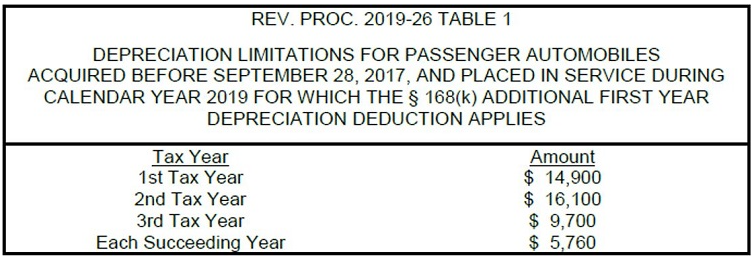

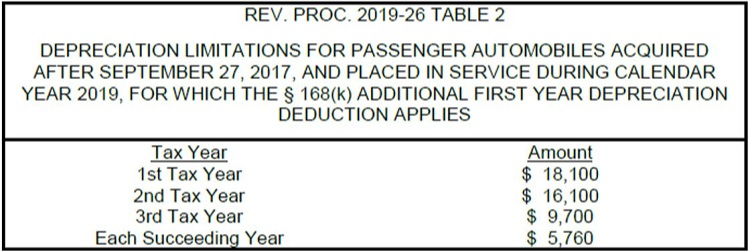

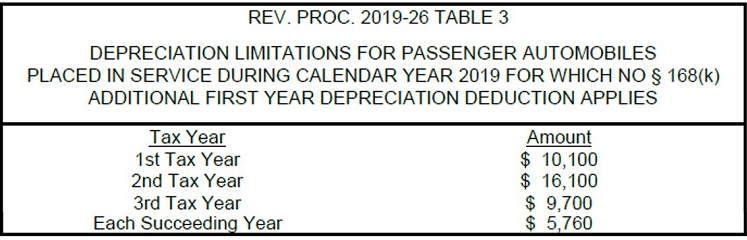

The IRS recently released Rev. Proc. 2019-26. In this revenue procedure, the IRS provides guidance on the dollar limitations imposed by section 280F on depreciation deductions for passenger automobiles. The guidance reflects the limits applicable to automobiles placed in service during the 2019 calendar year.

The revenue procedure contains three tables for taxpayers’ use in determining the permitted yearly depreciation deductions. These tables, included below, apply to passenger automobiles placed in service during the 2019 calendar year and vary based upon acquisition date and whether bonus depreciation applies:1