Key Takeaways

Understand details of restricted stock units (RSUs) to determine if they’re right for your company

- Tax rules and business considerations can help shape your decision to implement RSUs

- Tax considerations include nonqualified deferred compensation rules under section 409A and payroll tax withholding

- Understand the differences between a restricted stock unit and restricted stock to avoid confusion

- For any plan intended to issue RSUs, review [CR1] with your tax advisors to avoid unintended tax consequences

- As an alternative to actual equity, issuing RSUs can incentivize key employees without diluting ownership prior to vesting

In tight labor markets, employers are always looking for ways to incentivize key employees. Restricted stock units (RSUs) are one option to achieve this without diluting ownership prior to vesting. Before deciding what type of executive compensation device is right for your company, here are some answers to frequently asked questions about RSUs.

Q: What is a restricted stock unit?

A: A restricted stock unit is a promise to transfer shares (or make a cash payment) at some future date, typically after time or performance vesting requirements have been met. An RSU does not provide actual ownership in the company when granted. Instead, the transfer of shares (or cash) happens after vesting. (Performance-vesting RSUs are sometimes referred to as PSUs.)

Q: Why might a company want to issue RSUs instead of actual equity?

A: As equity ownership does not transfer upfront, RSUs provide a mechanism to incentivize employees without diluting ownership. That is because RSUs are generally subject to certain time or performance vesting provisions that must be satisfied prior to the recipient receiving the benefit of the transfer of the shares or cash.

RSUs provide an incentive not only for employees to stay with the company through the vesting date, but also to contribute to increasing the company value, which will result in a higher payment value when the RSU is settled. Unlike stock options, RSUs do not require a cash outlay (i.e., exercise price) by the recipient, which eases some of the administrative burdens for the employer and can also appeal to employees.

Q: How do RSUs work for public and private companies?

A: RSUs represent a promise to make a payment at some future date. If the RSUs are settled in shares, the recipient becomes an owner and, in the context of a public company, can generally transfer the shares without restrictions (other than any imposed by securities law). For private companies, although the shares are no longer subject to restrictions, there is typically not a readily available market, so the recipient may not be able to sell the shares right away or with as much ease.

Q: How is the value of an RSU determined?

A: The value of an RSU fluctuates, mirroring the value of company stock. Public companies that issue RSUs will use the fair market value (FMV) as reflected on the public exchange they trade on at the time the transfer is initiated.

On the other hand, private companies that issue RSUs don’t have a readily ascertainable market value. Instead, they must follow the general equity compensation valuation rules for private companies and use a reasonable valuation method, such as an express written formula, or have a third-party appraisal performed to determine the FMV per share.

Q: Are there section 409A considerations with RSUs?

A: Yes. In the event the RSU does not meet the short-term deferral exemption (such as when payment is expected to be made more than two and a half months after the year of vesting), it would be subject to the nonqualified deferred compensation rules under section 409A. Operating nonqualified deferred compensation plans requires careful consideration of the stringent and complex section 409A rules. Employers should consult a tax advisor and review their nonqualified deferred compensation plans regularly to ensure the plan is operating as intended and does not run afoul of section 409A rules, which could result in income inclusion at vesting and a 20% penalty tax to the employee if violated.

Q: How are RSUs treated for federal income tax purposes?

A: RSUs are not taxable at grant. Therefore, they allow a recipient to defer compensation into a later year because the recipient does not pick up the value of RSUs as compensation until vesting, which is typically in a year subsequent to the year of the grant. However, RSUs are generally designed to meet the short-term deferral exemption under section 409A. This means payment occurs within the same year of vesting or within two and a half months of the end of the year in which vesting occurred. In such cases, the RSUs are not considered nonqualified deferred compensation.

Once RSUs vest, the company settles them by transferring shares or making a cash payment. At

the time the transfer is initiated, the aggregate value is taxable compensation to the recipient. It is not uncommon for companies to miss this date of transfer requirement and tax RSUs only once per year—similar to certain fringe benefits—but this is not correct.

