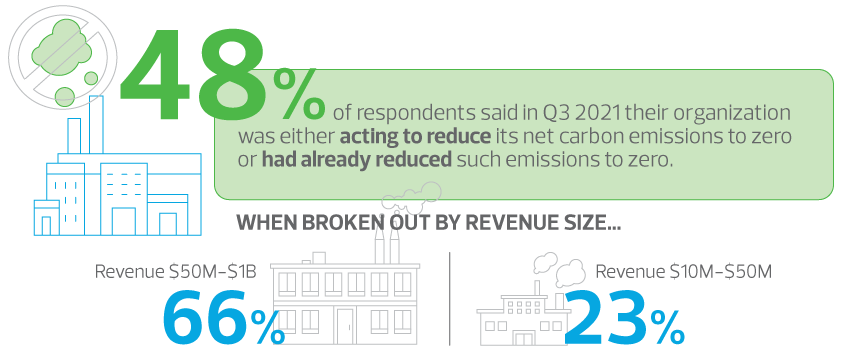

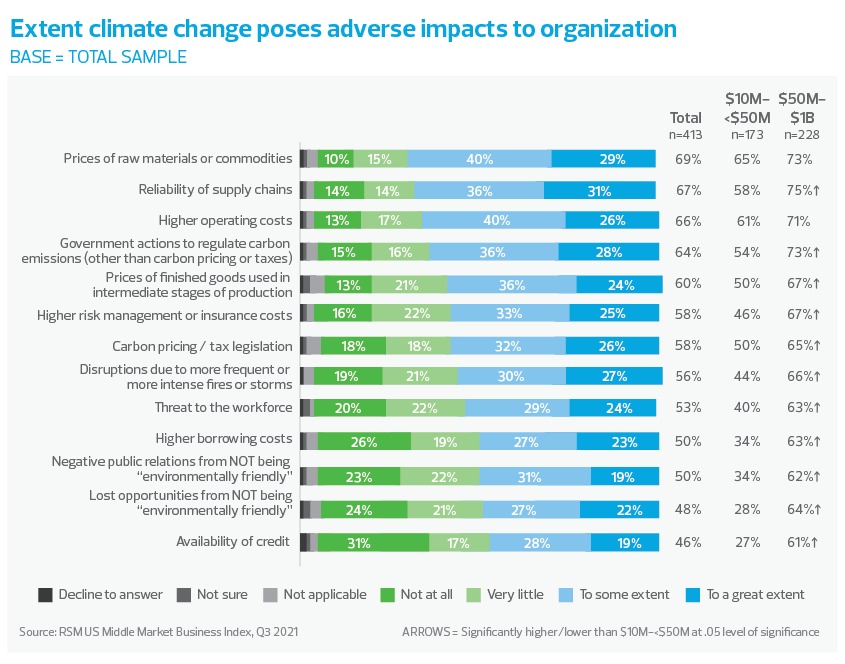

While ESG initiatives encompass a wide range of issues, those focused on the environment are of paramount importance, especially as more consumers and businesses factor sustainability into their buying decisions and as the Biden administration has prioritized net-zero emissions targets and other environmental goals. As such, pressures and shifts related to climate change continue to shape business planning for the future.

Many companies anticipate climate change will also present opportunities over the next three years. Twenty percent of respondents said climate change presents significant opportunities, with a notable gap based on size cohort; 9% of smaller middle market companies see significant opportunities, while that figure was 28% for larger middle market companies. Overall, 28% of respondents said climate change presents significant challenges, and 27% said it presents both significant opportunities and challenges.

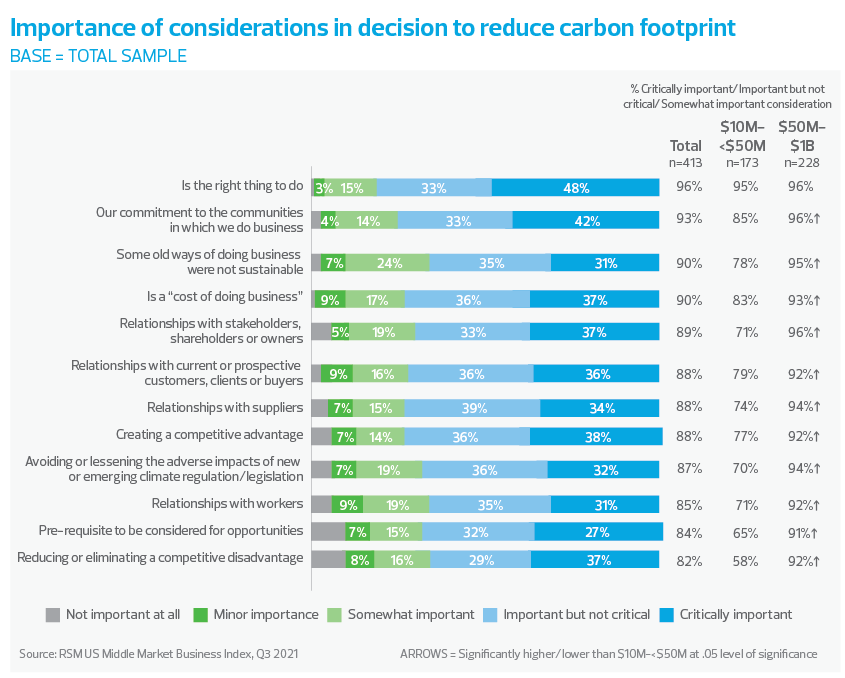

The fact that middle market firms are “much more exposed” to environmental and climate issues—along with social issues—than their larger counterparts means it is even more urgent that they adopt ESG strategies, says RSM US economist Dr. Tuan Nguyen.

“They don’t have a lot of capital; they don’t have the leverage. So they have to act,” he says. “And given that growing risk and competitive pressure from bigger firms that are adopting ESG, the middle market should consider implementing ESG as soon as possible.” Doing so can also provide some downside protection during social or environmental crises.