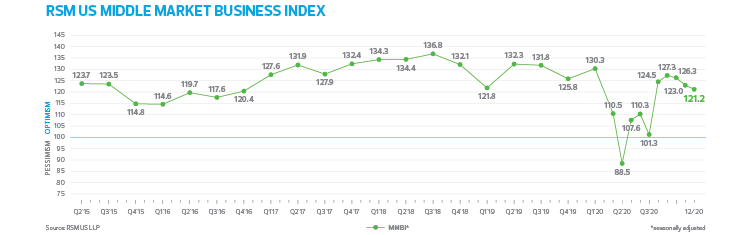

The English theologian Thomas Fuller once wrote that “the darkest hour is just before the dawn,” which is an apt summary of the U.S. economy right now. The proprietary RSM US Middle Market Business Index found that while only 39% of respondents indicated that the economy improved in December, overall top-line sentiment remained robust. The index registered 121.2, down only modestly from 123 in November.

December’s strong number was mostly attributed to expectations that business conditions and the economy will improve noticeably by the middle of the year. While sentiment on current economic conditions has soured, 59% of survey respondents stated that they expect the economy to improve over the next six months.

This dovetails with our own 2021 forecast, which expects that once a COVID-19 vaccine is widely distributed, the economy will boom and grow nearly 4.5% this year, with a growth rate exceeding 5% in the second half of the year.

Our survey indicates that middle market respondents expect a strong rebound in gross revenues and net earnings with 57% expecting an increase in the former and 61% expecting improvement in the latter. This stands in contrast with 46% who indicated a current improvement in gross revenues and 45% who cited a current increase in net earnings.

One of the key developments inside the middle market economy during the pandemic has been the pulling forward of advanced technology into the current production of goods and provision of services. In many respects, based on our conversations with clients, a decade’s worth of technology was pulled forward in less than a year. For this reason, it is not surprising that 52% of survey respondents expect to increase outlays on productivity-enhancing capital expenditures—for software, equipment and intellectual property—over the next six months. This is critical to prospects for middle market firms to meet the challenges of the post-pandemic economy.

The labor market outlook remains challenged, with only 39% of respondents noting a current increase in hiring and 33% reporting an increase in compensation during the month—a drop from 41% in November. Given the drag on the economy caused by the pandemic, this is to be expected. Again, like the general outlook on the economy, middle market firms expressed confidence that in six months, the jobs outlook will improve, with 54% noting that they will increase hiring and 55% will increase compensation.

Despite the positive outlook on gross revenues and net earnings, firms continue to indicate that they do not expect an ability to pass along rising prices to consumers even as prices paid for goods have increased and are expected to rise this year. Approximately 60% of survey participants noted an increase in prices paid in December, and 65% expect that condition to be sustained through mid-2021. While only 42% of respondents indicated an increase in prices received, 51% said they expected that to happen going forward.

Finally, and not surprisingly, middle market firms continued to carefully manage inventory levels, with 46% indicating an increase in their stock and 52% stating they expected to increase inventory over the next six months. One important development to note is that inventory building in the overall economy advanced significantly in the final quarter of 2020. That is one of the main reasons we expected gross domestic product to advance close to 5% in the final three months of last year, which will then act as a drag on growth in the first quarter, where we expect a 1.1% rate of growth.

This implies is that middle market firms are far better positioned to get through the last difficult days of the pandemic and will be ready for the strong economic expansion that will define the early phases of the economic recovery. We expect that 2021 will be a robust year of recovery, resilience and reimagination for the American middle market.