Real estate valuations are central to the performance measurement of alternative investments.

Key takeaways

The timing of real estate valuations is crucial for evaluating market risk as exit dates near.

Open-end structures are trending with fund managers looking to hold onto these core assets.

Tightened financial conditions and market volatility stemming from inflation shocks, geopolitical tensions and the banking turmoil have disrupted real estate investment, threatening property valuations and creating liquidity constraints.

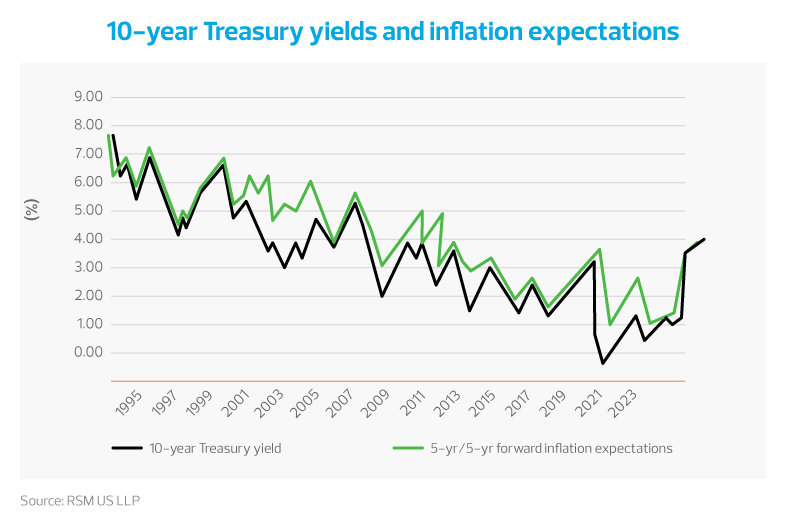

Despite a further slowing of the economy, the Federal Reserve’s rate hikes appear to be having their intended effect, as recent data shows bond yields peaked at the end of 2022 while inflation has dropped and is pushing closer to the 2% target; however, cuts in the policy rate are unlikely through the end of the year keeping the cost of capital high and 10-year bond yields elevated.

As bond yields serve as a pricing reference for real estate, this trend signals continued volatility and liquidity challenges across all sectors. Rising terminal cap rates and risk premiums will add pressure on the recovery of transaction volume and pricing uncertainty in the short term, which is not expected to correct itself until late 2024 or 2025.

Timing considerations during market uncertainty

Private equity managers have responded by restructuring their real estate investment strategies and capital stacks to realign with the risk appetites of investors. Real estate valuations are central to the process of performance measurement and will be critical to executing in a period of heightened uncertainty in pricing. When macroeconomic changes are happening at a rapid pace, monthly valuations are not uncommon to assist fund managers in gauging exit risks on current investment strategies. Secondary market premiums and discounts to a fund’s net asset value (NAV) can appear to challenge third-party valuations due to the perception of risk by investors. However, valuations of real estate assets based on current market conditions and lease assumptions at a point in time are one of the best ways to assist fund managers in providing investors with a reliable indicator of NAV.

