On Jan. 1, 2023, the Inland Revenue (Amendment) (Taxation on Specified Foreign-sourced Income) Ordinance of 2022 went into effect in Hong Kong. Hong Kong’s new foreign-sourced income exemption (FSIE) regime requires that certain foreign-sourced income accrued to (or earned by) a multinational enterprise (MNE) group member (MNE entity) engaged in a trade, profession, or business in Hong Kong be treated as originating in or derived from Hong Kong and subject to profits tax at the time of receipt. The Amendment Ordinance also changed the Inland Revenue Ordinance (IRO) to include provisions for transitional issues and relief from double taxation with regard to certain foreign-sourced income.

U.S. MNEs with Hong Kong subsidiaries should analyze whether they are subject to the new FSIE regime.

Covered taxpayers

Only MNE entities will be subject to the new FSIE regime as it is thought that MNE groups have a greater incentive to adopt aggressive tax planning strategies which may result in higher base erosion and profit-shifting risks.

Covered income

Specified foreign-sourced income means any of the following income arising in or derived from a territory outside Hong Kong:

- Interest

- Dividend

- Disposal gain from the sale of equity interests in an entity (disposal gain)

- Intellectual property (IP) income

However, it does not include any interest, dividend, or disposal gain derived by any of the following entities:

- A regulated financial entity

- An entity the assessable profits of which are chargeable to tax at the rate specified in a concession provision (as defined by section 19CA of the IRO) other than section 14A(1)

- An entity that is exempt from tax chargeable in respect of its assessable profits under section 20AC, 20ACA, 20AN, or 20AO of the IRO

- An entity that is a ship-owner and has any exempt sums excluded under section 23B(4AA) of the IRO from the amount of relevant sums earned by or accrued to the entity

Deeming provisions

If the income is received by the MNE entity in Hong Kong and the MNE entity does not meet the exception requirements in the year of assessment in which the income accrues, the specified foreign-sourced income will be deemed to be Hong Kong sourced (and as not arising from the sale of capital assets even if it does) and chargeable to profits tax in the year of assessment in which it is received.

Exceptions from the deeming provision

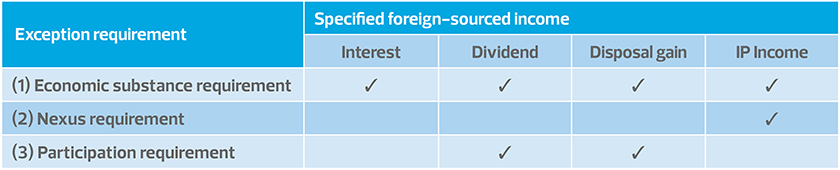

If the MNE entity satisfies the exception criteria for the specific types of incomes, the specified foreign-sourced income received in Hong Kong will not be brought into charge. The following criteria apply to exceptions: