As part of the Tax Cuts and Jobs Act (TCJA), there were changes to the federal income tax rates for corporations under section 11(b) of the Internal Revenue Code as well as the repeal of the alternative minimum tax (AMT) for corporations under section 55(a).

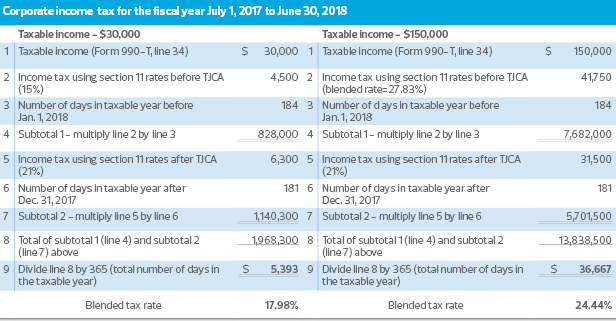

In a previous article, "Is there really a tax cut in the TCJA for exempt organizations?" we discussed the potential tax rate increase associated with the new 21 percent flat tax for exempt organizations with lower amounts of taxable unrelated business income (i.e. organizations with less than $90,385 of net unrelated business taxable income annually). In addition to the change from marginal rates to a flat tax rate, corporate exempt organizations filing Federal Form 990-T with a fiscal year beginning before Jan. 1, 2018 and ending after Dec. 31, 2017, will pay federal income tax using a blended tax rate and not the flat 21 percent tax rate under the TCJA that generally applies to tax years beginning after 2017. Fiscal year filers will have a second calculation that will need to be performed for the 2017-18 fiscal year. Corporations will determine the federal income tax by first calculating their corporate income tax for the entire tax year using the graduated tax rates in effective prior to TCJA and then calculating their tax using the new 21 percent rate, subsequently proportioning each tax amount based on the number of days in the tax year when the different rates were in effect. The sum of these two amounts is the corporation’s federal income tax for the 2017-18 fiscal year.

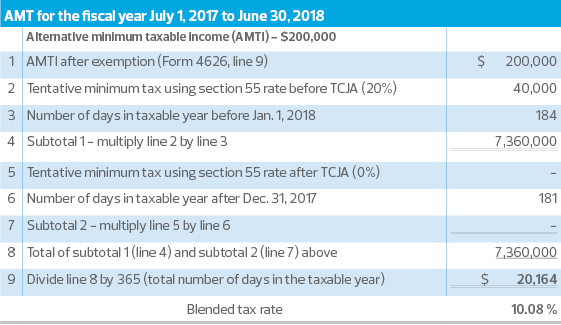

Prior to changes made by the TCJA, section 11(b) provided that the amount of tax imposed was based on a progressive rate structure where taxpayers with higher incomes were taxed at higher rates. The tax rate started at 15 percent and increased up to 35 percent depending on the amount of taxable income. In addition, section 55(a) imposed a tax equal to the excess, if any, of the tentative minimum tax for the taxable year, over the corporate tax for the taxable year (i.e. alternative minimum tax or AMT). The alternative minimum tax rate was 20 percent.

Section 13001(a) of the TCJA amended section 11(b) to provide that the amount of tax imposed by section 11(a) shall be a flat 21 percent of the corporation’s taxable income. Section 13001(c)(1) provides generally that this change in the tax rate for corporations is effective for taxable years beginning after Dec. 31, 2017. Section 12001(a) of the Act amended section 55(a) by limiting the application of the AMT to non-corporate taxpayers, thereby repealing the AMT for corporations. Further section 15(a) provides “If any rate of tax imposed by this chapter changes, and if the taxable year includes the effective date of the change (unless that date is the first day of the taxable year), then (1) tentative taxes shall be computed by applying the rate for the period before the effective date of the change, and the rate for the period on and after such date, to the taxable income for the entire taxable year; and (2) the tax for such taxable year shall be the sum of that proportion of the each tentative tax which the number of days in each period bears to the number of days in the entire taxable year.” Under section 15(c), for purpose of section 15(a) and (b), the effective date of the change made by sections 12001 and 13001 of the TCJA is Jan. 1, 2018.

Or, put another way, a fiscal year taxpayer will need to blend the graduated and alternative minimum tax rates in effect before the rate change date with the new rate in effect after the rate change date for their 2017-18 fiscal year. This blending is based on the number of days in each tax rate period. These calculations will need to be done for both standalone corporations as well as corporations that are part of a controlled group.

The following example illustrates the application of section 15(a) in determining the corporate income tax under section 11 for an exempt corporation having a fiscal year as its taxable year. Our example illustrates the income tax rate calculation for a taxpayer with a fiscal years ending June 30, 2018 and assumes a standalone organization: