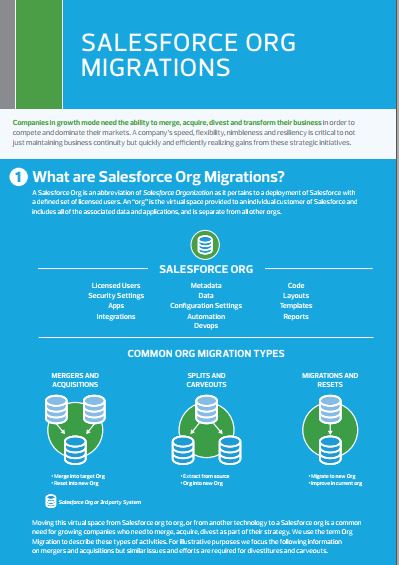

When companies undergo mergers, acquisitions, and carve-outs the need for managing systems such as Salesforce is critical. When two organizations join forces, it’s important to understand the best approach to combine capabilities and to have an execution team to make it happen correctly in the shortest time to value. For example, in an acquisition, the technology stack of both companies include solutions in marketing, sales, customer service, quoting, (CPQ), field service, and portals—determining the best approach that balances time to market, technical and data risk, cost and more can make all the difference between a successful or failed acquisition.

In addition, when carveouts occur, Salesforce needs to be split, requiring migration of specific processes, functions, and data so that they both can operate independently—meeting business and regulatory needs.

Experience matters

Because Salesforce is a highly featured application platform, Salesforce Org Migrations can be incredibly complex, with no simple cut and paste or import/export option to transfer Salesforce data. However, in support of many financial transaction events, the RSM Salesforce team frequently performs these challenging procedures – having developed a proven, comprehensive framework to help ensure a successful transition.

Our Org Migration 360 process begins with an assessment to analyze the best approach based on your strategic goals, timing, budget, technical and organizational readiness, and skills. We work with you to decide upon the best paths forward to meet your specific needs.

In addition to our extensive Salesforce migration experience, the RSM team has developed the M&A 360 framework to deliver value throughout the life cycle of mergers, acquisitions, and carve-out transactions. Our technology consulting advisors are also well-versed in assessing, consolidating, and transforming a wide variety of other system architectures and environments.