Under section 897, enacted by the Foreign Investment in Real Property Tax Act of 1980 (FIRPTA), gain on the disposition of a US real property interest by a nonresident individual or a foreign corporation is generally subject to US tax as income that is effectively connected with a US trade or business (ECI).

A US real property interest includes a direct interest in US real property and shares in a US real property holding corporation (USRPHC). A USRPHC is essentially any domestic corporation if, on certain testing dates, the fair market value of the corporation’s US real property equals or exceeds 50% of the fair market value of its real property and assets used in a trade or business.

REITs, which are classified as US corporations for US tax purposes, often fall within the definition of a USRPHC due to their extensive holdings in US real property such that a foreign investor’s gain on the investment will generally be taxed as ECI unless an exception applies. However, if the REIT is domestically controlled, shares in the REIT are not treated as a US real property interest even if the REIT would otherwise be classified as a USRPHC.2

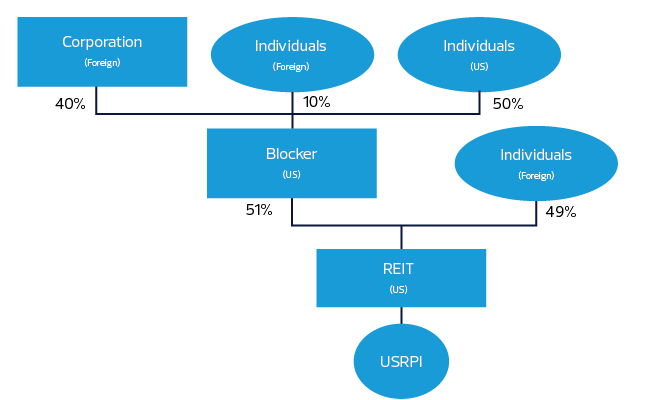

Section 897(h)(4)(B) provides that a REIT is domestically controlled if, throughout the five-year period preceding a disposition, less than 50% of the value of the REIT stock is held “directly or indirectly” by foreign persons.3 Section 897 does not define indirect ownership for this purpose. Prior to the issuance of the Proposed Regulations, the IRS had taken the position in PLR 200923001 that one would not look through a US corporation for this purpose, regardless of the percentage of foreign shareholders in the US corporation.4 Many foreign investors structured their investments in a REIT based on the position taken by the IRS in that Private Letter Ruling (PLR) (i.e., that US corporate ‘blockers’ would be treated as shareholders for purposes of testing control of a REIT). The Proposed Regulations took the opposite approach and would have required that ownership of the REIT be determined by looking through a US corporation if 25% or more of the US corporation was owned by foreign persons. The Final Regulations adopt the look through rule for US corporations but increase the foreign ownership threshold to 50%. Thus, only for purposes of determining whether a REIT is domestically controlled under the Final Regulations, shareholders of the REIT are determined by looking through a US corporation if foreign persons own more than 50% of the US corporation.

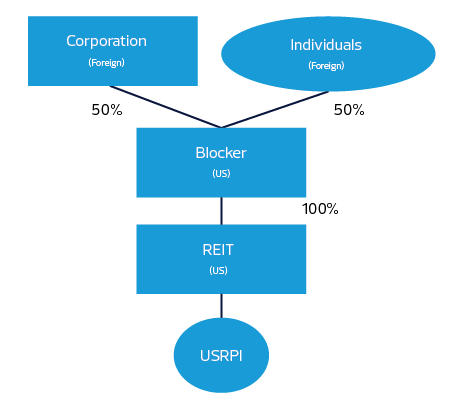

Many foreign investors invest in a REIT through a US corporation (a ‘US blocker’) to shield the foreign investors from earning ECI directly, which would create an obligation to file a US tax return. In many cases, more than 50% of the US blocker is owned by foreign investors. Prior to the Final Regulations, some foreign investors may have taken the position that the US blocker was not a USRPHC because its primary asset, the REIT stock, was not a US real property interest by reason of being owned by the US blocker that allowed it to qualify as domestically controlled. As a result, when foreign investors sold their shares in the US blocker, they may have determined that they were not required to recognize that gain as ECI under section 897 or file US returns. See illustration below.