Do you have assets you expect to grow significantly? Leaving such assets in your estate to appreciate during your lifetime may increase your estate tax bill. However, if you have already utilized your current available lifetime gift tax exemption, making an outright transfer and triggering gift tax might not be the most desired option. A Grantor Retained Annuity Trust (GRAT) can be a valuable tool to address this. It allows you to transfer wealth to future generations while freezing the current value of the assets for tax purposes and using minimal lifetime gift tax exemption.

What is a GRAT?

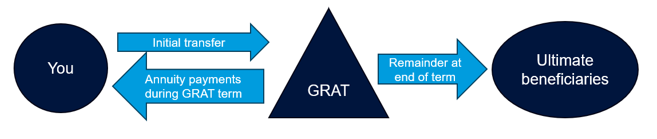

A GRAT is an irrevocable trust that exists only for a specified period of time. You initially transfer assets to the GRAT and then receive annuity payments back for the term of the GRAT. For example, you transfer an asset worth $1 million to the GRAT. Over the term, the GRAT pays you $999,999 of annuity payments. This results in a $1 ‘taxable gift.’ If the assets appreciate more than the annuity payment back to you, the excess appreciation escapes your estate transfer tax free. If the $1 million of GRAT assets grows to $1.5 million during the term, that $500,000 of growth will pass to your beneficiaries free of estate and gift tax. At the end of the specified term, the GRAT terminates, and the remaining assets are transferred to the GRAT beneficiaries (typically a younger generation), either outright or in trust.