Oil and gas Chapter 11 and other types of insolvency proceedings have increased markedly over the past few years with the decline in oil and gas prices, a circumstance that continued over the past year due to COVID-driven price volatility. Many unique issues arise in these insolvency cases due to the industry’s unique history of financial arrangements and participation agreements.

Basic credit structures are unique to oil and gas

Industry participants understand that oil and gas exploration and production (E&P) companies access credit through reserve-based lending (RBL) agreements and public debt. These loan agreements are secured by proven reserves, whether they are producing, nonproducing or undeveloped. Borrowing bases are routinely reassessed or redetermined by lenders based on reserve reports and valuations of the reserves, which are reflected in the advance rates on the values, e.g. a 50/30/20 loan may advance 50 percent of the producing reserves, 30 percent of the nonproducing reserves and 20 percent of the proven but undeveloped reserves. Unproven reserves typically receive advances in loan agreements. The values of other probable or possible reserves within additional properties may also be reflected on the reserve reports, which may or may not be encumbered under the RBL agreements as collateral. Thus, a key to understanding the financial picture for oil and gas companies is to evaluate the full range of assets and to determine what is pledged as collateral under the RBL, which assets are generating cash flows, and which assets remain unencumbered. Strategies can then be devised to utilize unencumbered assets and to deal with associated liabilities and the overall obligations of the enterprise.

Critical questions need to be addressed

As in any insolvency or workout situation, the business enterprise must address a mix of short-term cash flow-oriented questions as well as long-term operational and financial issues. Oil and gas enterprises present a number of more unique critical questions and concerns that will need to be evaluated:

- Can the insolvent enterprise operating within Chapter 11 provide its secured creditors with adequate protection payments to protect the lender from the diminution in value of the collateral? And, how will the amount of those payments be determined?

- Can the enterprise effectively segregate its cash collateral to everyone’s satisfaction? Since monthly production reports and reconciliations typically take 30-60 days to prepare, and the production is tracked based on unallocated revenue streams, can everyone agree to a common methodology for use during the bankruptcy proceedings?

- Under what methodology and facts will calculations be determined to address diminution in value claims made by secured lenders?

- How will environmental claims be determined, valued and bonded to ensure sufficient funds remain to reclaim affected properties? What type of bonds (surety bonds versus other bonds such as cash, securities, letters of credit, etc.) and will self-bonding or corporate guarantees be utilized?

- Can nonproducing or other assets be sold free and clear of liabilities under section 363 to free up cash? Critical issues regarding permits, contractual covenants and nonassignability clauses will need to be addressed.

- Will litigation or settlement funds be established to separate the business operations from claimants in order to facilitate the resolution of complex matters?

- A range of environmental issues is typically present, affecting litigants, regulators, financial prospects and valuation conclusions.

- What is the impact on midstream service agreements? The E&P, or upstream, sector pulls the oil and gas from the ground up to the wellhead. The midstream provider transports the oil and gas through pipelines and other delivery means. Agreements may (under Texas law) or may not contain covenants that “run with the land” to create real property interests in the volume of products extracted.

- Oil and gas cases are complex and require knowledgeable, high-level executive and management expertise. Will key employee retention plans (KERPS) or key employee incentive plans (KEIPS) be created, managed, measured for achievement and awarded?

- Will collective-bargaining agreements be rejected or modified by the bankruptcy court?

- What capital expenditures will be essential to preserve collateral and to facilitate business operations?

- What leases to explore, develop, extract, and produce oil and gas will be rejected or accepted by the bankruptcy court? Again, leasing interests may run with the land creating real property rights that need to be financially analyzed and valued.

- E&P companies may hold working interests (WI) to explore and develop oil and gas or other minerals with an obligation to pay associated costs. How will these interests be treated in the bankruptcy case?

- Royalty interests (RI), overriding royalty interests (ORRI) and net profits interests (NPI) will be tied to gross production and carved out of the WI. How will these interests be treated in the bankruptcy case?

- Production payments, as distinguished from ORRIs, will terminate upon lease expirations or upon achievement of production quota levels. How will these payment obligations be treated in the bankruptcy case?

- Joint operating agreements (JOA) are typically treated as executory contracts under the Bankruptcy Code and are not typically rejected. However, absent a JOA containing explicit rules for the division of costs and benefits of a well, the state default rules could apply and could impose fiduciary duties or other obligations on the parties that are inconsistent with their intent or expectations.

- Gathering and processing agreements (GA) with midstream providers may contain commitments and penalties that need to be evaluated and understood as part of short- and long-term planning.

The financial professional’s role

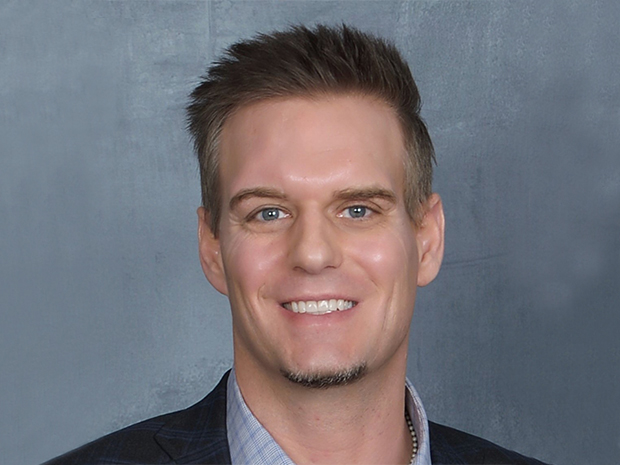

The main role of the financial consultant and financial expert is to educate. The professional’s role is to remain objective. The consultant and expert must help the attorney and client (whether it is the equity, management, secured lender or unsecured creditors) understand the financial aspects of the situation. In the board room or in committee meetings with lenders or creditors, the professional needs to accurately analyze and convey the facts and implications of the situation. In trial, the expert may testify as an independent, objective professional to educate the court and the trier of fact, whether it is a judge in a bench trial or a jury. Therefore, the professional’s ability not only to understand the issues, but the ability to communicate them clearly and in understandable language is paramount.

The professional’s credentials and experience are vital to establishing credibility with the client, the attorney and the judge. Selection of the right professional should be driven by the facts and circumstances of each case. The professionals themselves are governed by a wide range of rules defining the expectations for their conduct. Certified public accountants are governed by the American Institute of Certified Public Accountants, but financial experts may possess a variety of other designations or certifications that demonstrate their qualifications and which may impose performance rules and other financial and interpretive concepts upon them. Organizations offering credentials relevant to financial experts include, but are not limited to:

- Certified Fraud Examiner (CFE)

- Certified Insolvency Reorganization Advisor/Accountant (CIRA)

- Certificate in Distressed Business Valuation (CDBV)

- Accredited Senior Appraiser (ASA)

- Chartered Financial Analyst (CFA)

- Certified Financial Planner (CFP)

- Certified Financial Consultant (CFC)

- Certified Turnaround Professional (CTP)

- Certified Management Accountant (CMA)

The financial expert’s most important responsibility is to be honest and objective. Careful, analytical work that is articulately and persuasively presented can be the difference between winning and losing the logic, the negotiation or the case.