The company is entitled to a deduction equal to the amount of income recognized by the recipient. The timing of that deduction depends on whether the RSU is settled in shares or cash, as well as when payment is made in comparison to vesting.

Additionally, if the RSUs are settled in shares, the recipient becomes an owner and the holding period begins on the date of transfer. If the shares are held longer than one year, any appreciation or depreciation will be characterized as long-term capital gain or loss, respectively.

Q: Is a section 83(b) election available?

A: No. With RSUs, property (the shares) is not transferred until it is already vested; therefore, a section 83(b) election does not apply.

Q: What are the payroll tax consequences of RSUs?

A: RSUs are subject to tax under the Federal Insurance Contributions Act (FICA), which is comprised of the old-age, survivors, and disability insurance taxes, also known as social security taxes, and the hospital insurance tax, also known as Medicare tax (collectively referred to as payroll tax), for employees with a Form W-2 reporting requirement.

RSUs that are settled within two and a half months of the end of the year in which vesting occurred are subject to payroll tax withholding at the time payment is initiated.

If the RSUs are not settled within two and a half months of the end of the year in which vesting occurred, the special timing rule for nonqualified deferred compensation applies and payroll tax withholding may be required upon vesting. Notably, in this case, the RSUs would not be subject to federal and state income tax until the year of transfer or payment, resulting in a timing difference for payroll tax and income tax withholding.

Q: Can partnerships issue RSUs?

A: Theoretically, it’s possible for partnerships to issue something economically similar to RSUs, but it’s rare because partnerships would typically issue profits interests to achieve a similar result.

Q: How is an RSU different than restricted stock?

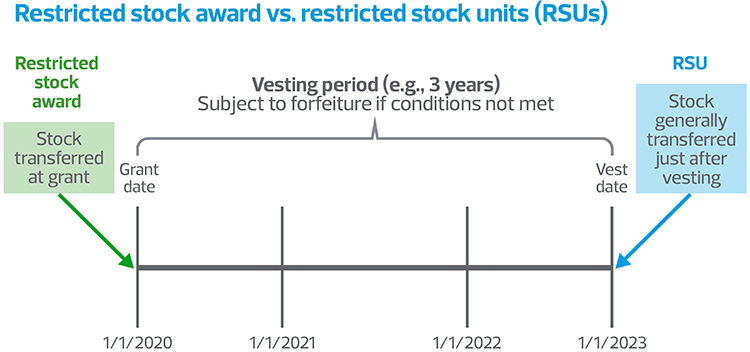

A: Restricted stock and RSUs bear similar names, which can cause confusion. However, there are some key differences, such as when the transfer of the shares occurs and whether a section 83(b) election is available.

- A restricted stock award transfers shares to the recipient at grant, but the shares are subject to forfeiture until the vesting conditions are satisfied. With RSUs, shares are not transferred until the RSU vests (see diagram below).

- As a restricted stock award transfers property (shares) at grant, the recipient can make a section 83(b) election within 30 days of receiving the restricted stock; that accelerates vesting for tax purposes and, as a result, accelerates the income inclusion into the year of the grant. Conversely, RSU grants do not transfer property at grant; therefore, a section 83(b) election is not available.

Q: What are some considerations when designing an RSU plan?

A: Companies should consider the following when formulating aspects of their written plan:

- Which key employees should receive RSUs?

- What type of vesting conditions will most incentivize employees?

- Will the plan meet the short-term deferral exception or be section 409A compliant? If so, what permissible payment events would the company like to include?

- Do employees have enough cash to cover the required tax upon vesting (if the RSUs will be settled in shares instead of cash)?

- Will special vesting rules apply in the case of death, disability, or other events?

- When and how many RSUs will be granted?

RSUs should be compared to other incentive compensation methods to determine if they achieve the company’s goals. If they do, the plan should be reviewed with tax advisors to ensure no unintended tax consequences occur.