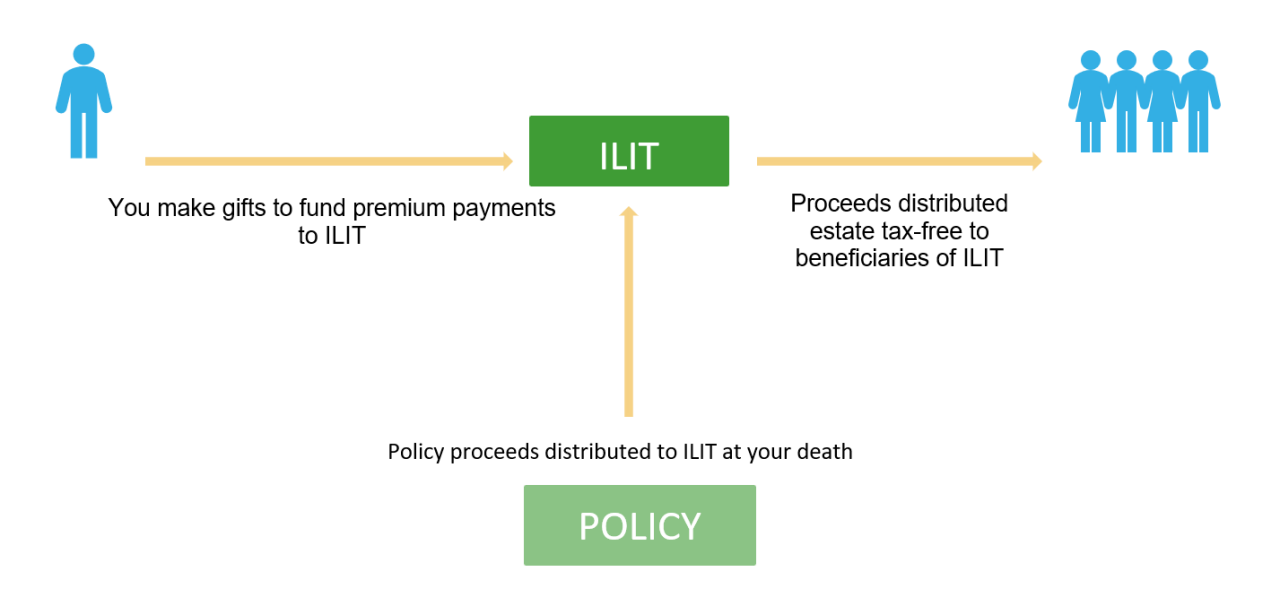

An Irrevocable Life Insurance Trust (“ILIT”) can be a valuable estate planning tool. By removing life insurance proceeds from your taxable estate and providing liquidity to your loved ones after your death, an ILIT can offer significant advantages. When strategically structured, gifts you make to an ILIT can qualify for the gift tax annual exclusion, preserving your lifetime gift and estate exemption for other uses.

What is an ILIT?

An ILIT is an irrevocable trust that holds one or more life insurance policies, where the ILIT itself owns the policy and is the designated beneficiary. The provisions of the ILIT provide for the ultimate distribution of the policy proceeds. You can fund the ILIT to pay premiums in a manner that typically avoids gift or income tax implications. Upon your death, the life insurance proceeds are paid directly to the ILIT. Since the ILIT, and not your individual estate, owns the policy, the proceeds are excluded from your taxable estate.