Despite the name, Intentionally Defective Grantor Trusts (IDGTs) are not necessarily ‘defective’ when it comes to your estate plan. In fact, IDGTs can be an incredibly useful and valuable estate planning vehicle. By strategically selling assets to an IDGT, you can potentially reduce your taxable estate and provide long-term benefits for your family.

What is an IDGT?

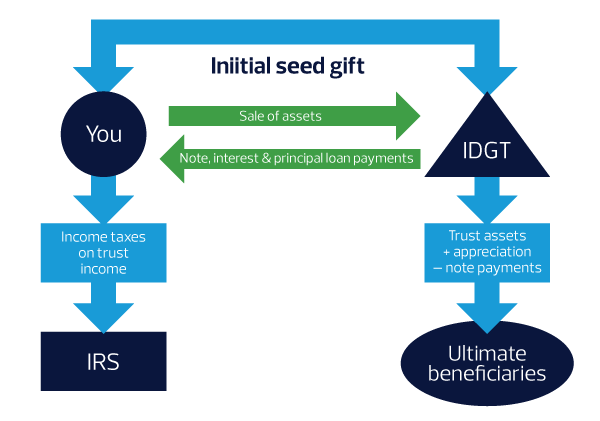

See our related article Estate Planning Q&A: Gifting to Intentionally Defective Grantor Trusts explained to understand the basic structure of an IDGT and how to make a traditional gift to your IDGT. This article discusses selling assets to your IDGT. The transaction is structured much like any other sale. You sell assets to the IDGT in exchange for a promissory note equal to the fair market value of the assets. This removes the assets from your taxable estate and replaces them with the note, essentially ‘freezing’ the value included in your estate. For example, you sell an asset with a fair market value of $5M to your IDGT in exchange for a $5M note. The asset grows outside of your estate to a fair market value of $10M. The asset appreciates outside of your estate, but only the $5M value of the note is included in your estate.

Because an IDGT is not considered separate from you for income tax purposes, the sale transaction is generally disregarded. When appropriately structured, a sale to an IDGT can transfer wealth to future generations without triggering transfer taxes or income taxes.