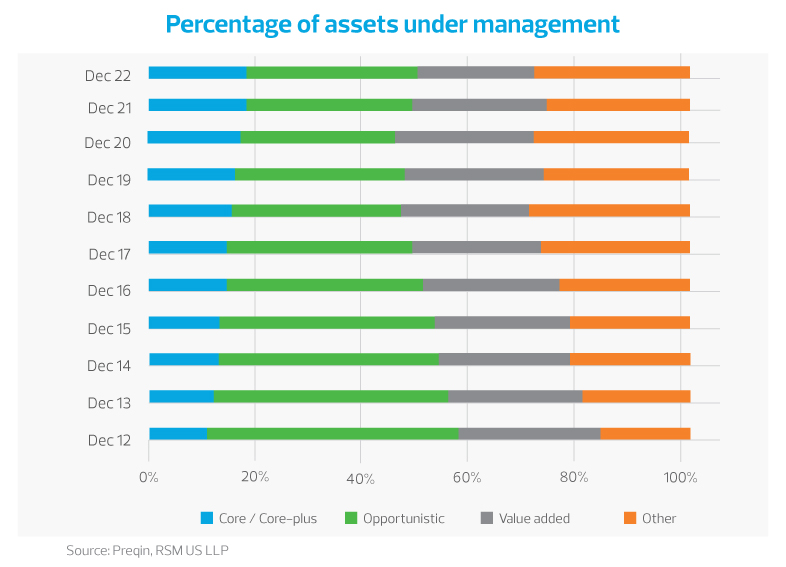

The timing of valuations of real estate assets can differ for higher-risk opportunistic funds versus lower-risk funds with long or indefinite lives. For the former, investors expect to see a return on and a return of capital in 3-7 years as development, redevelopment, or property-level upgrades impact the prospective market rent of these assets. Similarly, debt funds and alternative financing strategies generally provide short-term capital solutions to the current lending environment. In these situations, valuations are typically required for annual reporting and are monitored to evaluate market risk, but the frequency and importance increase as exit dates approach.

On the other hand, holding core and core plus assets with stable cash flows has become attractive to help mitigate the current pricing risk. Open-end structures are an intriguing trend being used by fund managers to hold these core assets. While the conditions may be ideal for long-term vehicles as the real estate sectors evolve and 10-year treasury bond yields begin to lower, regular valuations (typically annual with quarterly updates) will be vital to provide a more accurate and necessary indicator of the fund manager’s progress and monitor redemption risk in an illiquid market. Additionally, since investor subscriptions and redemptions after the lock-out period are priced by market valuations, an independent third-party specialist is highly recommended to maintain investor confidence.

Determining the value of an investment property

Real estate investors rely on different valuation methods to estimate the market value of a property. Here are two commonly used techniques:

1. Income approach

This is the primary valuation method used to estimate a transaction price for an income-producing real estate asset. This method uses a discount rate (market-level internal rate of return or IRR) and terminal capitalization rate to calculate a net present value (NPV) of the return on and return of capital with the assumption that the asset is purchased with 100% equity. When considering market conditions, the income approach is mostly forward-looking based on investor and market expectations at a point in time.

2. Sales comparison approach

This method uses comparable sales evidence to provide market support for the value estimate resulting from the income approach. It provides an indicator of value based on comparable properties, but caution must be used to ensure investor and market expectations haven’t changed between the date of sale and the date of value for the fund’s assets.

While both methods effectively measure property values, they can also be challenging to employ amid market uncertainty. Until financial conditions loosen and allow transaction volume to recover and rent growth to normalize, making an accurate valuation requires staying abreast of current market conditions.

In our experience, providing true mark-to-market valuations of real estate assets requires daily tracking of market conditions against investor expectations. We leverage customized property valuation reports to facilitate transparency for all stakeholders.

“RSM provides an annual, narrative fair market valuation for an investment fund with over $16 billion in Class B multifamily assets. To provide quarterly updates, we built a valuation model that reevaluates market leasing assumptions, yield expectations, and terminal capitalization rates,” explains Joel Baxley, RSM real estate valuation leader. “If there is a decrease in value of 5% or more between quarterly valuations, the fund's rules require RSM to complete a full narrative report, which is shared with their investors. This valuation process and modeling can be replicated for any commercial real estate asset.”

The takeaway

Effective underwriting requires careful analysis of asset fundamentals and deep market understanding as it drives commercial real estate investment and lending. With the multitude of assumptions involved in value determination, liquidity challenges and volatility make the process even more challenging. Access to real-time data and having the right team in place to tackle portfolio valuation is critical to a fund manager’s success.

Experience matters when valuing real estate assets at the portfolio and single-asset levels. Our independent, third-party valuations provide fund managers with a critical piece of information needed to measure performance against a benchmark. Moreover, investors receive an unbiased confirmation on whether the fund manager’s pricing of real estate assets is reliable and in line with market conditions as of the date of value.