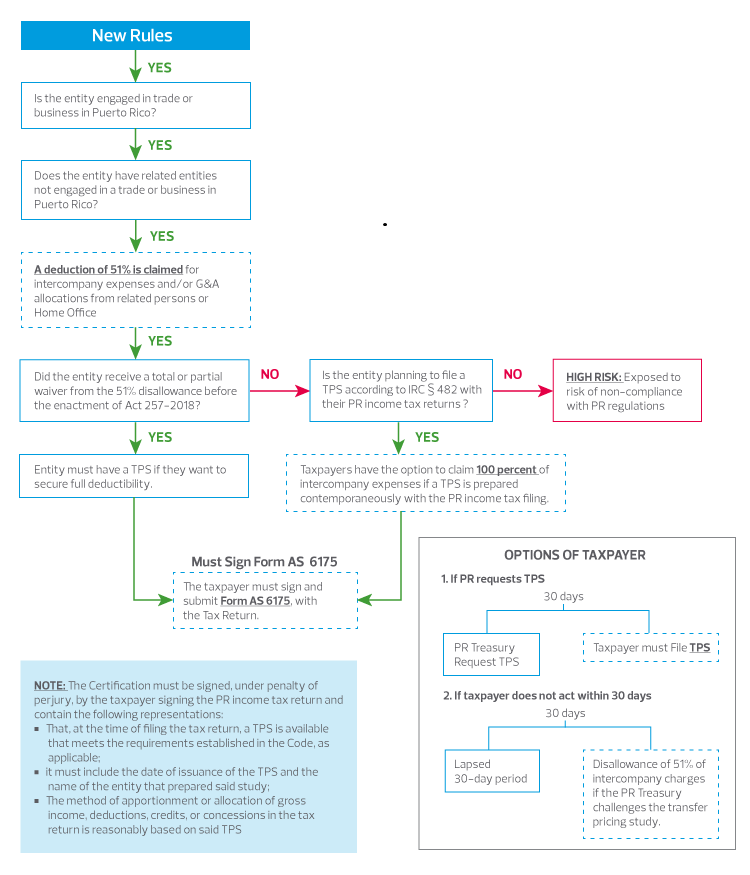

On May 11, 2021, the Puerto Rico Treasury Department (PR Treasury) issued Administrative Determination No. 21-05 (DA 21-05), establishing new rules that would require a transfer pricing study (TPS) to deduct cross-border expenses incurred with related entities not engaged in trade or business in Puerto Rico.

This article will discuss section 1033.17(a)(17) of the 2011 Puerto Rico Internal Revenue Code (the Code) and DA 21-05, which provides guidance for filing a TPS with the PR Treasury and clarifies new compliance requirements where there are transactions between affiliated entities in PR and the US. In addition, the article will briefly highlight Administrative Determination No. 21-08 (DA 21-08), which clarifies that the 30-day filing requirement applies to the TPS and not Form AS 6175 as required in DA 21-05.

Background

Puerto Rico has historically maintained a hands-off approach providing little to no guidance on transfer pricing. In recent years, new non-transfer pricing provisions have been introduced into the Puerto Rico tax rules, some of which affect intra-group transactions.

Act 257-2018 modified the 51% limitation allowing taxpayers to deduct 100% of expenses paid to related parties that operate within Puerto Rico and have related entities not engaged in a trade or business in Puerto Rico.

For tax years beginning after Dec. 31, 2018, the new rules allow such expenses to be fully deductible, provided the taxpayer:

- Signs and submits the approved Form AS 6175 Certification of Compliance (Certification) under penalty of perjury with the tax return.

- Prepares a TPS to confirm that the transaction(s) are arm's length based on sections 482, 6662, and associated regulations; and

- Completes the TPS contemporaneously with the tax return filing that reflects such transfer prices.

- Only reports submitted in accordance with US regulations will be accepted.

For the impact of changes to transfer pricing guidance under PR IRC, see below: