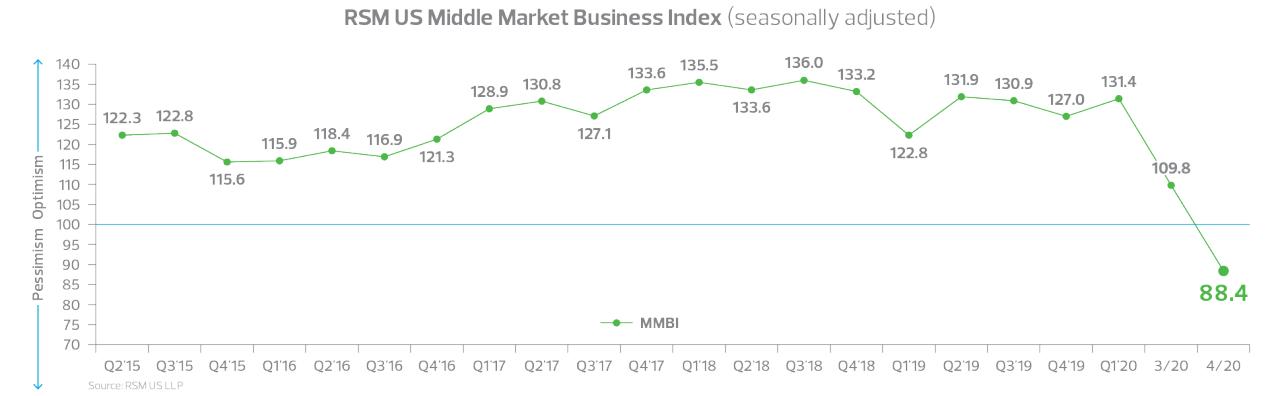

The shocks that cascaded through the American economy due to the Covid-19 pandemic struck a blow to the heart of the real economy in April. Middle market business conditions suffered significant declines, sending the proprietary RSM US Middle Market Business Index to a historical low of 88.4 in the April monthly reading, from 109.8 in March. These monthly readings show the depth of the pandemic’s impact on the middle market, when compared to the first quarter final reading of 131.4, as the combination of self-imposed social distancing by the public and shelter-in-place guidance from federal, state and local governments effectively shut down the economy.

The major takeaway from the data shows that a majority of executives surveyed indicated that these shocks are large and pervasive. They do not anticipate significant improvement in the economy, earnings or revenues over the next six months. In addition, it is highly probable that the decline in sentiment across the board, as well as future expectations on growth, employment, revenues and earnings, were related to the lack of access to government funding. This coincided with the problematic launch of the Small Business Administration’s Paycheck Protection Program and the delayed launch of the Treasury/Federal Reserve’s Main Street Lending Program. Indeed, borrowing conditions for middle market firms deteriorated in April, as 33% of participants indicated a more difficult situation; however, just 14% expect the problem to continue in the six months ahead.

The data strongly imply that the $2.9 trillion in aid put forward by the federal government and nearly $650 billion in liquidity commitments, which underscore the central bank’s Main Street Lending Program, will not be sufficient to revive the beating heart and soul of the real economy in the near term. A robust aid plan and subsequent stimulus package will be required to achieve escape velocity for the economy later this year, and into 2021.

The MMBI survey readings are consistent with our forecast for a near-40% decline in second-quarter gross domestic product; the dour six-month-ahead outlook is a risk to our optimistic expectation for a rebound of greater than 20% in the final three months of 2020. Roughly 83% of MMBI survey respondents indicated a general decline in economic prospects during April, while 51% stated they expected a decline in economic conditions over the next six months. If those expectations hold, we will be lowering our optimistic forecast for a rebound in the fourth quarter.

The outlook on gross earnings and net revenues was equally bleak. Approximately 61% of participants noted a decline in gross revenues during April, while half expected a decline in middle market prospects until late fall. Fifty-nine percent of executives said they experienced a decline in net earnings in April, and 50% expect to see a decline over the next six months.

Economic reset likely

Data on employment, compensation and capital outlays, while not as bleak as that on the economy, gross earnings and net revenues, is still troubling and strongly implies that expectations of a third-quarter rebound should be reset. Approximately 46% of survey participants noted a decline in April hiring and 37% anticipate a downturn over the next six months.

The outlook on capital expenditures implies a productivity slide through the middle of 2020, as 53% of respondents noted that they reduced expenditures during the month, and 44% are likely to do so over the next six months.

Roughly 29% of participants noted a decline in current compensation offered in April, and expect that to be the case over the six months. If those expectations bear out, they would imply general wage stickiness across the economy, a reduced risk of deflation, rising real wages and a sustained outsize decline in production and output. This data is the foundation of our current baseline forecast of “Depression-Like Shock, No Depression.”

The economy is likely to avoid the major risk of the moment: deflation eating away at individual wages, increasing the U.S. household and commercial debt overhang and causing large declines in industrial output and economic activity. Should wages not remain sticky, then the risks of a much more pronounced decline in the economy increase.

Inflation expectations inside the prices paid and received questions in both the current quarter and six months ahead remained relatively stable, with a modest downward bias toward lower prices, but not outright deflation. The inventory outlook indicated modest declines in inventory in April and over the next 180 days.