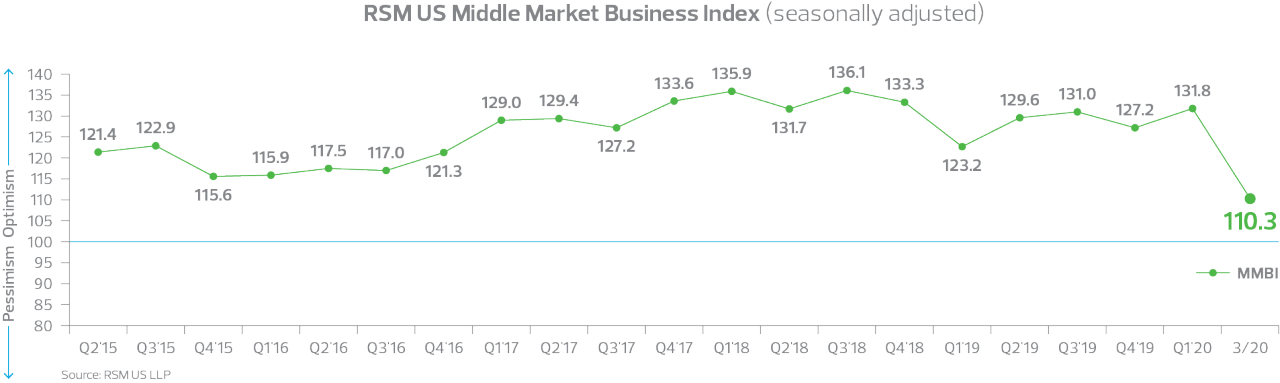

The top-line reading is consistent with a recession in the middle market and the national economy. We think that the recession started in March and the trough will be in the second quarter of the year when the national economy will contract by a pace of greater than 30%. The recession should end in the third quarter of 2020, and recovery should begin, in earnest, during the fourth quarter of the year, when the economy will expand by a pace of greater than 20%.

We are presenting the March data as the first in a series of monthly readings for what is typically a quarterly index in order to more closely track business sentiment in light of the global health crisis. The reading was based on surveys conducted from March 16 to March 30; we suspect the index’s decline would have been even more severe had results been gathered in early April amid the full force of the economic shutdown, as the majority of U.S. states have now issued stay-at-home orders and closures of nonessential businesses, sharply curtailing demand.

Perhaps the most telling responses in the survey were around employment, with 30% of those polled indicating that hiring had decreased in March, and 31% saying they expect it to decrease over the next six months. What had been, prior to the new coronavirus outbreak, a longstanding tight labor market has morphed, in just weeks, into an environment on par with the Great Depression with U.S. unemployment surging above 13%.

Not surprisingly, 61% of executives polled during the month said the economy had worsened, while 51% expect a continued downturn over the next six months. Thirty-eight percent saw gross revenues decline, while 45% expect them to drop in the next six months. While a little more than a third (36%) said net earnings decreased in March, 43% see them falling in the next six months.

This data tracks with other economic indicators we watch, including new orders and purchasing. A recession that began in the manufacturing sector last year now encompasses the broader economy. We do not realistically expect the economy to restart until at least June, when we hope that businesses can begin to incrementally reopen their brick-and-mortar operations.

In the meantime, we expect the federal government to continue to roll out temporary funding efforts in the form of low-interest loans such as the newly announced $600 billion Main Street Lending Program and related measures, in an effort to stem the fallout from this unprecedented global health crisis.