The following content is reprinted with permission by the AIRA Journal; Volume 35: No. 2.

The Tax Cuts and Jobs Act (TCJA) was signed into law on Sept. 22, 2017.1 The TCJA generally expires in 2025 and many of the “paybacks” in the TCJA take place in the later effective years of the Act.

In particular, three provisions of the TCJA will result in large “stealth” tax increases for many C corporations in the 2022 tax year. These provisions may disproportionately affect distressed C corporations.

Capitalization of Research and Development Expenditures

The Internal Revenue Code of 1954 added section 174 which provided taxpayers the option to immediately deduct Research & Development (R&D) expenditures under section 174(a) or elect under section 174(b) to capitalize them over a period of at least 60 months.2

For taxable years ending on or after Dec. 31, 2000, software development costs could be (i) deducted currently under rules similar to section 174(a); (ii) capitalized and amortized over 60 months from the date of completion of the project; or (iii) capitalized and amortized over 36 months from the date the software is placed in service.3

The TCJA amended section 174(a) to eliminate the ability to currently deduct R&D expenditures in tax years beginning after Dec. 31, 2021.4 As such, domestic R&D expenditures will have to be amortized over 5 years and 15 years for expenditures incurred outside of the United States, both with a midyear convention.

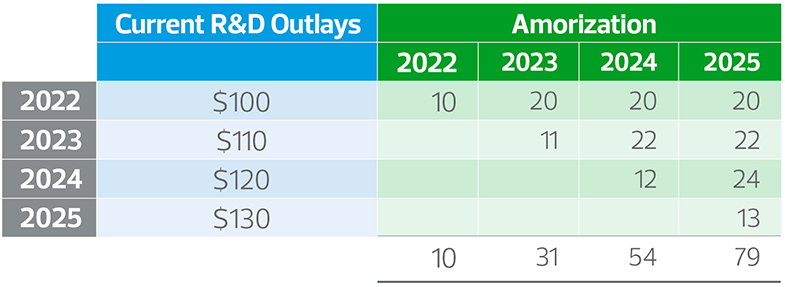

When considering the timing implication of this provision, taxpayers with R&D expenditures would be disproportionately affected in the 2022 tax year, as only 10% of the R&D expenditures could be deducted (12/60 months times 50% midyear convention). As depicted in the table below, by 2025, significantly more R&D expenditures incurred during tax years 2022 through 2025 could be deducted than during the initial 2022 tax year: