U.S. economy remains impaired.

That being said, the low-hanging fruit in terms of the recovery has been picked, and the middle market should anticipate sustained moderation in any improvement in the top line MMBI index. That main reading will of course be subject to volatility in supply and demand linked to the ebb and flow of the pandemic. RSM’s model of the pandemic implies that infections are again on an upswing, with seasonal changes causing individuals to move back indoors. If the infection rate begins to move back to its summer 2020 peak, there will likely be a slowing in overall economic activity and an easing in middle market sentiment.

The September increases in both the seasonally adjusted and non-seasonally adjusted readings of middle market business sentiment are statistically significant at levels of .05 and .10, respectively. Responses to the main index questions included for the monthly reading mostly implied modest improvement in economic conditions, with the exceptions of employment, credit and borrowing, which were essentially unchanged.

Most encouraging were executives’ responses to current and forward looking questions on the economy, revenues and earnings. A majority of 52% of respondents said the economy improved over the last month, with 68% stating they expected it to do so over the next six months. Half of the respondents stated that gross revenues improved and a robust 64% expect better revenues through the first quarter of 2021. On the net earnings front, 48% said they had increased, implying room for improvement; 63% said they expect earnings to rise over the next 180 days.

Cautious views on hiring, compensation and capex

While the improving economic conditions underscored the optimistic outlook, firms project a much more cautious view on hiring, compensation and capital investments. Only 38% of survey participants noted an improvement in hiring in the month, and 54% stated a willingness to do so over the next six months. Just 42% expressed a willingness to increase compensation to support current hiring, and 53% intend to so going forward.

Not surprisingly, capital investment remains weak, with only 37% of respondents noting an increase on the month, and 51% stating a willingness to boost investment through end of the first quarter of 2021. From our vantage point, this spending reticence remains the Achilles’ heel of the middle market. Given the decline in gross revenues and earnings during the now seven-month pandemic, it is natural that middle market firms would pull back on all nonessential outlays of capital, while managing hiring, compensation, fixed business investment and inventories carefully.

In this respect, the outlook of the middle market is no different than that of small or large firms that have reduced spending on productivity-enhancing equipment, software and intellectual property. It is clear that going forward there will need to be a policy shift out of Washington toward permanent changes to the tax code that favor a 100% deduction on capital investments to bolster national productivity.

The reopening of the economy has created an increase in demand for goods used at earlier stages of production as well as intermediate goods. Thus, it is not surprising that 60% of respondents noted an increase in prices paid, and 64% said they expected higher prices for those inputs going forward. However, only 43% noted an ability to pass along those costs, with 52% stating they expected to do so in six months. These data do denote some margin compression, and given current income dynamics in the economy, may crimp the otherwise rosy set of expectations going forward.

Inventory management, as one would expect following a severe shock to the economy, remains paramount to the middle market. Only 40% of executives polled stated that they increased inventories on the month, and 54% indicated an expectation to do so going forward. This implies expectations for a weak holiday spending season, since now begins the traditional period when middle market firms would begin to build up inventories in anticipation of holiday-induced demand.