Structural macroeconomic changes have created a renewed focus on operational efficiencies.

Key takeaways

For portfolio companies, redesigning core business processes can improve performance.

Divesting from noncore business units can refocus resources and efforts.

Structural macroeconomic changes such as the increased cost of capital, persistent inflation and expanding regulatory policy, as well as microeconomic changes such as evolving consumer preferences, shifting workforce demographics and technological advancements, are drastically affecting how middle market businesses operate. These forces have created a renewed focus on operational efficiencies. For most middle market businesses, achieving operational excellence can bolster enterprise value even more significantly than it could have prior to these structural shifts.

The key value variables that executives must focus on look much different today than they did in a zero-interest-rate policy environment. For an asset manager that owns operationally complex businesses, identifying and optimizing the key value variables within their portfolio companies can lead to expedited exits and increased returns on investment for their investors.

The key value variables that executives must focus on look much different today than they did in a zero-interest-rate policy environment.

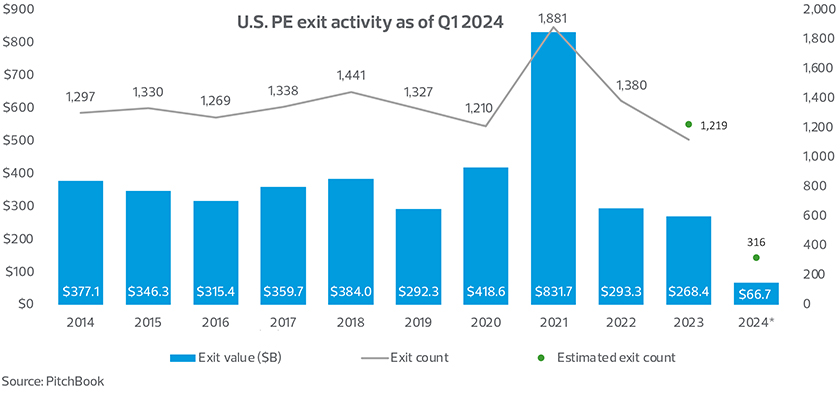

U.S. private equity (PE) exit activity was off to a tame start in 2024, according to PitchBook data, with roughly 316 exits for an aggregate of $66.7 billion in Q1 2024. This represents a decrease of 19% in exit value quarter over quarter, reversing the bounce back in exit value seen in Q4 2023.

Exit activity is a critical piece of the PE life cycle: Not only is it the leading indicator of a fund’s performance but it also feeds the start of a new investment cycle by recycling capital to meet new fundraising needs. A prolonged and material imbalance between selling and purchasing can disrupt industry growth. Unlike in 2022, when buying kept plowing ahead while selling lagged, acquisitions were down in 2023 by about 25%, reducing the net gap between exits and acquisitions by $178 billion. However, a deficit of $353.8 billion still needs to be closed.

Identifying and optimizing the key value variables, at both the fund and portfolio company levels, can help close that deficit. With the proper data, experience and capital, asset managers can increase the value of their portfolio, paving the path to a successful exit.

A successful business process reengineering implementation can help simplify and standardize overcomplicated work, automate repetitive processes, increase scalability, and eliminate wasteful practices.

Reexamining core business processes

For portfolio companies with complex operations, redesigning core business processes can lead to performance improvement. Business process reengineering (BPR) focuses on analyzing and redesigning workflows within an organization to dramatically improve efficiency. This practice involves rethinking the current processes at a fundamental level and questioning every aspect of how work is done. A successful BPR implementation can help simplify and standardize overcomplicated work, automate repetitive processes, increase scalability and eliminate wasteful practices.

Strategic redirection

If the organization is already operating at its highest level of competency, strategic redirection might be the key value driver for the enterprise. Divesting from noncore business units can refocus resources and efforts on the organization’s areas with the highest profitability and growth potential. Market restructuring can aid in identifying new markets or expanding existing ones to create innovative revenue streams for the organization. Additionally, strategic acquisitions can help the organization achieve desired business objectives.

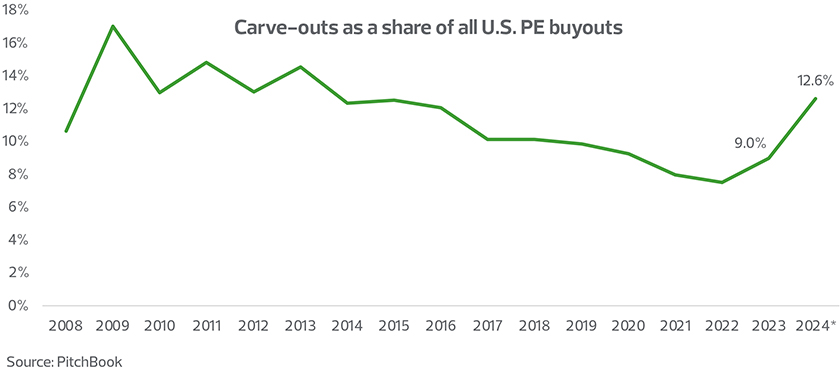

Carve-outs and add-ons are especially attractive for fund managers in today’s operating environment. General partners can benefit from more accessible financing to get these deals done. The acquired divisions can serve as platforms for new growth or enhance scale and efficiency within existing portfolios. Carve-outs amounted to 12.6% of all U.S. PE buyout deals in Q1 2024, marking the highest share since Q2 2016, per PitchBook data.

The path forward

A methodical approach that integrates strategic planning, operational excellence and ongoing evaluation is required to successfully implement change. Asset managers need a holistic view of their organization, at both the fund level and the portfolio company level, to thoroughly analyze the current state of the enterprise. Using disparate data or analyzing each value variable in a silo will not achieve the desired results.

At the fund level, activating specific operational levers can help achieve superior returns. Implementing industry best practices and ensuring compliance with regulatory requirements can help manage risk and boost the fund’s reputation in the market.

Collaborating with an organization that has the resources to help general partners and the portfolio company management team navigate through the current economic environment is essential. Advisors with extensive knowledge and experience can provide insights into industry standards, helping teams assess how to adjust core business processes and manage risk.