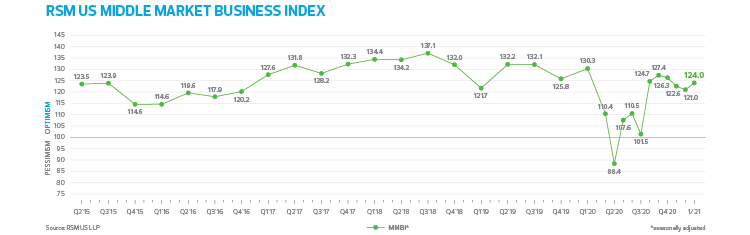

Despite the challenges posed by the most intense phase of the public health crisis, sentiment among middle market business executives rose in January, according to the proprietary RSM US Middle Market Business Index.

The index, part of the RSM US Middle Market Business Index survey for the first quarter, improved to 124 on the month, up from 121 in December. It is the highest reading since October, though it is still below its pre-pandemic level. The increase in the seasonally adjusted and nonseasonally adjusted index in January is significant at levels of 0.05 and 0.10.

The juxtaposition of the rising sentiment in the RSM survey and the tepid economic data over the past few months remains in place.

Current sentiment around the economy, gross revenues and net earnings remains challenged at best among those surveyed, while the forward-looking questions on the same topics in the RSM survey point toward a rapid reflation of the economy with the return of constructive net earnings and revenues as the economy reopens.

Most important, as the economy reflates, the majority of middle market firms are not passing along price increases associated with the reconstitution of demand, although a majority of executives said that they intended to do so later this year, which requires close monitoring as the economy reopens.

The economic deceleration into the first quarter of the year is clear in the data. Only 29% of executives noted an improvement in overall economic conditions, 39% noted a deterioration and 28% implied no change. That rather bleak view is tempered by the 56% of executives who expect improvement in the next six months.

While the current view of the economy is somewhat bleak, a plurality of respondents, or 44%, noted a current improvement in gross revenues and 43% indicated an improvement in net earnings. Like their forward view on the economy, 60% of the executives indicated they expect an improvement in gross revenues over the next six months and 59% anticipate growth in net earnings.

The optimism around expectations about the economy, earnings and revenues is the primary impetus behind the improvement in overall middle market business sentiment to kick off the year.

Given that the economy is operating at near 80% capacity as middle market firms begin to prepare for what we expect to be a hypercompetitive, post-pandemic economy, firms are clearly gearing up to hire workers, increase compensation and make investments in their own firms. The survey found that 56% of respondents said that they are going to increase hiring, 55% are going to increase compensation and 48% are going to increase outlays on productivity-enhancing capital expenditures.

This should be a clarion call to middle market firms that are now beginning to think through what the economic landscape will look like following a once-in-a-hundred-year pandemic.

That optimism, however encouraging, stands in contrast with the 44% of executives who increased hiring in the current quarter, the 42% who increased compensation and the 38% who increased capital expenditures.

One important note: In the comments that executives could add to their survey responses, participants across a range of industrial sectors said they were moving aggressively to increase spending on improving productivity. Others, in contrast, remained quite cautious and expressed uncertainly about the path ahead on the integration of technology into the production of goods and provision of services.

We strongly urge firms to consider the investment opportunity around real negative interest rates for middle market firms.

One of the more interesting developments inside the middle market outlook is the evolving sentiment on inflation. Currently, 66% of respondents noted an increase in prices paid, but only 41% of survey participants reported passing those prices through to clients. This six-month average of prices paid stands at 60% and that same metric for prices received rests at 42%, both near current levels. Looking forward, 67% expect prices paid to rise over the next six months and 60% state that they intend to pass along those price increases to customers; both figures were above their respective levels of 63% and 52% observed over the past six months.

This implies that current concerns about an immediate and permanent increase in the price level -- that is the definition of inflation—are overblown. But it will be interesting to see if firms that for years have not been in possession of pricing power suddenly find that power and clients willing to accept higher costs.

Given the modest backup in interest rates and inflation expectations—both remain below 2%—this will be one of the more interesting economic narratives this year. Right now, firms that constitute the beating heart and soul of the real economy are not pointing to a near-term risk in pricing to the economic outlook.

Current and expected fiscal support may be a boon for middle market firms that have access to more credit options as the question on borrowing, or how easy it is to obtain credit, swings back into positive territory. The lending environment is tight, but it is not getting any tighter thanks to help from policymakers.

Survey respondents continue to remain cautious on the rebuilding of inventory levels, with 43% indicating current improvement and 49% stating they expect to do so over the next six months.