Open-end funds are particularly attractive for core assets that generate strong cash flows.

Key takeaways

These long-term funds offer flexibility in fundraising, investment options and exit strategies.

Navigating administrative and tax complexities often requires advanced technical skills and technology.

Market volatility resulting from higher interest rates and lower transaction volumes has real estate fund managers seeking alternative investment structures to provide liquid shelter from the storm. For real estate investors who value the ability to increase or withdraw their investments quickly, open-end funds can be attractive.

While closed-end funds can provide bigger returns, their success often depends on good timing during the real estate life cycle. The acquisition and disposition periods must be planned just right to capitalize on market conditions.

Open-end funds, on the other hand, have been particularly attractive for core assets that generate strong cash flows, providing more consistent returns to managers and investors alike. With no established termination dates, these long-term funds offer flexibility in fundraising, investment options and exit strategies. But they also come with specific structuring and administration complexities to consider before launch, such as redemption risk, valuation needs and tax implications.

The emergence of longer-term investments

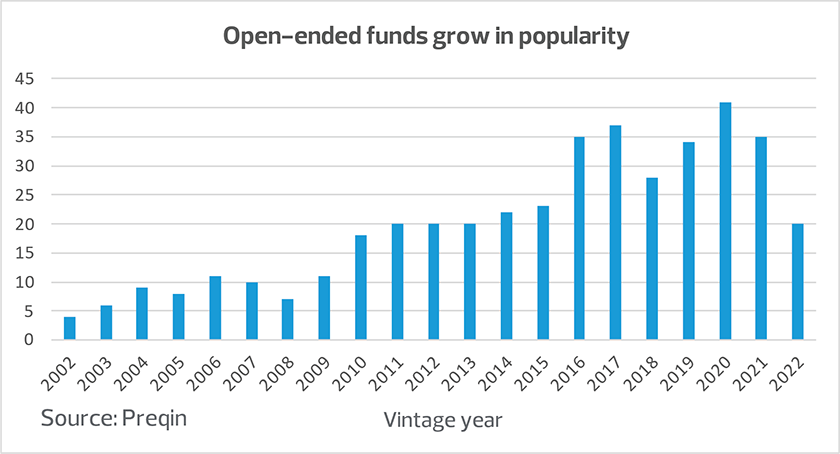

Over the last two decades, open-end funds have gained popularity within the real estate market. Since 2010, an average of 30 new funds have entered the market annually.

Meanwhile, managers of closed-end opportunistic funds that entered the market over the last several years executed on their strategies to develop or reposition assets and exit at record cap rates in 2021 and early 2022. With the subsequent rapid halt in transactions, many are left with a nearing fund termination date and a remaining portfolio of cash-flow assets, unable to offload them at their target return.

Unfortunately, 2023 has been off to a rough start, with a 25% decline in transaction volume and a 34% decline in aggregate deal value from the final quarter of 2022. As inflation persists, interest rates are projected to continue rising through the end of the year, with normalization not anticipated until the end of 2024 or early 2025. Heightened borrowing costs and an unfavorable lending environment will continue to pressure transaction volume downward and cause price appreciation to level off.

Given the short-term outlook, many investors and lenders are looking to protect their capital by focusing on the income component of property returns and the durability of cash flows over the long term. Middle market fund and portfolio managers have been successful in rolling their existing core assets into an open-end vehicle to align with investors’ long-term, lower-risk appetite. It relieves the pressure of seeking exit price appreciation under time constraints and allows for the delivery of steady returns to investors through property income distributions while the market corrects itself.

Liquidity on the radar

Typically, open-end structures offer investors the benefit of more readily available liquidity, as the funds are able to continually raise new capital by offering quarterly subscriptions and redemptions. However, fundraising has been losing steam at a rapid pace, with a 19% drop in capital raised in the first half of 2023 compared to the last half of 2022.

Determining the appropriate lockup period (generally two to five years) will be especially important for new launches to ensure the fund’s liquidity is stable once redemptions are allowed. The recovery of assets under management is projected to follow a pattern similar to that of transaction volume, requiring a few years for the return of real estate investor optimism and establishment of a new growth cycle.

For existing funds, redemptions pose a larger concern in the near term. The decline in fundraising momentum, coupled with tightened lending conditions, will cripple liquidity. Funds may be forced to sell assets at a loss in this market to pay out redemption requests if guardrails are not in place. Consider that redemptions across U.S. nontraded real estate investment trusts (REITs) jumped to $12.2 billion in 2022 from $1.5 billion in 2021, according to real estate advisory firm Robert A. Stanger & Company. And during the first half of 2023, major nontraded REITs limited redemptions based on a percentage of net asset value (NAV) as investors began to withdraw their capital at an increased rate due to the volatility in valuations.

Frequent monitoring and accurate reporting of NAV will be critical, as that metric dictates the admission and redemption of investors and generally serves as the benchmark for determining incentive fees paid to the fund manager. With the market at a standstill, it’s particularly challenging to determine such a significant mark. Increased transparency into real-time asset performance, underwriting, and projected returns can instill investor confidence and mitigate redemption rates.

Tax considerations

When structuring an open-end fund, understanding how the inherent tax complexities affect limited partners and the recipient (often the fund manager) of the sponsor “promote,” or excess profits, will help minimize tax obligations and maximize returns on investment. As more investors enter and exit the fund, and as more assets are acquired and depreciated, allocations can become very complex and often require advanced technical knowledge and tax technology programmed with the latest tax rules and jurisdictional laws.

In an open-end structure, new limited partners may enter and exit the fund throughout the year, causing a revaluation event. Each time this occurs, any built-in gain must be captured and allocated to the legacy investors. That built-in gain also must be attributed to the underlying properties of the fund. As the properties depreciate, the expense will be allocated among the investors over time to reduce the remaining built-in gain.

If a property were to sell before the built-in gain is depleted, the legacy investors would likely have to recognize more gain than their proportional share, as they were invested in the fund during the appreciation period. Allocations may become so complex that compliance with tax requirements may exceed the capabilities of conventional processes, including the use of a traditional spreadsheet program.

The takeaway

Tightened financial conditions have disrupted real estate investment, threatening property valuations and creating liquidity constraints. Open-end funds provide a long-term strategy focused on stabilizing property income performance and allowing flexible investment options. While the benefits are clear, the open-end investment structure comes with administrative and tax complexities that require an advanced technology infrastructure and knowledgeable advisory teams to help ensure the fund’s success.